Tag: uup

Is the US Dollar Nearing a Break-Out Move Higher?

For readers at See It Market, we usually show developments with the U.S. Dollar Index via the Invesco DB US Dollar Index Bullish Fund...

U.S. Dollar Heading Higher In 2019 (Elliott Wave Analysis)

When we wrote about the U.S. Dollar ETF in October, we indicated a preference for the scenario with a modest downward retrace instead of...

US Dollar ETF (UUP): Breakout or Retreat From Here?

Three months ago we posted a chart at See It Market showing how the U.S. Dollar ETF (NYSEARCA:UUP) had reached an important resistance area per...

What’s the U.S. Dollar Really Worth?

I have tried in both creative and straightforward ways to discuss with you how vulnerable the overall market is.

In the same way, I have...

Is It Time To Cash Out On Your Currency Trades?

If you traded long the U.S. Dollar or shorted another currency based on our January post or our more recent update in May, it's time...

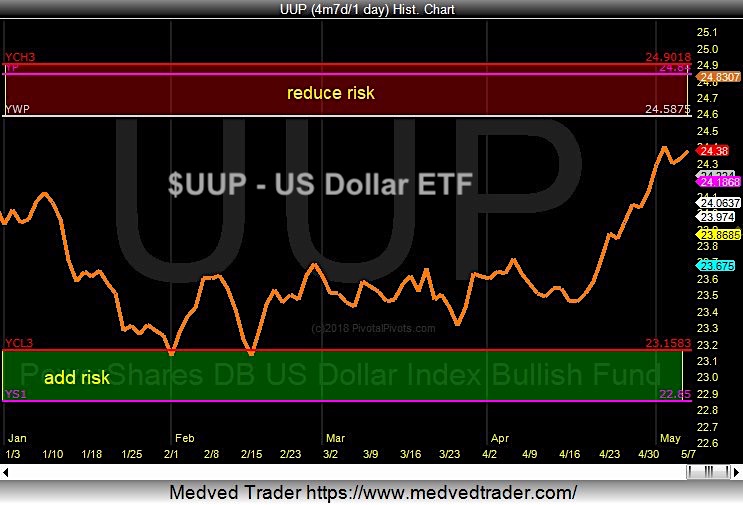

US Dollar ETF (UUP) Should Find Sellers At $25 Yearly Pivot

The US Dollar is bouncing higher and showing some relative strength lately.

How far will the rally carry the Dollar?

In the chart below, I highlight...

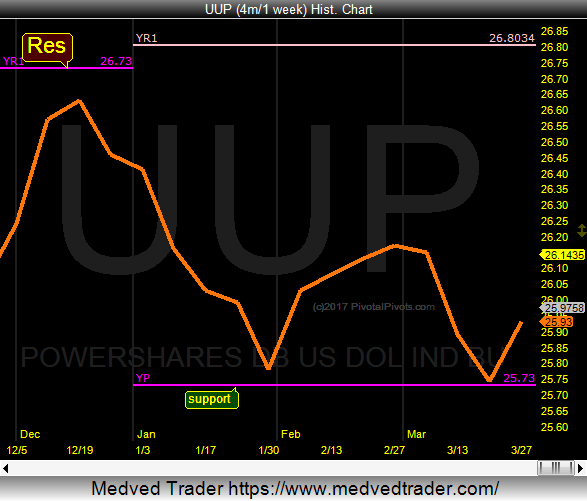

US Dollar Index Forms Double Bottom Pattern At Yearly Pivot

The US Dollar Index (CURRENCY:USD) and Bullish Dollar ETF (NYSEARCA:UUP) are forming a double bottom price pattern on their respective trading charts.

As well, both patterns are taking...

US Dollar Rally: Consolidation Continues Into Fed Meeting

There continues to be lots of talk surrounding the US Dollar following its incredible rally to 14 year highs off Trump’s election victory.

So, where...

US Dollar Index Overbought: Is A Recharge In Order?

The US Dollar Index (CURRENCY:USD) is starting to catch traders' eyes again. The recent rally has been relentless, hitting Gold and Emerging Markets over...

A Look At The Gold (GLD), T-Bonds, Dollar Market Triangle

Over the past year, there's been a very interesting relationship between the Gold (NYSEARCA:GLD), the U.S. Dollar (NYSEARCA:UUP), and Treasury Bonds (NASDAQ:TLT).

I've talked about...