Tag: market sentiment

CEO Sentiment Is Slowly Improving In 2024

The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

CEO Optimism Abounds

After a volatile 2023, CEO confidence seems...

Inflation Narrative Reaches Inflection Point With Major Implications

In baseball, a knuckleball is a distinctive pitch that only a very few significant leaguers can perfect. The goal of a knuckleball is to...

U.S. Equities Weekly Market Outlook: Looking For Leadership

The major U.S. stock market indices have seen an uptick in volatility this week.

The recent market action is in line with our outlook that...

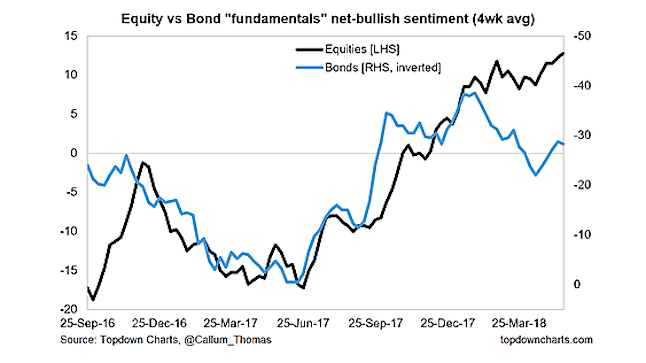

Market Sentiment Update: Investors Getting “Bulled Up” On Stocks

Looking at the charts this week investors remain bullish, and judging by the margin debt and leverage charts - investors are clearly voting with their...

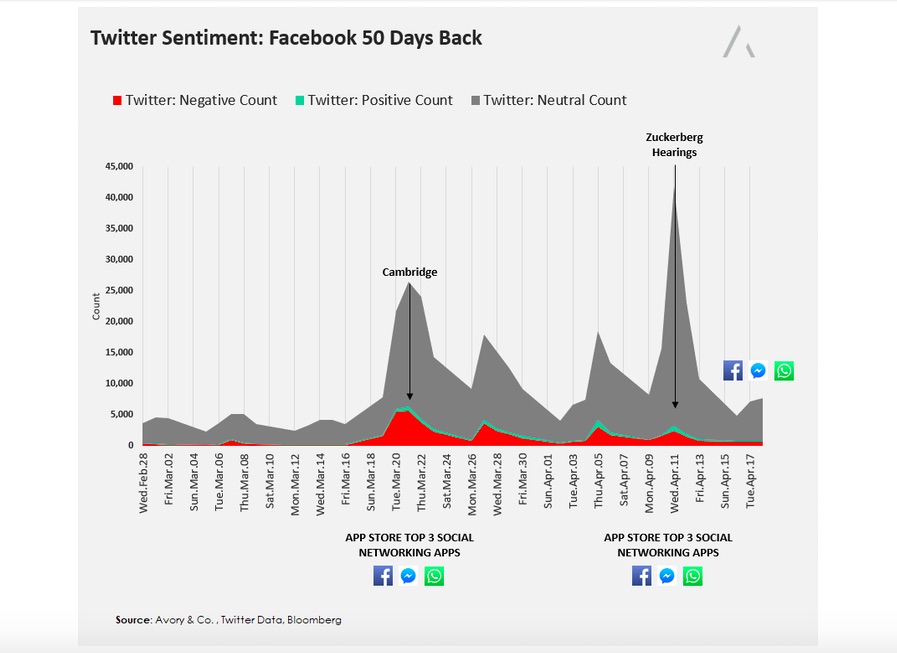

Facebook Sentiment Data Firms After Negative News Firestorm

It's Friday, so it is time for my Chart of the Week!

As you know, I love data. Over the last month, I have been...

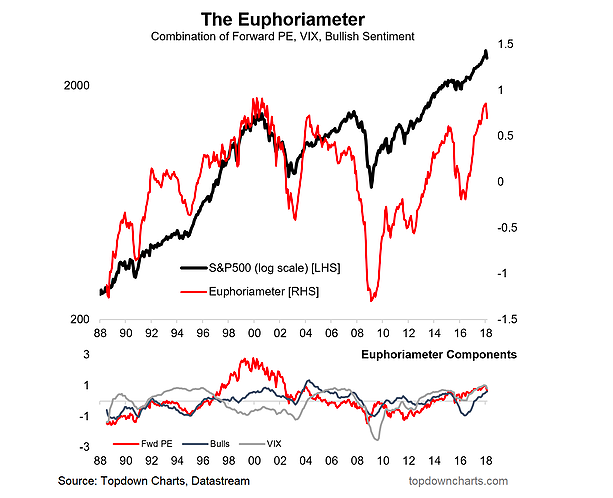

Investor Sentiment Update and Outlook: 5 Charts

The much awaited and widely predicted correction (that no one really ended up predicting) has turned 2 weeks old now, and driven the S&P...

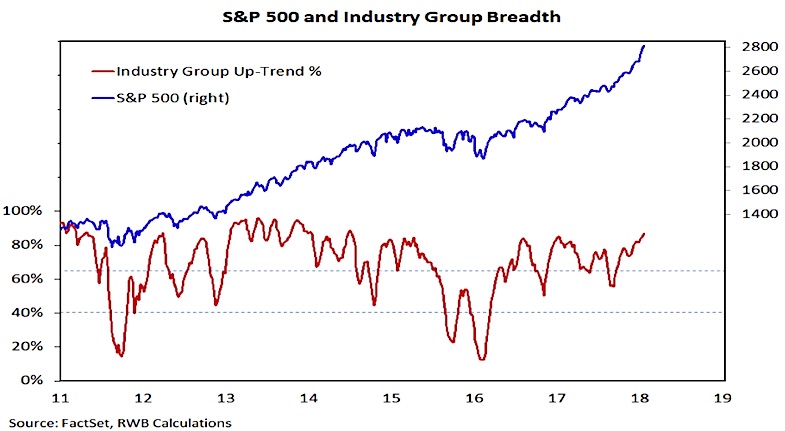

U.S. Equities Weekly Outlook: Rally Participation Strong

U.S. equities continue to trade at all-time highs. The broader stock market trend is benefiting from strengthening market breadth. Meanwhile, excessive investor optimism continues...

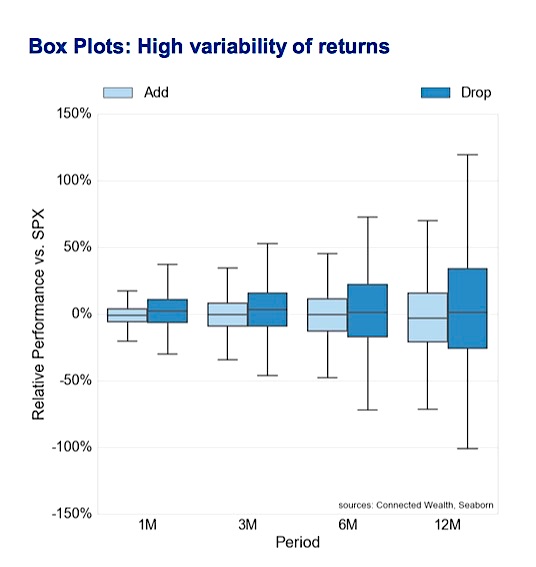

Indexing Bias: Investment Realities And Opportunities

This post was written by Derek Benedet and Craig Basinger of Richardson GMP.

Behavioral Finance combines behavioral and cognitive psychology theory with conventional economics and...

The Sure Thing: What Could Possibly Go Wrong For Investors?

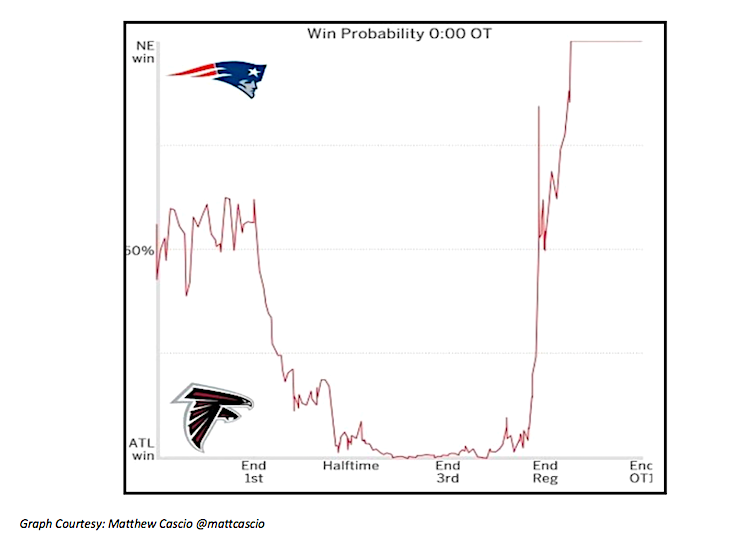

The New England Patriots pulled off a stunning come-from-behind victory in Super Bowl LI, and one that was truly unprecedented in American football. Throughout...

Investor Sentiment Polls Study: Careful Using Indicators In Isolation

During the bull market of 2002 to 2007, I noticed something very interesting with respect to the American Association of Individual Investor's (AAII) poll....