Tag: historical volatility

Today’s Perspective On Recent Stock Market Volatility

VOLATILITY IS ALWAYS STRESSFUL

With lingering concerns about trade, markets sold off Monday with all three major U.S. indexes posting intraday declines of greater than...

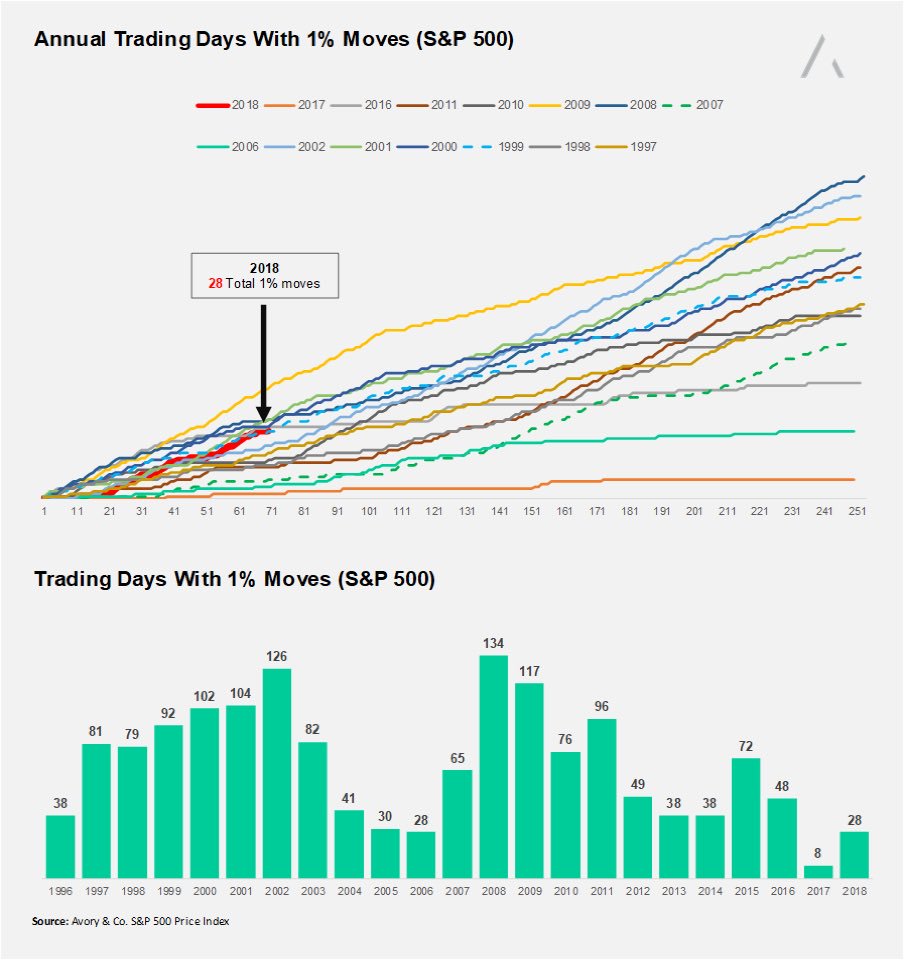

Investing Perspective: 2018 Market Volatility Is Overhyped

So far in 2018, the narrative has been about volatility. Many outlets have expressed concerns regarding the magnitude of daily moves. In most circumstances,...

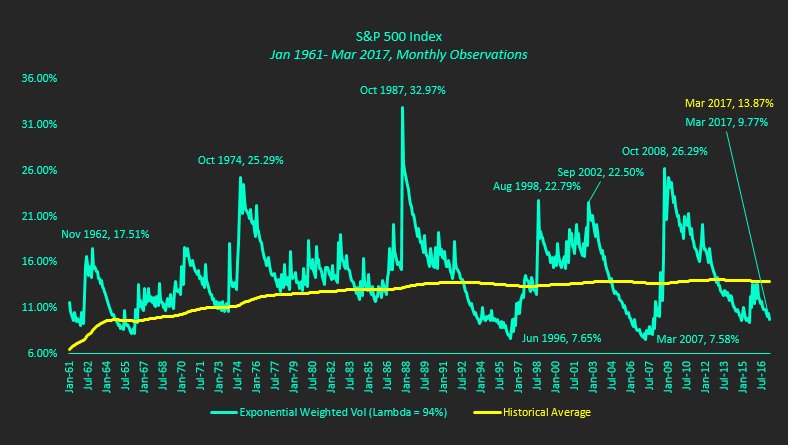

S&P 500 Index: Weighted Volatility Near Historical Lows

Realized volatility on the S&P 500 Index (INDEXSP:.INX) is approaching historically low levels; similar levels that were achieved in June 1996 and March 2007.

Both...

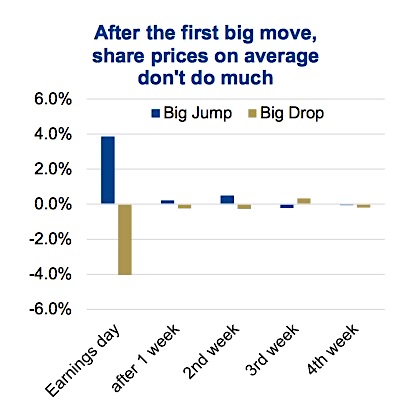

Study: How Stock Prices React To Corporate Earnings Releases

This post was written by Craig Basinger and Derek Benedet of Richardson GMP.

Behavioral Finance combines behavioral and cognitive psychology theory with conventional economics and...

What History Tells Us About Low VIX Readings & Stock Market...

What Does History Tell Us About A Low VIX, Complacency, And Stock Market Risk?

Given the S&P 500’s (INDEXSP:.INX) weak performance (see A, B, and...

Will A Low VIX Index Lead To Another Stock Market Crash?

We hear a ton about equity markets and the volatility surrounding it. On occasions hearing how because market volatility is low that a stock...

Weekend Market Commentary: When Trends Turn Into Whipsaws

One of the more legitimate reasons I started trading options is that I wanted the ability to adapt to changes in the market by...

Market Recap: Volatility May Hold Key To Bottom In Stocks

The Big Picture

When the market seems uncertain, it’s helpful to step back and ask yourself what participants might be thinking at different price levels...

Weekend Market Commentary: Volatility And Price Tell The Story

The Big Picture:

Move along everyone, there’s nothing to see here...

As someone who follows the markets constantly, it’s interesting to see how the Twitter stream,...

Sector ETFs With The Richest Options Premiums

Investors and options traders sell puts and put spreads to generate additional income or acquire stock. In many cases, traders attempt to time their...