Tag: credit markets

Goldman Sachs Take On Corporate Debt: Myopic or Self-Serving?

“The biggest problem that most people have is that they read Wall Street research reports and they believe the Wall Street hype… Wall Street...

Corporate Bond Market Insights: The Maginot Line

Since the post-financial crisis era began more than a decade ago, record low-interest rates and the Fed’s acquisition of $4 trillion of the highest...

Corporate Debt Tsunami: $3 Trillion Time Bomb?

This article was written by Will Nasgovitz – CEO and Portfolio Manager, Heartland Advisors.

For most of the past 10 years, corporate debt has been...

2019 New Year’s Checklist For Stocks and the Credit Markets

As we flip the page to January 2019, I thought I'd share a stock market checklist for the beginning of the new year.

Having already...

Halloween Corrections Are Scary, But Global Debt Binge Is Scarier

For most grown-ups, Halloween isn’t all that scary but stock market corrections are, and we are in one now.

The TSX Composite, S&P 500, NASDAQ...

A Change In The Risk Profile Of Corporate Credit

Today we'll dig into the credit markets and highlight some emerging concerns (near-term).

Since the September / October 2017 corporate bonds issuance surge, investment grade...

Sovereign Debt Stew: U.S. Treasuries Are Not Without Risk

The Earth is flat

Cigarettes are healthy

Leeches are the cure for everything

The universe revolves around the Earth

California is an island

...

Credit Markets Still Bullish As Virtuous Cycle Continues

When corporate bond buyers stepped up into the January/February 2017 issuance period, they were almost immediately rewarded with price markups thanks to what seemed...

Slippery Signs Coming from the Junk Bond Market

High yield bonds can often serve as a leading indicator for the equity markets. And although indexes which track high yield returns have not...

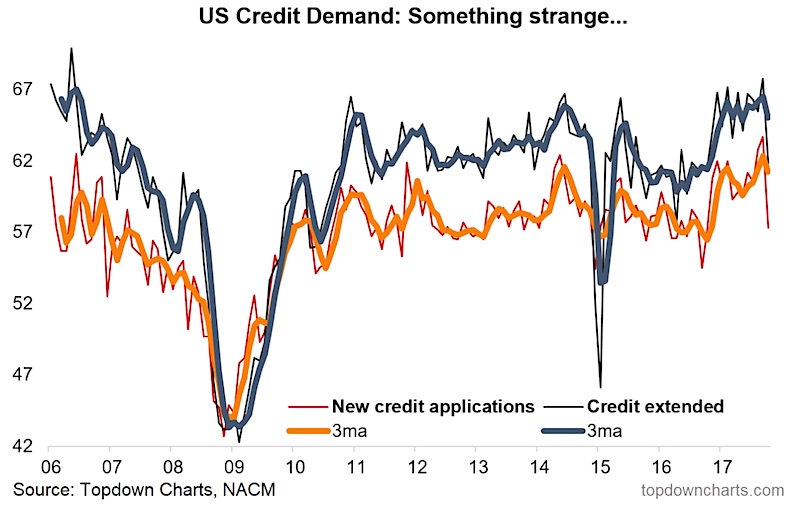

Unusual Credit Indicator Reports Big Drop In Demand

As I was going through and updating the various indicators that I monitor something in the credit space surprised me. The NACM CMI (think of this...