Tag: credit default swaps

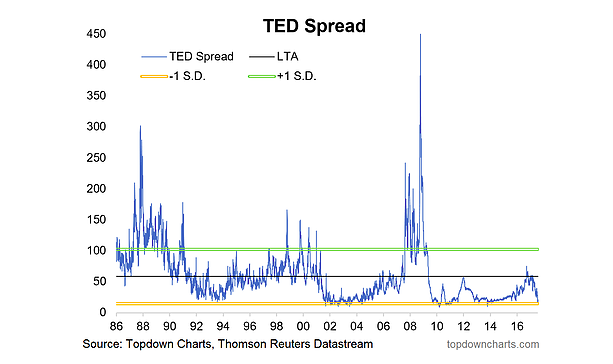

The TED Spread Is Dead… Again

The TED spread is something a lot of people were seemingly worried about a few months ago - at least that bearish crowd that provide the...

May 2017 Credit Markets Recap: Big Month For Corporate Bonds

May 2017 was a sufficiently stunning month in the credit markets.

And it deserves an update on the litany of data the I laid out...

April Credit Markets Recap: The Bull Market Marches On…

April proved to be yet another month of frustration for bears and those, like me, who are simply looking (and hoping) for a stock...

Corporate Credit Markets: Party Like It’s 2017!

It has been quite a while since I have written about the state of the corporate bond market.

Longtime readers know that I follow the...

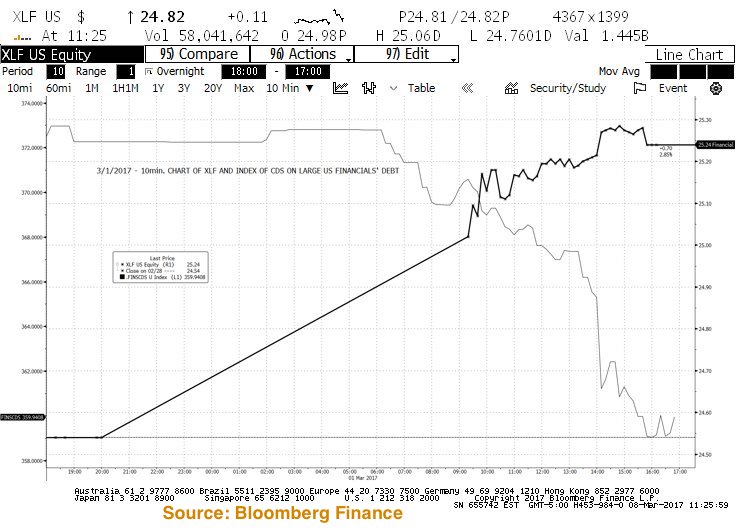

Credit Markets Update: European Financials Firm After BREXIT

I thought I'd provide a quick update on the credit markets in the aftermath of BREXIT. In particular European financials.

The attached chart below shows...

Are Credit Markets Signaling More Pain For Stocks?

I have been offering a fair amount of color on the twists and turns of corporate credit and credit derivatives, and their impact on...

Evaluating The Chinese Market Crash: Stocks vs Credit

Chinese stocks have effectively crashed and, given the laughable reliability of the underlying companies' financials, it shouldn't surprise anyone if the Chinese market crash...

Credit Markets Update: Is Something Scary Headed This Way?

With the “big bad event” that was the payroll number out of the way, it’s worth recapping the state of the corporate credit markets...

Flickering Hope In The Energy Sector: A DeMark View

Over the last couple of weeks I have been tweeting that the credit market for the Energy Sector (and select energy related names) seems...

The Current State Of The Global Credit Markets

Last week I wrote on how I interpret corporate credit and credit derivatives as guideposts for equity markets. In this piece I am going...