The first three months of the year concluded with the popular stock market averages recording their sixth straight quarterly gain and the best performance from the S&P 500 Index (INDEXSP:.INX) since 2012.

After experiencing a modest pullback in March, stocks recovered much of the lost ground the final week of the quarter with the Dow Jones Industrial Average (INDEXDJX:.DJI) and S&P 500 finishing the period about 1.00% from record levels.

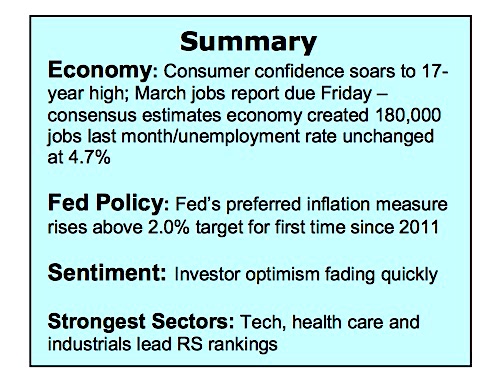

Although a frustrating month for investors, the March pullback provided needed relief from investor psychology where optimism had become excessive. The boom in confidence also spread to the economy as expectations by consumers, small- businesses and large-cap CEOs jumped beyond near-term economic reality.

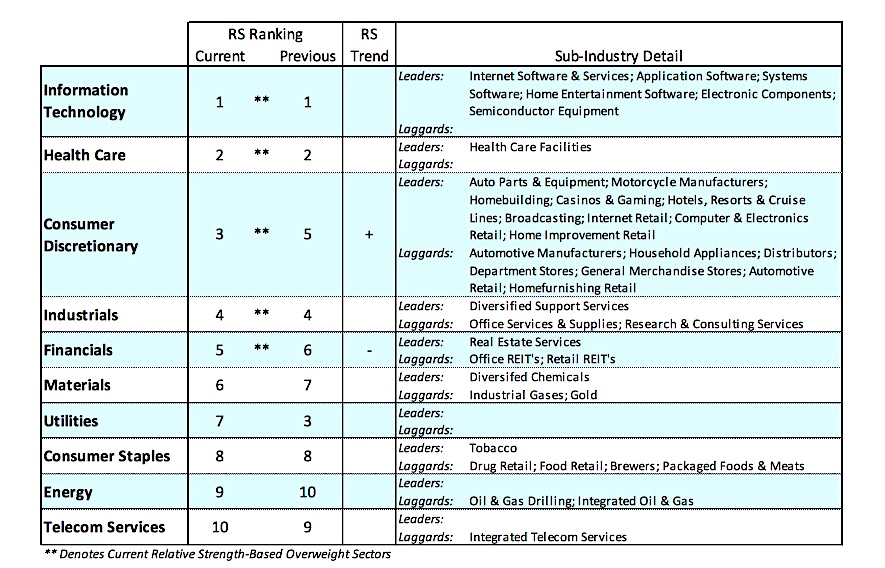

Historically, rising confidence about the future is a precursor of increased consumer spending, capital investment and job creation. This helps explain why stocks remain only a small-fraction from the highs despite the uncertainty out of Washington. First- quarter earnings will be the focus of attention the next few weeks. Given that expectations for corporate profits are higher could lead to disappointment and the possibility that that the post-election rally will not likely get recharged until we move deeper into the second quarter.

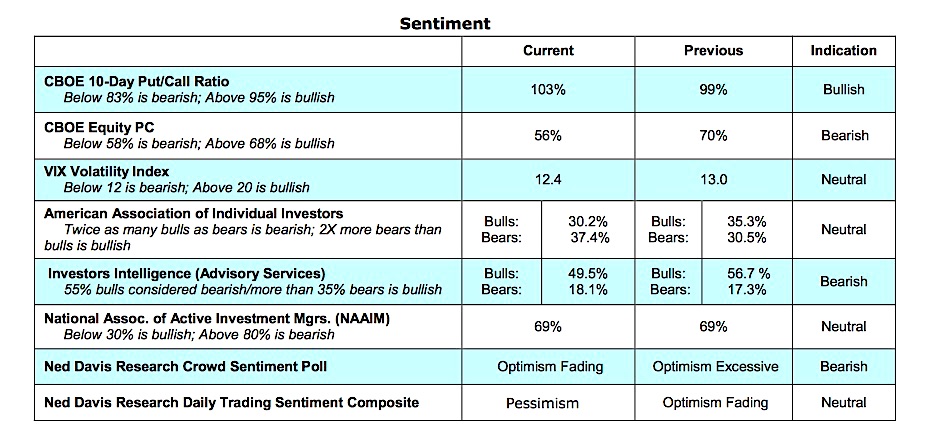

Investor Sentiment – Key Indicator

The technical indicators of the stock market continue to argue the case for a

consolidation/correction phase continuing in the second quarter. Investor optimism

reached the highest level in three years in late February. This suggested that a large measure of short-term liquidity had been spent. This partially explains the loss of upside momentum in the stock market in March. Confidence levels pertaining to the economy remain elevated but investor optimism is waning. The latest data from Investors Intelligence (II), which tracks the opinion of Wall Street letter writers, has plunged to 49% from 63% at the peak in averages on March 1.

Further deterioration in the II data would suggest that a buying opportunity is approaching. The most recent survey from the American Association of Individual Investors (AAII) confirms that optimism has retreated. Last week’s AAII data showed only 30% were bullish versus 37% that were expecting lower prices. A drop to 25% bulls in the AAII survey would offer additional signs of a market low approaching. The latest report from the National Association of Active Investment Managers (NAAIM) shows an allocation to stocks of 69%, unchanged from the previous week. At the pre-election lows for stocks the NAAIM allocation to stocks was 59%. The message from the sentiment indicators is that excessive investor optimism has peaked with the mood shifting toward caution. A continued movement of investor psychology toward pessimism would raise the likelihood of a summer rally in the stock market.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.