During this incredibly slow session, I took the pulse of lots of different stock market sectors.

Some are alive and well.

Others are dead, but alive.

And others are just plain dead.

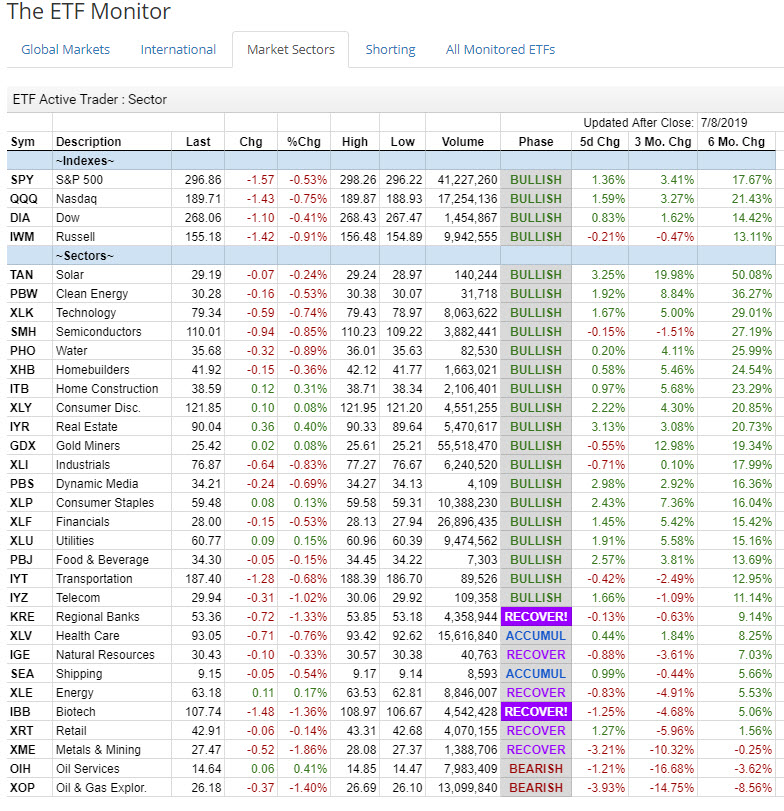

So, rather than go through the list using words, I thought it better to show you our ETF Monitor list.

The ETF Monitor is proprietary software owned by MarketGauge.

It has multiple invaluable features.

For one, the ETF Monitor tells us the phases of market sectors. When the phase is highlighted, that means the phase has changed for that day.

We look for a 2-day confirmation of a phase change.

In other words, we need to see that phase change confirm on the next consecutive trading session.

Note that all the indices are in bullish phases.

The sectors in bullish phases with the top 3 strongest gains over the last 6 months are Solar Energy ETF (NYSEARCA: TAN), Clean Energy ETF (NYSEARCA: PBW) and the Technology Sector ETF (NYSEARCA: XLK).

If you look down the list, Water, Homebuilders and Construvction, Gold Miners, Consumer Staples, Utilities and Food comprise some of the other stronger sectors.

All remain in Bullish Phases.

Biotechnology IBB, worsened in phase from accumulation to recovery. That means it failed to hold the 200-DMA.

Regional Banks KRE had the same scenario as IBB.

Two of the Economic Modern Family members, IBB and KRE are worth paying attention to.

Retail-the Granny of the Modern Family, confirmed the recovery phase today.

The bearish sectors are Oil Services and Oil and Gas Exploration.

A direct contrast to alternative energy for sure.

Whether dead, alive or dead/alive, the phases suggest that the indices, even on red days, are healthy until the phases worsen.

As for the rest, as always, I take the best clues from the Economic Modern Family. Alive or dead, the ultimate scenario we traders want to see is that they are in alignment.

For now, they are skeletal, but still half-dressed for a rally.

S&P 500 (SPY) – Inside day. 298.82 printed a new all-time high. 297 pivotal and support at 294.25.

Russell 2000 (IWM) – Inside day. 154.75 is the major pivotal 50-WMA to hold. 158 and 161 resistance overhead.

Dow (DIA) – Inside day. 269.60 the new all-time high. 267 support.

Nasdaq (QQQ) – 191.44 the new all-time high. 188.25 support.

KRE (Regional Banks) – 53.75 the 200 DMA now resistance to clear.

SMH (Semiconductors) – 115.70-116 resistance. Support at 109.22

IYT (Transportation) – 188.50 key to clear again while 186.07 is the key support to hold.

IBB (Biotechnology) – 109.27 now resistance and 105.30 support.

XRT (Retail) – 42.45 pivotal area-has to close above 43.15. Support at 41.75

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.