Despite the general lack of volatility in the financial markets, stocks remain range bound.

How long will this continue for? What fundamental and technical indicators are we watching going forward?

Learn more in our latest investing research outlook.

Highlights:

- Inflation Pressures Rising

- Treasury Yield Rise Not Getting Confirmation

- Q1 Results Generate Positive Earnings Surprises

- Stock Rally Comes With Return Of Optimism

- Breadth Thrusts Remain Elusive

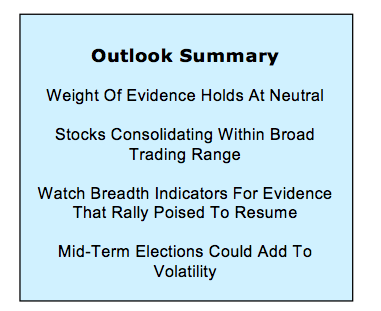

Stocks overall have rallied off of their recent lows, and some segments of the market (namely small-caps) have actually broken out to new highs. The weight of evidence, however, suggests the backdrop is little changed. As such, recent stock market strength is viewed within the context of continued consolidation.

The volatility that emerged in the first quarter has cooled as we move toward mid-year and the pace at which the stock market has experienced daily swings of 1% or more has slowed. A summer-time shift in focus toward the mid-term elections could mean that this lull is a temporary respite and perhaps not evidence that the storm has fully blown itself out.

Rhetoric and actions from the Federal Reserve and headlines relating to corporate earnings garner so much attention, but their key influence on stocks, particularly over the next few months, will likely be relative to any changes in expectations that emerge. Evidence that the Fed may be compelled to pursue a more aggressive than expected path of policy normalization or that blow-out earnings of the first quarter fail to generate positive follow-through for the remainder of the year could become headwinds for stocks.

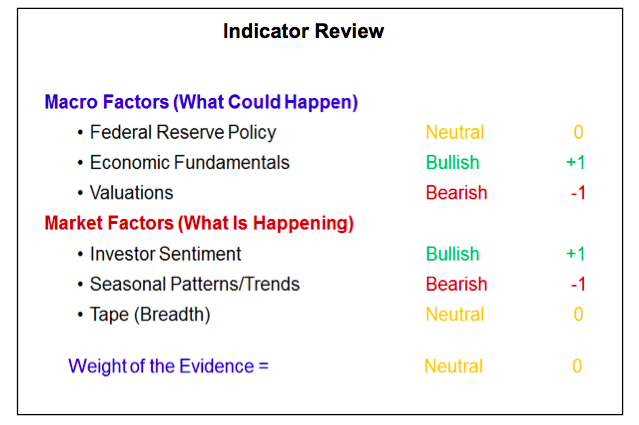

The rally off of the April lows has come with resurgent optimism and without evidence that broad market trends are keeping pace with the index-level improvements. Breadth remains neutral, and we continue to score sentiment as bullish, giving a nod to the excessive pessimism that emerged as stocks sold-off earlier this year over evidence that longer-term optimism may not have been fully relieved. With the weight of the evidence still neutral, it would be premature to chase rallies or overreact to any renewed weakness that may emerge.

Before proceeding to our review of the weight of the evidence, it may be worthwhile to contextualize market movements seen so far in 2018. Despite recording 32 daily moves of 1% or more, the S&P 500 is trading within a few percent of where it began the year. In the words of a recent headline from the Wall Street Journal, “Markets run fast only to stay in place.” Near-term volatility has ebbed somewhat as the S&P 500 has moved off its recent lows and small-cap stocks have moved to new highs, but absent evidence that consolidation is yielding to a sustainable move higher (most specifically an upside thrust in short-term breadth indicators), it would be premature to conclude that this lull in volatility is much more than a near-term respite.

Federal Reserve Policy is still neutral. At this point the Fed is signaling its intention to raise interest rates two more times in 2018. The uncertainty around Fed policy is whether an uptick in wage costs and evidence that underlying inflation is rising at its fastest pace in 10 years will prompt a revisiting of this plan. The most recent statement from the FOMC suggests it may not, as a shift in language was viewed by many as a sign that the Fed may be willing to tolerate (and in fact may welcome) evidence that inflation will run somewhat ahead of its 2% long-term target.

The effect of Fed policy is not only measured through central bank actions (at home and abroad) but also through the messages sent by bond market. As such, the recent move above 3.0% by 10-year T-Note yields is garnering considerable attention. The early-year test of this level capped a relatively sharp spike in yields. While of some near-term psychological importance, the 3% level itself is likely not meaningful from a longer-term perspective. What matters more for stocks is the pace at which yields rise (or fall) rather than absolute levels that are achieved. It is also interesting to note that the recent move higher in the 10-year T-Note yield has not been confirmed by German 10-year Bund yields. That could limit near-term upside in yields and help keep Fed Policy from becoming a headwind for stocks.

Economic Fundamentals remain bullish. Year-over-year growth in Real GDP continues to move higher, approaching the top of the range that has persisted for much of the past two decades but not yet achieving escape velocity. While the business cycle is perhaps approaching maturity from calendar perspective, research by the Federal Reserve has shown that recoveries do not die of old age.

The most reliable real-time indicators of recession risk suggest there is little evidence that economic weakness is on the horizon.

continue reading on the next page…