Broad Stock Market Outlook for March 2, 2018

Deeper tests continue across the board as momentum weighs heavy with sellers forcing prices down across the indices.

Today we watch support regions near 2662 in ES_F- a failure there sends us to 2634 before value buyers try to step in once more.

S&P 500 Futures

Support holds at 2658 for now. Failure to break and hold above 2684.75 will present more downside as quite likely. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 2684.75

- Selling pressure intraday will likely strengthen with a failed retest of 2658

- Resistance sits near 2678.75 to 2700.5, with 2717.5 and 2746.5 above that.

- Support sits between 2660.5 and 2649.5, with 2632.25 and 2613.5 below that.

NASDAQ Futures

Deep dips continue after bounces here for yet another day. Support today sits lower and again our eyes should focus on how well traders behave at these levels -near 6692. Sellers are clearly in charge of the charts for now with bounces providing ideal spaces to take short trades with the least risk. Buyers will need to take us back above 6778.75 and hold, else we will set our eyes on 6642 and 6589 as the potential downside continuation. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6779.5

- Selling pressure intraday will likely strengthen with a failed retest of 6692

- Resistance sits near 6746.75 to 6766.5 with 6798.5 and 6879.5 above that.

- Support sits between 6706.5 and 6692.75, with 6634.5 and 6548.75 below that.

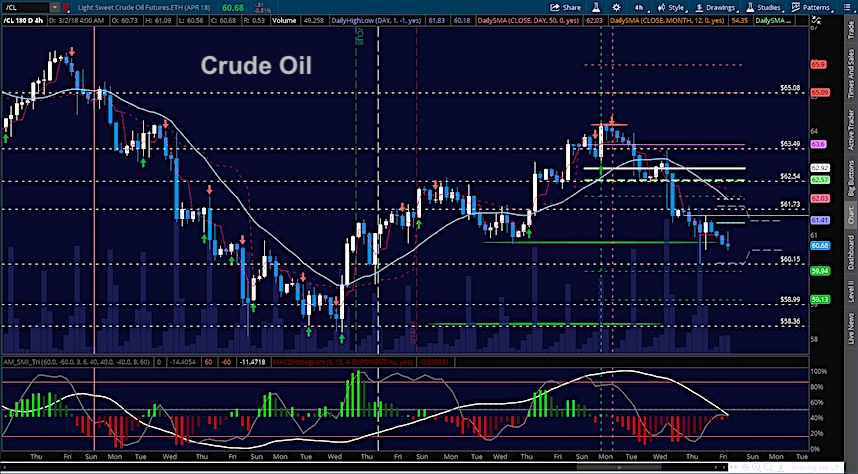

WTI Crude Oil

Deep support near 60.7 has been a battleground since yesterday. Decisions there will move the chart into a likely congested space between 60.15 and 62.2. Bearish undercurrents still show so bounces are likely to be met by sellers at the first pass. Translation – don’t buy the highs of the bounces you are watching. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 62.12

- Selling pressure intraday will strengthen with a failed retest of 60.6

- Resistance sits near 61.13 to 61.78, with 62.10 and 62.77 above that.

- Support holds near 60.9 to 60.17, with 59.9 and 59.36 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.