Broad Market Outlook for February 6, 2018

As with yesterday, traders are watching the opening tick and the early morning range. Our first “high” will be our watch zone with the overnight low our deep support. As discussed, we continue to be in a short cycle and have touched correction levels.

We now need to recapture 2649 (and hold), or else sellers will remain in control and the correction will continue. We are oversold and bounces are expected but there are trapped buyers out there. Use discipline.

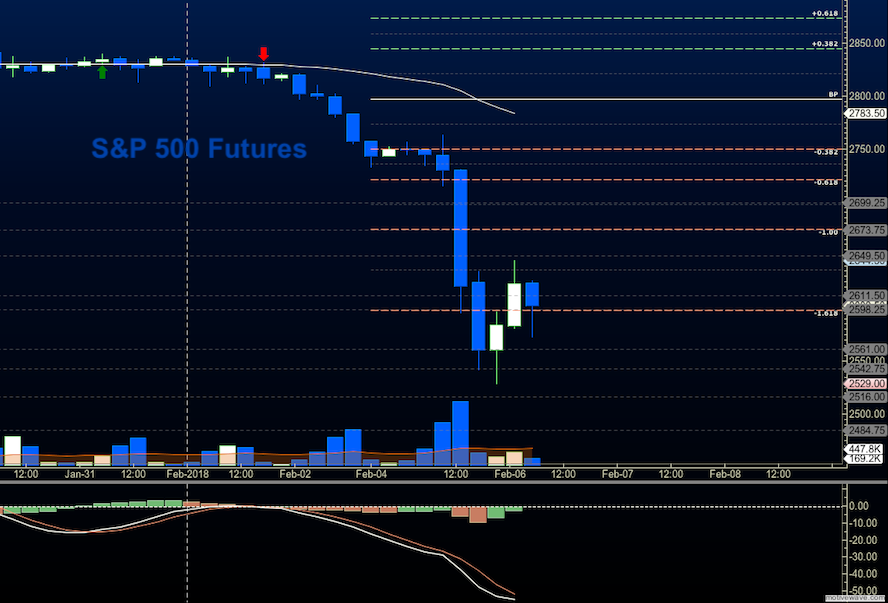

S&P 500 Futures

Resistance watches are now the name of the game if you are trying to pick bottoms (not a good plan right now) – if buyers can’t hold support level bounces, we’ll have yet another drift down. Momentum is still steeply negative, which means there will be bottom pickers again near a new level around 2598. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 2628.75

- Selling pressure intraday will likely strengthen with a failed retest of 2594

- Resistance sits near 2611.75 to 2626.5, with 2649.25 and 2673.5 above that.

- Support sits between 2604.5 and 2561.5, with 2542.25 and 2529.5 below that.

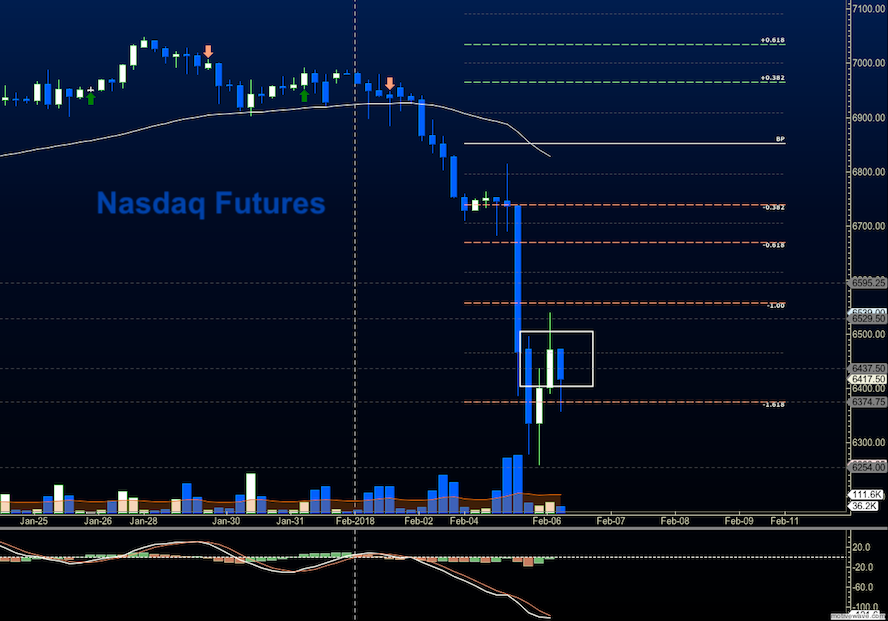

NASDAQ Futures

Momentum continues negative as traders try to bounce off the early morning lows- the same thing they did yesterday that failed. Buyers have to recover regions above 6539 to exercise any holding power in the charts. Countertrend bounces are likely with extreme readings all around so be careful to position your trades thinking first about risk. Failure to recapture 6502 will send prices lower back to congestion near 6374. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6511.5

- Selling pressure intraday will likely strengthen with a failed retest of 6374

- Resistance sits near 6474 to 6509.25 with 6529.5 and 6595.5 above that.

- Support sits between 6402.25 and 6375.5, with 6257.75 and 6126.25 below that.

WTI Crude Oil

API after the close. Traders fell into the lower ranges listed in yesterday’s support levels where we now hold. Trading remains choppy with momentum drifting lower into edges that could retest the 60 level. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 64.04

- Selling pressure intraday will strengthen with a failed retest of 63.2

- Resistance sits near 63.83 to 64.04, with 64.74 and 65.2 above that.

- Support holds near 63.2 to 62.9, with 62.2 and 61.54 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.