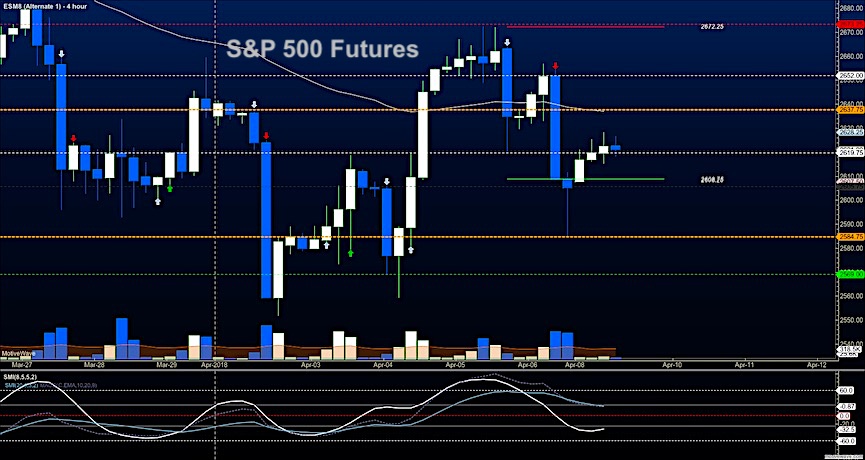

Broad Stock Market Outlook for April 9, 2018

An overnight relief bounce in stock market futures greets traders Monday morning. Even so, the S&P 500 and Nasdaq are prone to selloffs on tests higher into price resistance.

A broader look at stock market futures shows a range bound market with the edges or our price ranges likely to give us reversal opportunities upon initial testing.

A familiar test of 2620 as resistance greets us this morning. We remain in choppy congestions with some negative drift today with our lows holding. The line in the sand to shift the balance intraday seems to be near 2635. Failure to breach 2630 is likely to bring more selling. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intradaywill likely strengthen with a bullish retest of 2628.75

- Selling pressure intradaywill likely strengthen with a bearish retest of 2614.50

- Resistance sits near 2635.75 to 2649.5, with 2667.25 and 2684.75 above that.

- Support sits between 2618.25 and 2607.5, with 2594.5 and 2568.50

NASDAQ Futures

Relief bounce here as well but without the breach of resistance above 6530. As lower highs continue to present, we remain in bearish formations with this chart as with the other broad indices. The line in the sand today seems to be present around 6484 as sellers will likely accelerate the action down below this level. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intradaywill likely strengthen with a bullish retest of 6530.75

- Selling pressure intradaywill likely strengthen with a bearish retest of 6484.50

- Resistance sits near 6527.5 to 6557.5 with 6604.5 and 6636.25 above that.

- Support sits between 6497.5 and 6486.5, with 6457.25 and 6414.75 below that.

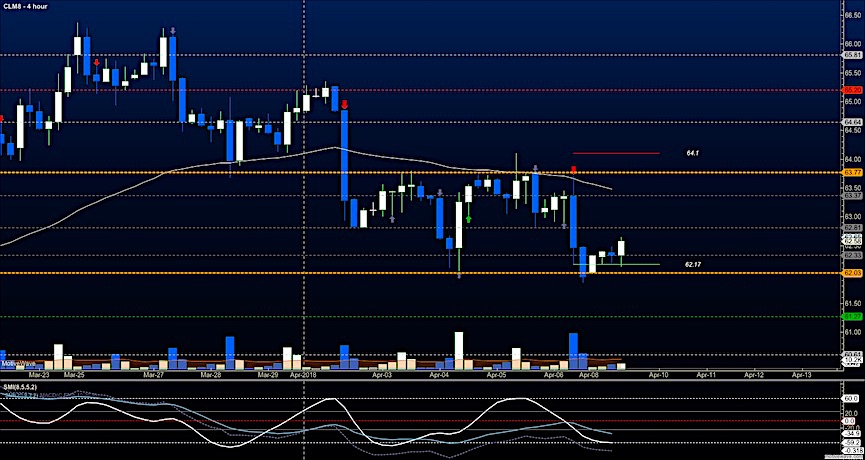

WTI Crude Oil

Oil continues to fade under selling pressure with 62.8 as near resistance this morning. Bounces from here are still prone to selling below 63.3 with a chance to break the early morning lows below 62 if we fail to breach and hold the 62.8 line in the current bounce. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intradaywill likely strengthen with a bullish retest of 62.84

- Selling pressure intradaywill strengthen with a bearish retest of 62.48

- Resistance sits near 62.8 to 63.39, with 63.82 and 64.86 above that.

- Support holds near 62.2 to 61.9, with 61.47 and 61.13 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.