Stock Market Futures Trading Considerations For December 5, 2017

The S&P 500 (INDEXSP:.INX) and Nasdaq (INDEXNASDAQ:.IXIC) are trading marginally higher on Tuesday morning. In the commentary below I break down the trading setups for both futures indices along with crude oil.

Note that you can access today’s economic calendar with a full rundown of releases.

S&P 500 Futures

In an interesting change, traders could not lift price off the fade into the gap fill of above the open of the day before the close. We have a big support area near 2633 mentioned yesterday, and buyers have everything to prove here. If we fade below that, a bearish motion could follow into deeper levels seen last week near 2606.75- but buyers could still show up here. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2644.5

- Selling pressure intraday will likely strengthen with a failed retest of 2633.5

- Resistance sits near 2644.5 to 2654.5, with 2660.5 and 2665.25 above that.

- Support holds between 2633.5 and 2626.25, with 2617.5 and 2606.5 below that.

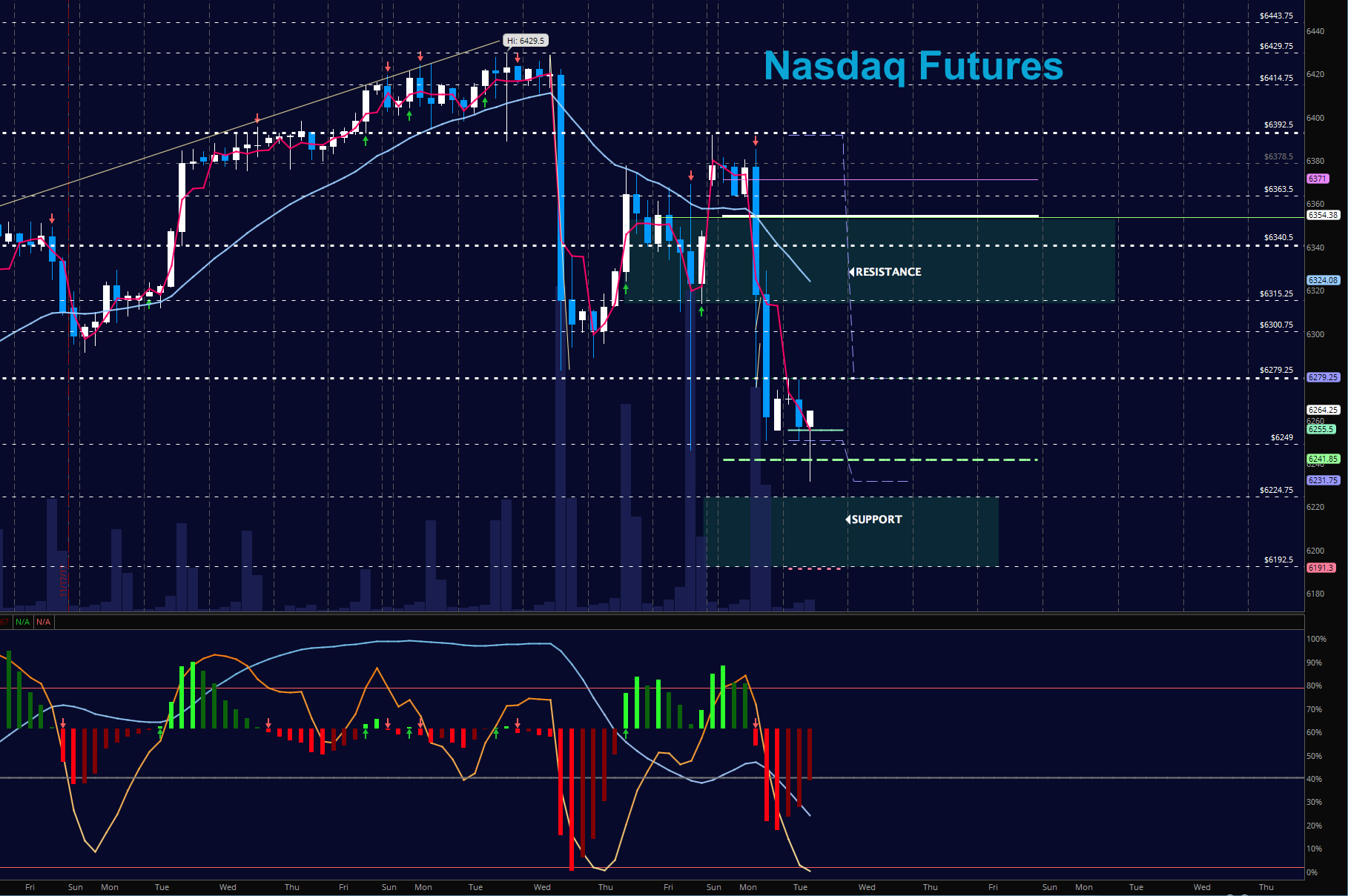

NASDAQ Futures

Nasdaq weakness continues yet again and undercurrents continue to lose ground. Old support levels are now intraday resistance. Deep dips are now the order of the day as well as lower highs. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6279.5

- Selling pressure intraday will likely strengthen with a failed retest of 6245.5

- Resistance sits near 6286.5 to 6300.5 with 6315.75 and 6328.75 above that.

- Support holds near 6238.5 and 6224.75, with 6192.25 and 6165.5 below that.

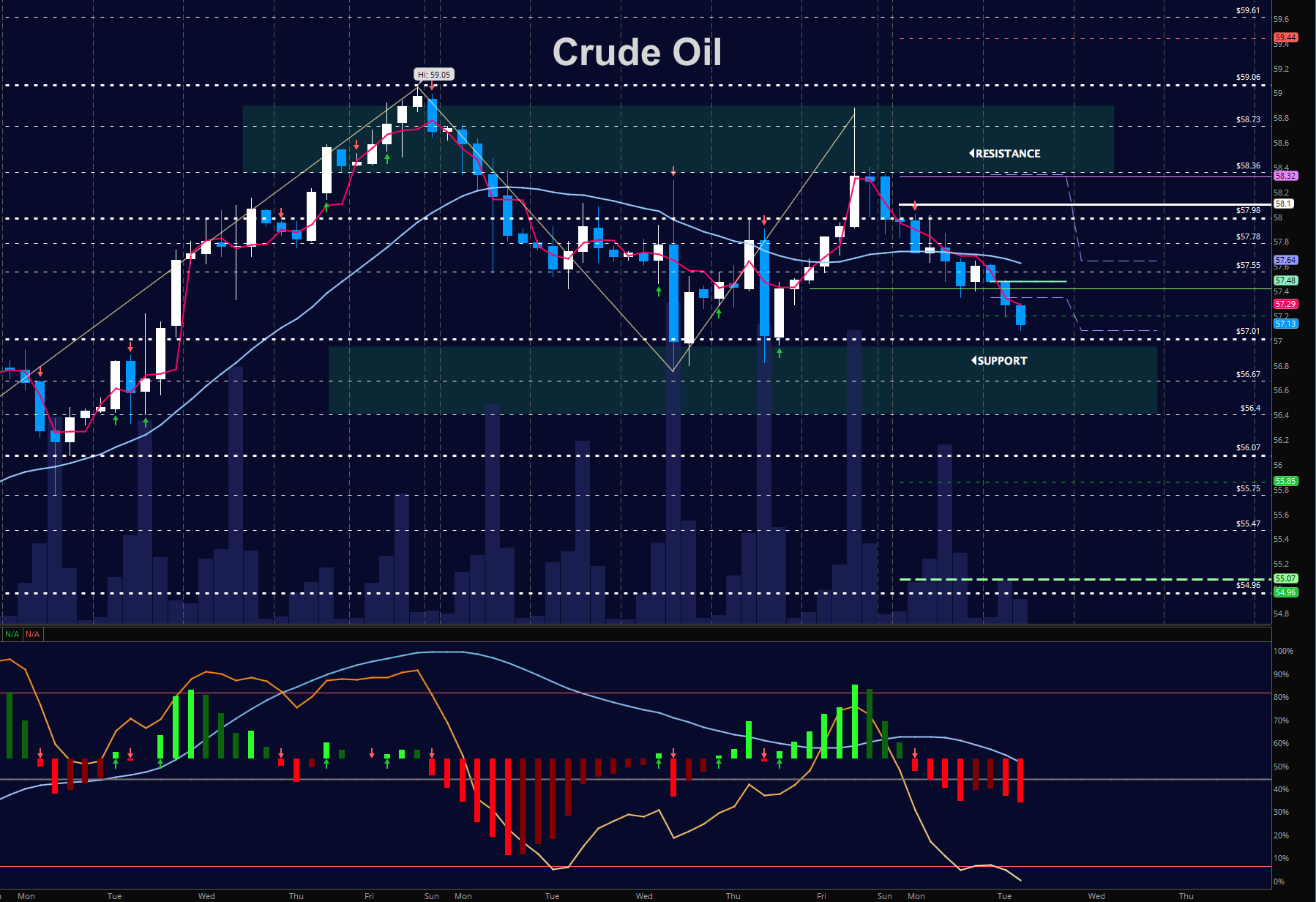

WTI Crude Oil

With weighted traders at extreme levels long, the fade grabbed hold and now we battle at the level of 57. Failure here will be troubling for buyers. For the bullish motion to hold, we must recover 57 if lost. The bigger undercurrent is still weakening from strong bullish action. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 57.36

- Selling pressure intraday will strengthen with a failed retest of 56.8

- Resistance sits near 57.36 to 57.64, with 57.98 and 58.38 above that.

- Support holds near 57.01 to 56.67, with 56.4 and 56.07 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.