Stock Market Futures Considerations For April 27, 2017

The S&P 500 (INDEXSP:.INX) finally took a breather yesterday. After rallying in the morning up to our targeted range, the index pulled back. See below for trading setups.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers.

S&P 500 FUTURES (ES_F)

As suspected, (see yesterday’s post), we saw price chasing into 2394 before sellers took control and forced price back to breakout levels. The song remains the same -Watch for failed retests with negative divergence to consider shorts into support levels (which continue to hold higher). Momentum is mixed and volatility suggests a congested sideways day ahead – 2381 holds as support, and 2389.25 is now resistance.

- Buying pressure intraday will likely strengthen above a positive retest of 2389.25 ( careful here as sellers will try to push them down)

- Selling pressure intraday will likely strengthen with a failed retest of 2380.5

- Resistance sits near 2389.25 to 2392.25, with 2394.5 and 2397.75 above that

- Support holds between 2380.5 and 2377.5, with 2374.75 and 2365.5 below that

TRADE SETUPS

Upside trades – Two options for entry

- Positive retest of continuation level -2386(careful with resistance ahead)

- Positive retest of support level– 2382.75

- Opening targets ranges- 2374, 2376.5, 2379.75, 2380.75, 2384.25, 2388.75, 2391.25, 2394, 2397.75, 2402.25

Downside trades – Two options for entry

- Failed retest of resistance level -2382.5

- Failed retest of support level– 2380.5

- Opening target ranges– 2378.5, 2375.25, 2372, 2368.5, 2365.5, 2361.25, 2359, 2357.5, 2354.75, 2349.75, 2344.5, 2341.25, 2338.5, 2335.75, 2331.5, 2329.25, 2325.75, 2320.5, 2317.75, 2312.75, 2307.75, 2305.5, 2299, 2293

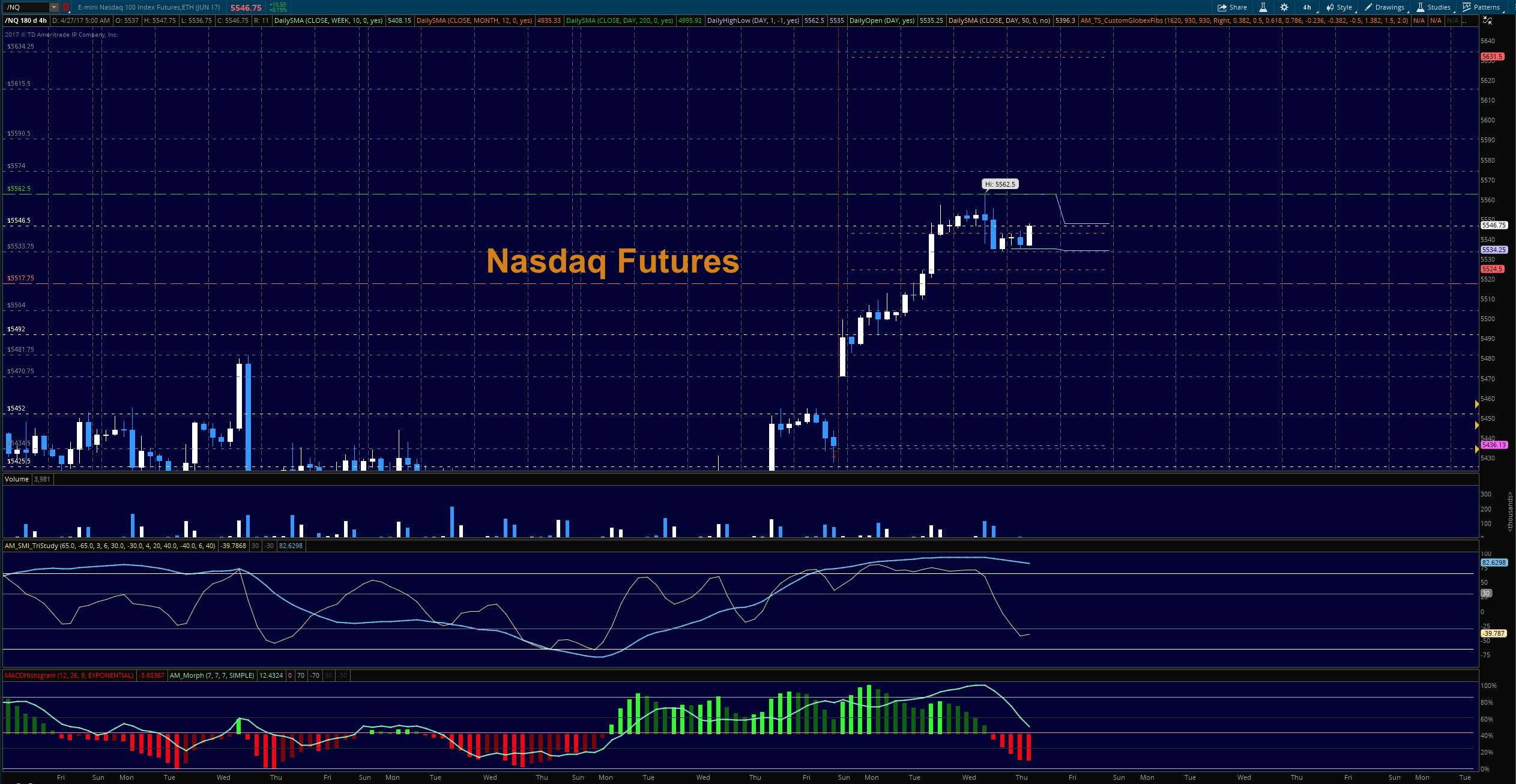

NASDAQ FUTURES (NQ_F)

New highs faded at our top target of 5462.25 (see yesterday’s post), but momentum told the story of the fade ahead of time. We still hold higher support, now at 5534. Pullbacks will continue to find buying support but a potential topping formation could be on the horizon. How well we hold 5534 will be the litmus test with a drift to 5524 and 5517.75 if we do not. Intraday momentum is mixed.

- Buying pressure intraday will likely strengthen with a positive retest of 5557.75 – watch your size

- Selling pressure intraday will likely strengthen with a failed retest of 5524.5

- Resistance sits near 5557.75 to 5562.5, with 5574 and 5590.5 above that

- Support holds between 5492.25 and 5483.25, with 5470.75 and 5462.25 below that

TRADE SETUPS

Upside trades – Two options

- Positive retest of continuation level -5552.75

- Positive retest of support level– 5534.25

- Opening target ranges – 5524.25, 5527.75, 5533.75, 5537.5, 5542.25, 5557, 5562.5, 5574, 5590.5, 5604.5, 5615.5. 5634.25

Downside trades – Two options

- Failed retest of resistance level -5546 (watch for higher lows if chart is trying to move upward)

- Failed retest of support level– 5542

- Opening target ranges –5548.75, 5542.25, 5537.75, 5527.75, 5524.5, 5517.75, 5509, 5502.75, 5599.5, 5492.75, 5486.5, 5480.75, 5471.25, 5462.75, 5455.75, 5452.25, 5442.5, 5437.75, 5431.25, 5424.5, 5412.25, 5404

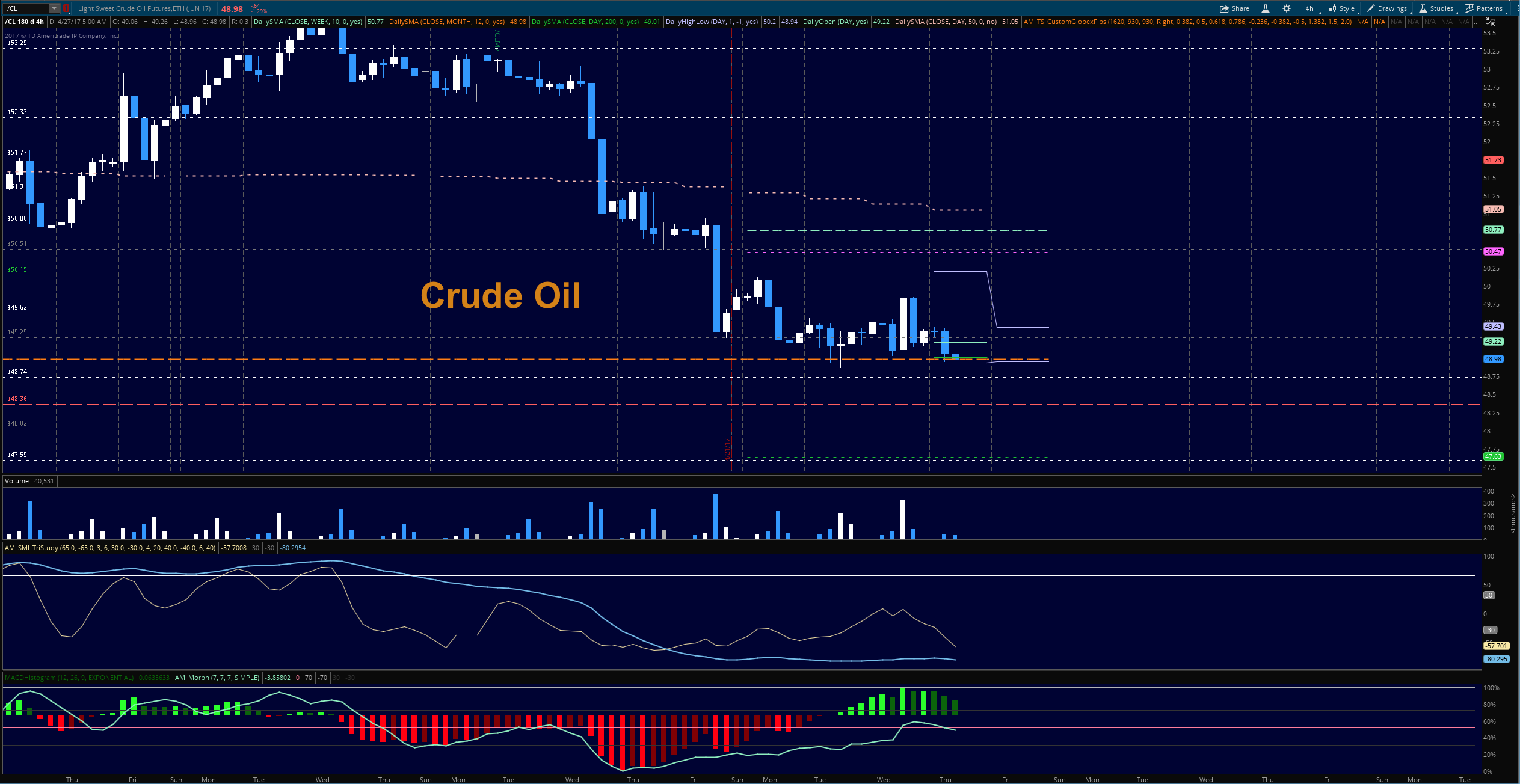

CRUDE OIL – WTI

At this writing, battle royale wages at monthly support levels near 49.1 – Traders are unwilling to give way to selling pressure as buyers pick it up off low tests near 49, but momentum suggests that the fade down may arrive anyway. To hold a trade at this level now is nothing more than a gamble without empirical evidence showing the clear direction. As such, I wait quietly for evidence of directional strength in order to follow along.

- Buying pressure intraday will likely strengthen with a positive retest of 49.6

- Selling pressure intraday will strengthen with a failed retest of 48.94

- Resistance sits near 49.55 to 50.12, with 50.78 and 51.34 above that.

- Support holds between 49.01 and 48.86, with 48.46 and 48.08 below that.

TRADE SETUPS

Upside trades – Two options

- Positive retest of continuation level -49.56

- Positive retest of support level– 49.34

- Opening target ranges– 49.55, 49.9, 50.14, 50.49, 50.86, 51.16, 51.34, 51.51, 51.78, 52.02, 52.32, 52.68, 53.02, 53.27, 53.56, 53.74, 53.98, 54.11, 54.38, 54.89, 55.27, 55.68,

Downside trades – Two options

- Failed retest of resistance level -49.4

- Failed retest of support level– 49.09

- Opening target ranges for non-members – 49.26, 49.14, 48.86, 48.56, 48.3, 48.08, 47.59

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day. Visit TheTradingBook for more information.

Our live trading room is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.