Broad Stock Market Outlook for March 19, 2018

Charts are at important support levels and there should be some measure of argument between buyers and sellers across these congested regions.

However, with prices pushing lower in early trading, it’s wise to watch your support zones carefully… and keep your stops tight.

S&P 500 Futures

Support watch is lower near 2734 as lower highs are present. This is a key support zone with deep dips below finding additional buying action at the support areas. We still need to break and fail to recapture 2734 before sellers can gather traction today- The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2746.5

- Selling pressure intraday will likely strengthen with a bearish retest of 2733

- Resistance sits near 2746.5 to 2754.5, with 2767.75 and 2783.75 above that

- Support sits between 2736.75 and 2729.75, with 2715.5 and 2705.5

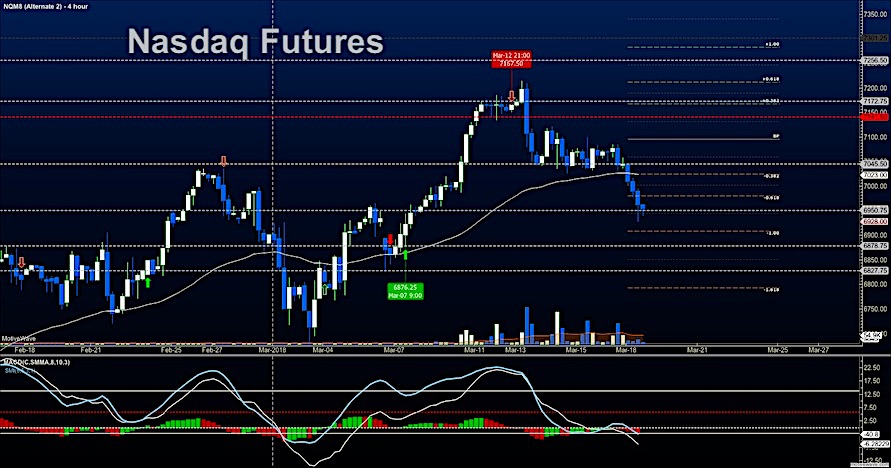

NASDAQ Futures

Breakdown after price congestion and now testing old resistance and support near 6950.5. Failed retests in this region will open a fade that could slip into 6827. Deep dips here are likely to bounce off the lower levels – recapture will be bullish and failure to hold above 6950 will make for more bearish action. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 7023.75

- Selling pressure intraday will likely strengthen with a bearish retest of 6940.5

- Resistance sits near 6992.5 to 7008.5 with 7023.5 and 7076.5 above that.

- Support sits between 6950.5 and 6940.75, with 6928.75 and 6878.75 below that.

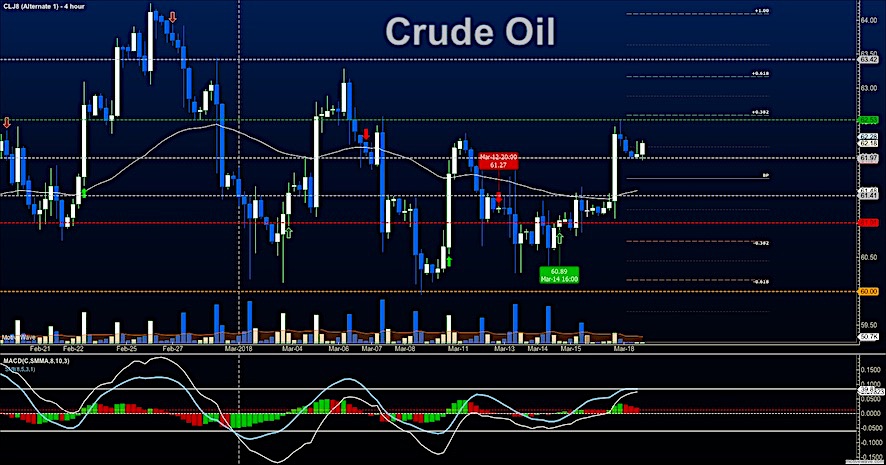

WTI Crude Oil

Ranges continue between 60.5 and 63 as traders hold us above 62 but clearly at resistance. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 62.56

- Selling pressure intraday will strengthen with a bearish retest of 61.4

- Resistance sits near 62.53 to 63.07, with 63.42 and 64.05 above that.

- Support holds near 61.9 to 61.68, with 61.22 and 60.89 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.