Broad Stock Market Futures Outlook for April 23, 2018

The current formations across the major stock market indices suggest buyers are taking a breath and allowing sellers to move the prices into higher lows and prior congestion zones.

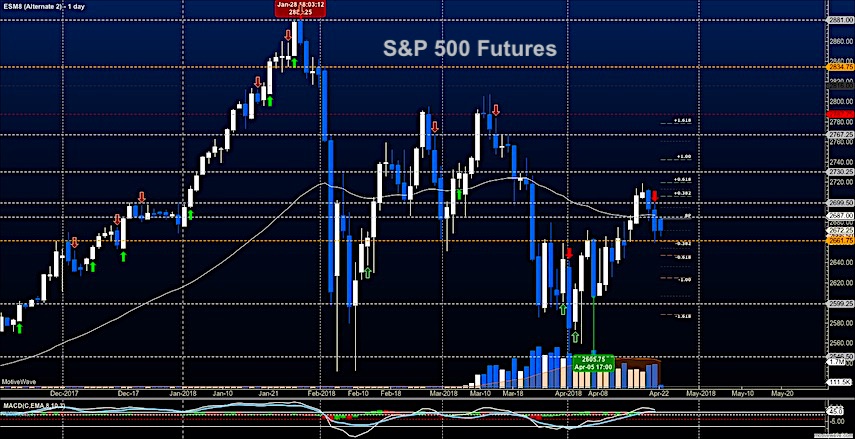

The S&P 500 is in a retrace of bullish motion from last week and close to support levels that need to hold across the board. Failure at the lows of last Thursday will bring sellers back to the table. Definitely a space to be very cautious with size.

S&P 500 Futures

Support from Friday’s bounce near 2661 holds – this will be the line in the sand with a failed retest spelling trouble for long positions intraday. If you like holding trades for a longer period of time, I would suggest waiting for price resolution out of this area as cross-currents may prove difficult to navigate. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2686.75

- Selling pressure intraday will likely strengthen with a bearish retest of 2661.5

- Resistance sits near 2679.25 to 2684.75, with 2702.25 and 2717.75 above that.

- Support sits between 2665.75 and 2654.5, with 2646.5 and 2632.50

NASDAQ Futures

Bounce off higher low congestion is in progress this morning as buyers try to get us back over 6721 – currently sitting as resistance today. Holding 6721 will be important to buyers today. Below 6660, buyers will have more difficulty retracing. Watch your size as there are cross-currents. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 6722.75

- Selling pressure intraday will likely strengthen with a bearish retest of 6660

- Resistance sits near 6692.5 to 6720.25 with 6765.5 and 6819.25 above that.

- Support sits between 6665.5 and 6635.5, with 6611.75 and 6587.75 below that.

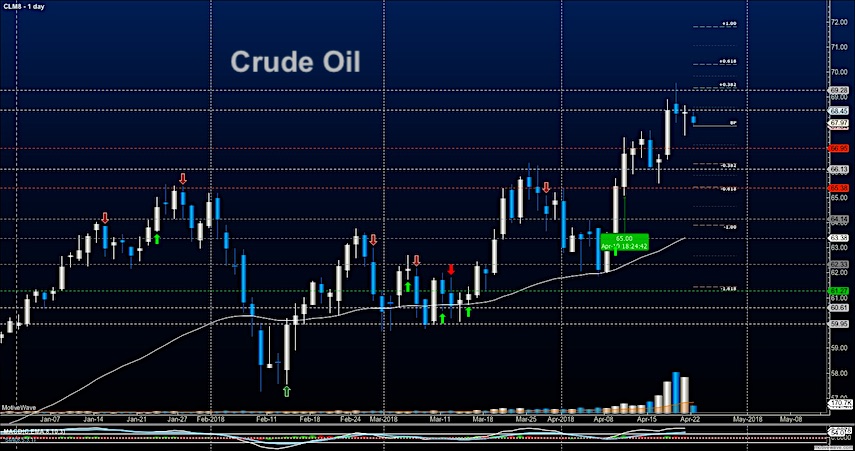

WTI Crude Oil

Lower resistance near 68.4 keeps traders range bound between 67.7 and 68.46. Friday’s low will provide support if traders are intent on holding the bounce that we see forming this morning at the base of congested support. The failure to make new highs is the first test of a reversing formation – this occurred Thursday at the rejection of 68.7 and prices continued into the support area near 67.7. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 68.46

- Selling pressure intraday will strengthen with a bearish retest of 67.60

- Resistance sits near 68.38 to 68.67, with 69.12 and 70.22 above that.

- Support holds near 67.7 to 67.26, with 66.95 and 66.47 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.