S&P 500 Futures Trading Considerations For April 17, 2017

The S&P 500 (INDEXSP:.INX) bounced right where we expected (see yesterday’s post). But there’s a lot of work to do. Buyers still need to be disciplined and understand that the support range below needs to hold.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers.

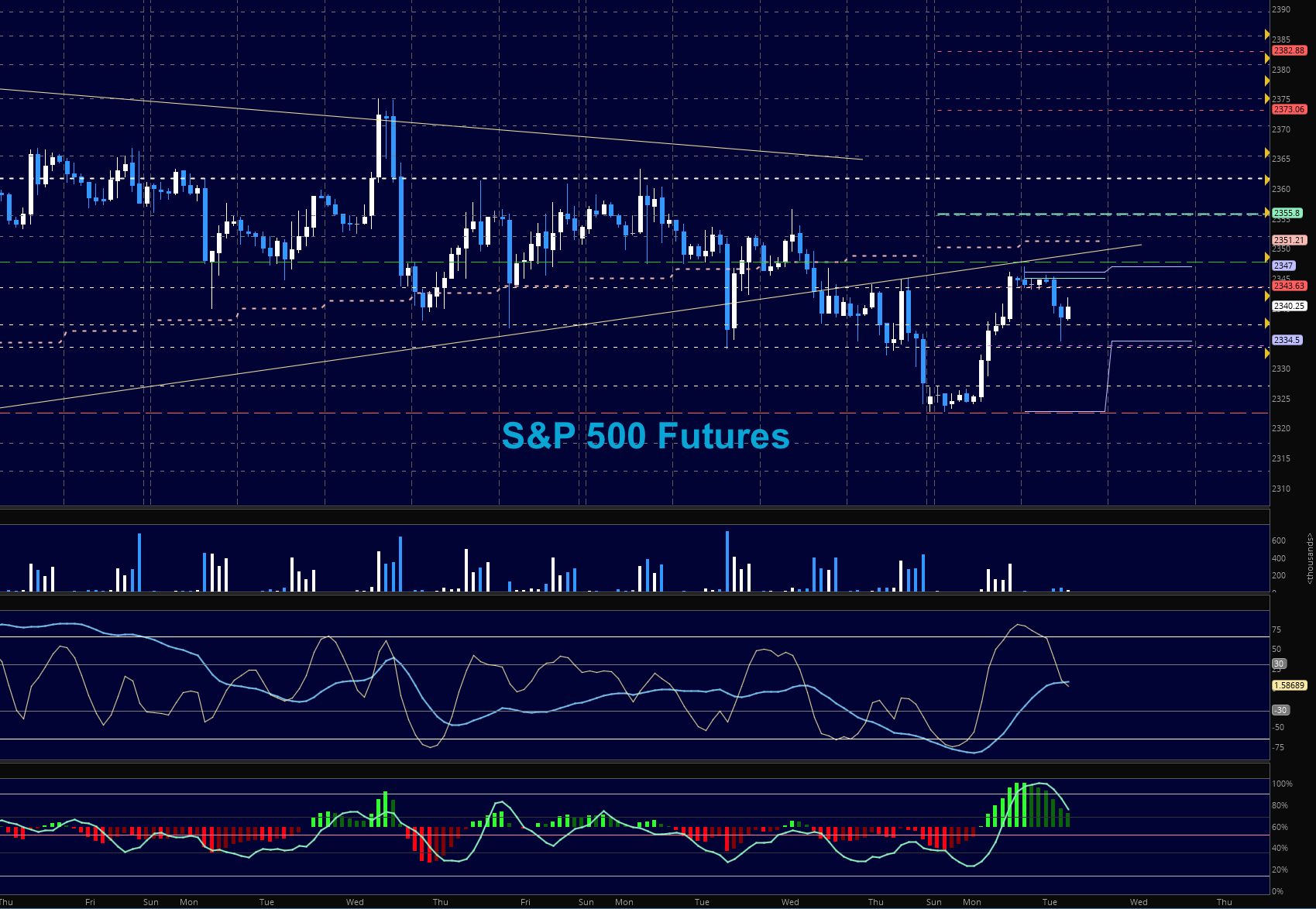

S&P 500 Futures (ES)

Buyers came to the rescue yesterday at key support levels and took us all the way to resistance near 2347. As we took to this range, sellers came in to push the chart back down and now buyers have moved near the top of the support range near 2335 – as mentioned, this range between 2317 and 2335 is still very important for buyers to hold. Gold and the 30-year bonds faded off their highs but still in bullish formations. Volatility futures also moved off their highs. Intraday momentum followers have been doing well as long as they watch volume drift off in the direction of their trade. Caution all the way around is suggested with size.

- Buying pressure will likely strengthen above a positive retest of 2354.5

- Selling pressure will likely strengthen with a failed retest of 2334

- Resistance sits near 2346.5 to 2354.5, with 2357.5 and 2361.25 above that

- Support holds between 2334 and 2322.5, with 2317.75 and 2305.5 below that

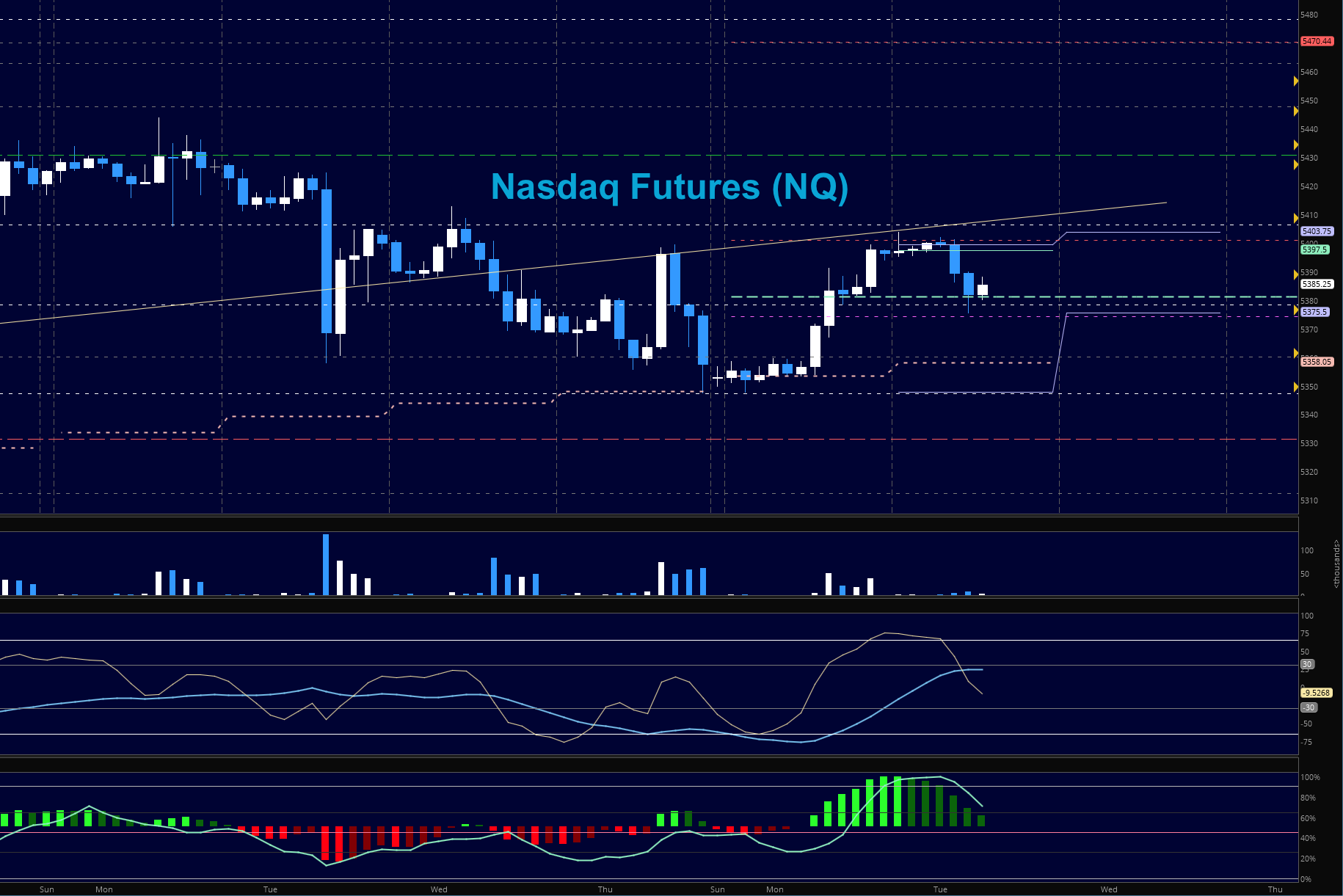

NASDAQ Futures (NQ)

Traders resolved the bounce upward into important resistance near 5404 overnight but sellers quickly returned to test higher lows. This signals to me that we are likely to see choppy markets with wider swings. Traders chasing momentum will move us around on both sides of the congestion (as it looks right now anyway). New higher support is building at 5381, so this level will likely be the litmus test today. Above the region, we should have buyers in charge and below the region, sellers will hold the power. Level to level trading is best here and preparing for both the entry and exit.

- Buying pressure will likely strengthen with a positive retest of 5404.5 (use caution as sellers sit near 5411)

- Selling pressure will likely strengthen with a failed retest of 5374.25

- Resistance sits near 5394.5 to 5404.5, with 5411.75 and 5430.5 above that

- Support holds between 5374.25 and 5358.25, with 5347.5 and 5331.5 below that

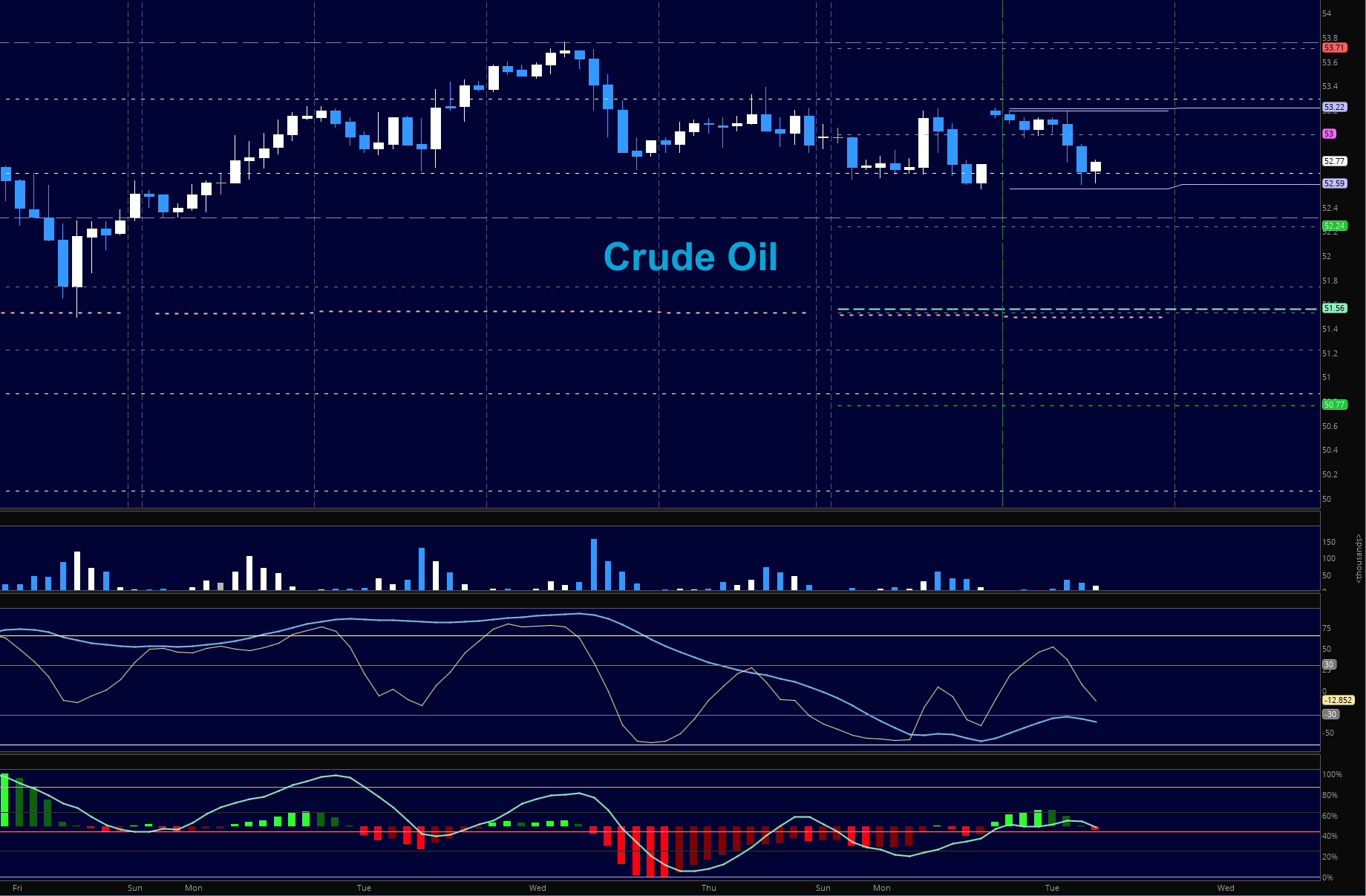

CRUDE OIL –WTI

Oil has remained in tight formations for a few days and with momentum suggesting that selling is possible into support. Price action remains very choppy with sellers sitting near 53.2 and buyers near 52.63. News is mixed with the API report on the horizon after the close.

- Buying pressure will likely strengthen with a positive retest of 53.36

- Selling pressure will strengthen with a failed retest of 52.5

- Resistance sits near 53.36 to 53.78, with 54.11 and 54.53 above that.

- Support holds between 52.52 and 52.2, with 51.69 and 50.88 below that.

Our live trading room is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.