Stocks are in rally-mode on positive news about trade talks. But, market cycles are suggesting near term pressure and volatility.

The stock market gained ground last week as investors refocused on the China trade war; for the week, the S&P 500 INDEXSP: .INX rose by 53 points to 2979, an increase of nearly 2%.

The stock market faltered early in the week when the US and China enacted fresh tariffs on each others’ imports. But optimism later exploded on news that representatives would discuss a possible new round of trade negotiations in October.

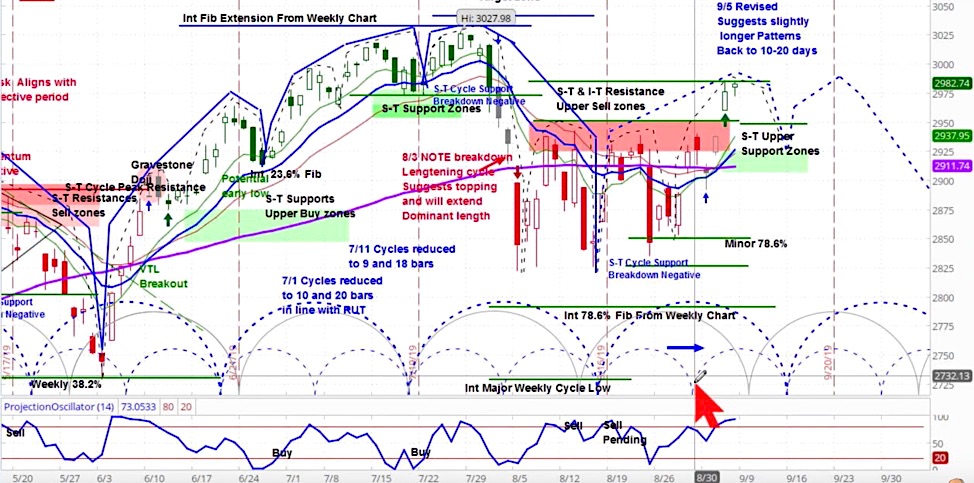

Our approach to technical analysis uses market cycles to project price action.

We feel it is first of all important to focus on the fact that momentum has flipped from bearish to bullish in the short-term.

However, based on intermediate term cycles, we do not believe this will last long. Look for the Volatility Index INDEXCBOE: VIX to remain active.

For the coming week, our analysis is for renewed pressure on the SPX, within the context of its current minor cycle shown on the chart above. The near term support zone is between 2910-2925.

S&P 500 (SPX) Daily Chart

Stock Market Video for the week of September 9

For a more detailed analysis of both of these charts, check out the latest episode of the askSlim Market Week show.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.