Modern Portfolio Theory sits at the core of just about every portfolio construction process.

Although developed some seventy years ago, the core beliefs of Modern Portfolio Theory remain as applicable today as they did then. By combining various asset classes that have different return and volatility characteristics, a portfolio can be constructed to target an expected return given an appropriate level of risk (volatility).

More recently, say the last 25 years, this approach has been at the core of proportionately combining equities and bonds to achieve different portfolios to suit various investor needs and objectives. To put it frankly, this has worked very well helping many investors reach their goals.

However, Modern Portfolio Theory may have a problem going forward. Don’t worry, we are not going to hack on bonds based on a fear that yields may rise in the future, creating a portfolio drag. There are already enough bond haters out there. The issue we are seeing goes beyond just the bond argument – correlations have been rising just about everywhere. In today’s world, correlations have been changing, with more and more asset classes becoming increasingly correlated. The problem: when the correlations between investments are higher, it becomes harder to diversify risk in a portfolio.

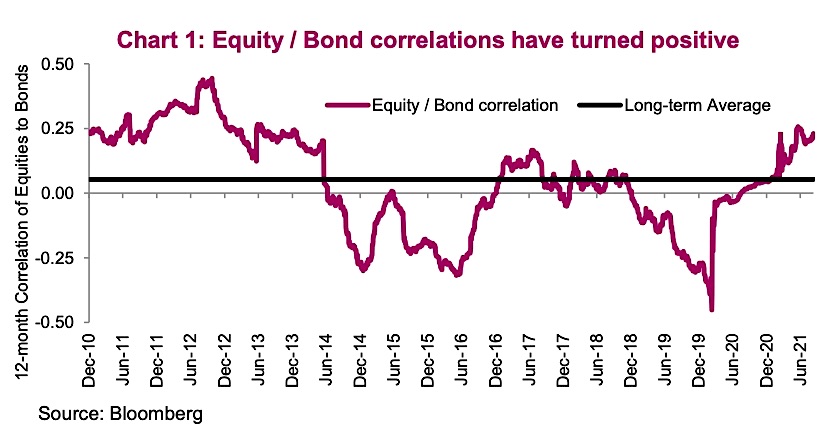

Let’s start with the big one, global bonds and global equities. Combining equities and bonds has benefitted from a generally negative correlation for much of the past few decades. However, this correlation has turned positive of late (chart 1), implying reduced diversification benefits when combining bonds and equities. This isn’t too much of a concern, given that the long-term average is slightly positive.

But don’t throw out your bonds just yet. This correlation tends to return to be strongly negative during risk-off periods in the equity markets. This reflex action during corrections helps maintain bonds in portfolios, even if they experience periods of low or even negative performance.

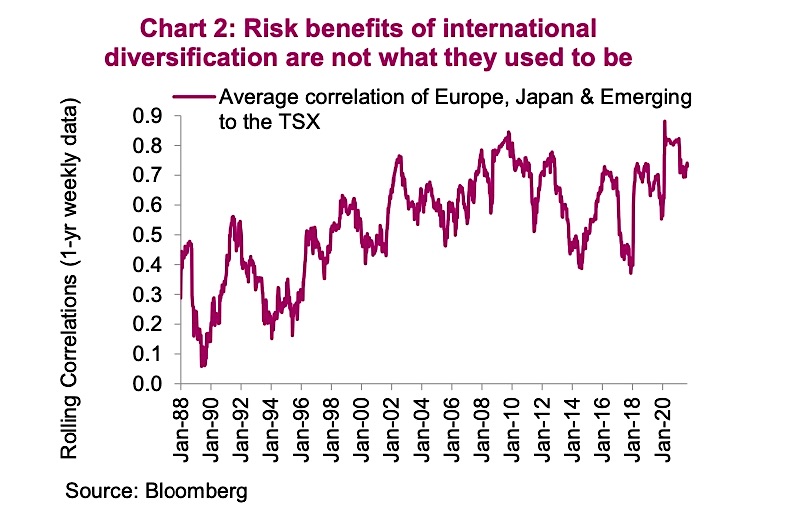

Rising correlations go beyond just bonds and equities. Equities themselves have become increasingly correlated – this can be seen in the rolling correlation between international equity markets. International equity diversification used to be a powerful risk reduction strategy, providing exposure to equity markets that are comprised of different companies and sector mixes and exposed to different economic and interest rate regimes. But in a world that has become more and more interconnected, whether by communications, economically or by group think among central banks, global equity markets are moving as one. (see chart 2 below)

We are not suggesting investors should shy away from international diversification. Truth be told, most Canadian investors suffer from home country bias and could use more international exposure. Other markets still offer different return profiles. However, the risk benefits are not what they used to be.

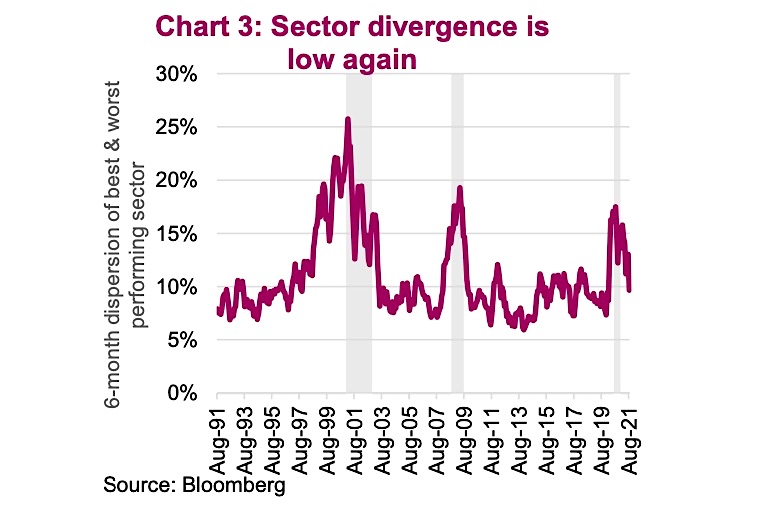

Even within equity markets such as the S&P 500 Index, diversification benefits are muted. Chart 3 below is the average divergence over six months of the best and worst performing sectors. This helps reveal the degree of variation between different sectors over time. When all sectors are moving closer together, the benefits of diversification, even with one equity market, are muted.

Similar rising correlations compared to equities can be seen in commodity markets, alternatives, the list goes on. Correlations appear to be higher.

Investment implications

Diversification remains at the core of portfolio construction. However, in markets dominated by major factors such as pandemics, previously unheard- of monetary influences and fiscal spending with few limitations, the macro rules the roost. This has changed historic correlations and relationships between asset classes. While they may change again as the world reverts to whatever normal is going to be, in the meantime, finding effective diversification strategies for portfolios will be at a premium.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.