Marvell Technology (NASDAQ: MRVL) sank 5% on Friday morning, after the semiconductor company projected weak guidance for both earnings and revenue.

However, the stock failed in resistance and its market cycles indicate weakness until April.

The company reported earnings per share of $0.25 and total revenue of $744 million, compared to Wall Street expectations of $0.25 and $743 million. However, management’s projections for this quarter’s earnings and revenue came in below consensus estimates.

Last year the company merged with semiconductor producer Cavium. CEO Matt Murphy explained that after the merger, “The new team quickly aligned our growth trajectory with market trends such as 5G, cloud, AI, automotive, and enterprise refresh cycle.”

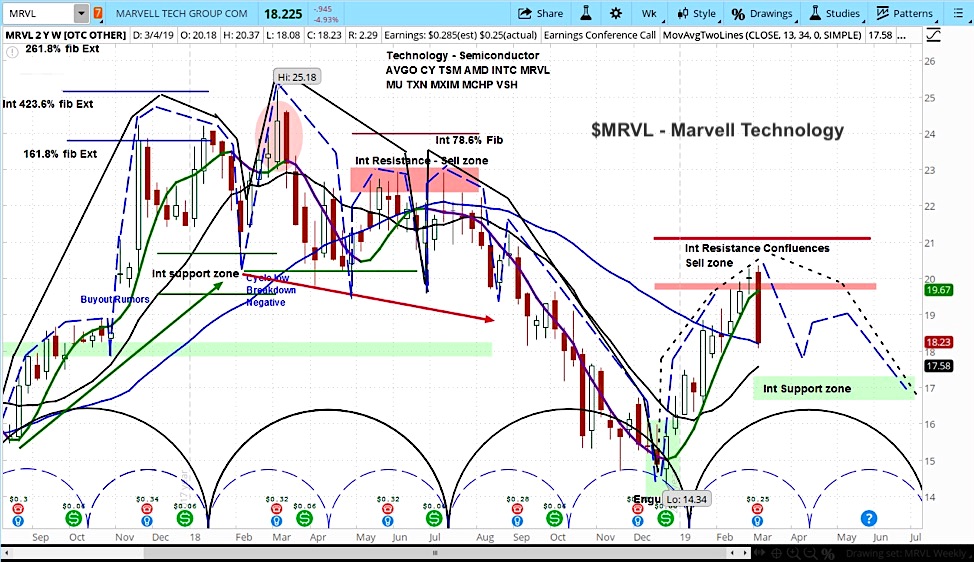

Our approach focuses on stock market cycles, which are shown on the bottom of the chart above.

MRVL has likely started the declining phase of its current cycle. It has been negative, and is now failing in resistance. The cycle patterns suggest a move to around $16.50 by July.

Marvell (MRVL) Weekly Chart

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.