A Black Swan With A 124-Day Notice?

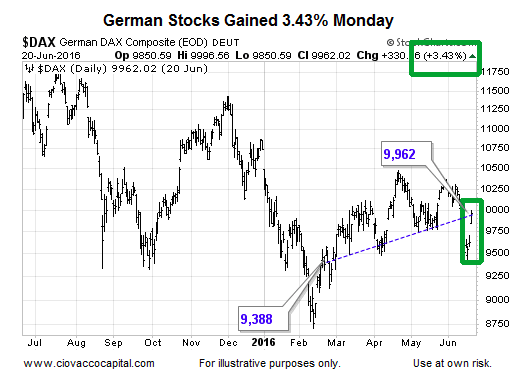

On February 20, 2016, U.K. Prime Minister David Cameron announced the EU Referendum would be held on June 23 (i.e. Brexit vote). When votes are cast this week, the financial markets will have had 124 calendar days to consider every possible relevant factor and every possible outcome. Given the S&P 500 is hovering near its recent highs and the German stock market rallied 3.43% Monday, it is probably fair to say the most recent read by the financial markets favors the “stay in the EU” outcome.

In the chart of the German stock market (DAX) above, it is also noteworthy that German stocks are quite a bit higher today relative to the day the referendum was announced, which means fear has been waning rather than increasing since February 20 (see slope of dotted blue line).

What Can We Learn From The Currency Markets?

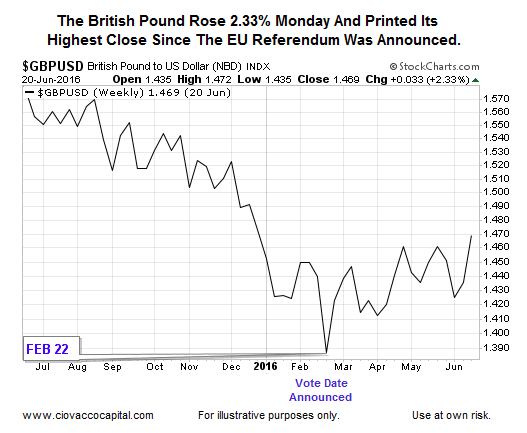

George Soros recently warned that a “leave the EU” outcome Brexit vote would have negative consequences for the purchasing power of the British pound. From the BBC:

“The value of the pound would decline precipitously,” he writes. “It would also have an immediate and dramatic impact on financial markets, investment, prices and jobs. I would expect this devaluation to be bigger and also more disruptive than the 15% devaluation that occurred in September 1992, when I was fortunate enough to make a substantial profit for my hedge fund investors.”

After the largest and most powerful hedge fund managers have had their staffs use the last 120-plus calendar days to look at every possible variable in Thursday’s EU referendum, are hedge funds selling the British pound to prepare for a “leave the EU” outcome? Not yet. In fact the British pound is trading near its highest levels since David Cameron announced the EU referendum on February 20. Monday, the British pound posted its biggest one-day rise in almost eight years. This comes just a few days before the Brexit vote.

A Stay Vote May Produce A Muted And Short-Term Response

Given the financial markets are pricing in and anticipating a “stay in the EU” outcome, it is possible that stock market bulls will be disappointed with the magnitude of gains, and more importantly, the sustainability of the gains in the financial markets. Logic says markets will have a positive reaction to a stay vote; the question relates to the magnitude and sustainability of the reaction, which would be something for the markets to decide.

A Stay Vote Will Not Cure All Of Europe’s Economic Ills

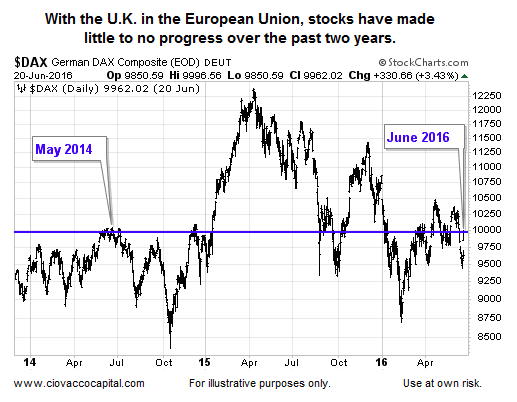

Has the U.K.’s membership in the EU over the past two years resulted in economic prosperity and new highs in European stocks? No, in fact the German DAX stock market is currently trading at the same level it was over two years ago. When we wake up Wednesday, the U.K will be in the EU. If the “stay in the UK” vote prevails, when we wake up Friday the U.K. will still be in the EU. And effectively nothing would be different than the last two years of stock market malaise.

The Good News May Have A Short-Term Impact

Therefore, the good news for the markets under the stay scenario primarily relates to the removal of a possible and unexpected negative outcome (leave the EU). However, a stay vote will not significantly alter the economic realities in Europe, nor the global economy. And given the market is preparing for a stay Brexit vote, the stay scenario falls under the “that is what we were expecting” category. And this does not typically produce large and sustained rallies in risk assets.

Volume May Be A Tell This Week

If the market is anticipating a “stay in the EU” outcome and the market believed a large and sustained move would follow in the S&P 500, then we would expect stocks to be rising this week on heavy volume. Volume in the S&P 500 ETF (SPY) has been tepid so far this week.

The Wild Card Is If The Markets Are Wrong

Could the financial markets be wrong in their current assessment of Thursday’s vote? Sure, markets can be wrong, but that is the lower probability outcome. Large and sustained moves in stock markets come when markets are caught off guard and have to reprice for an unexpected outcome. Therefore, a “leave the EU” outcome has a much greater probability of producing a significant and sustained move in asset markets, especially relative to the expected “stay in the EU” outcome. In the end, the voters in the U.K. will decide, and the financial markets will determine the reaction. Our approach will be to be ready for all scenarios, understanding referendums and markets have an almost infinite number of variables.

Thanks for reading.

Twitter: @CiovaccoCapital

Author or his funds have long positions in related securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.