The popular stock market averages lost more than 1.00% last week on concerns that pro-business programs from Washington could be delayed. And this week began on a similar note.

Given that stock market valuations are historically high, it is widely believed that tax and regulatory relief is essential if corporate fundamentals are to catch up with stock prices. The S&P 500 (INDEXSP:.INX) currently stands at 2341.

Is A Stock Market Pullback Overdue?

Although corporate earnings are in recovery mode, which we believe will allow the long-term trend to continue, the near-term outlook argues for a period of consolidation. The last time stocks experienced a significant correction was nearly nine months ago, which is an unusually long time for a rally to persist without a stock market pullback.

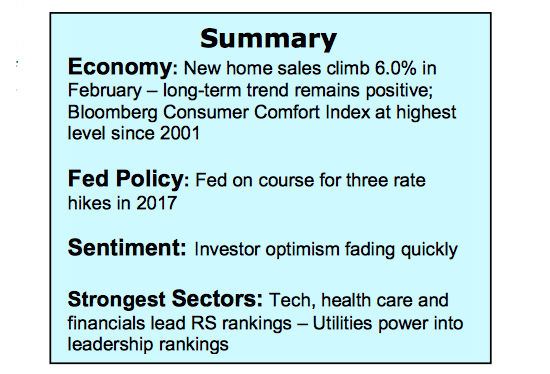

Investor Psychology

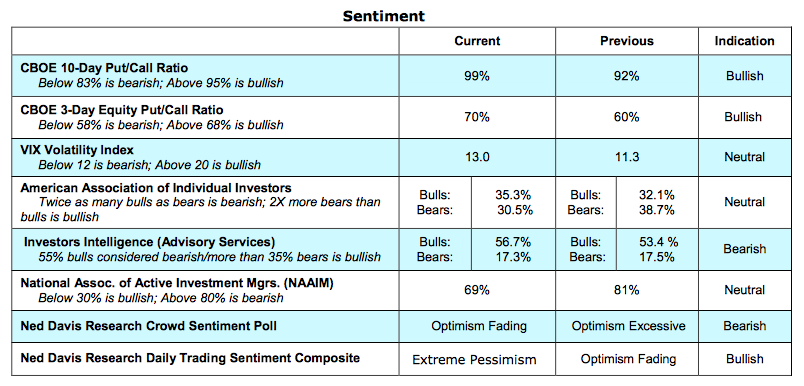

The fact that stocks have failed to make upside progress this month has taken a toll on investor psychology. Investor confidence that reached worrisome levels in late February is reversing quickly. This suggests that the consolidation/correction phase will be limited in both time and price. The next important rally, however, will not likely get underway until psychology moves full circle with investors turning excessively pessimistic. Evidence of this could first appear in the performance of the CBOE Volatility Index (INDEXCBOE:VIX) – currently around 13. The VIX moved above 20 during both the Brexit scare and the day before the presidential election. A sharp rise in the VIX would argue that pessimism has reached an extreme and the consolidation/correction phase has run its course.

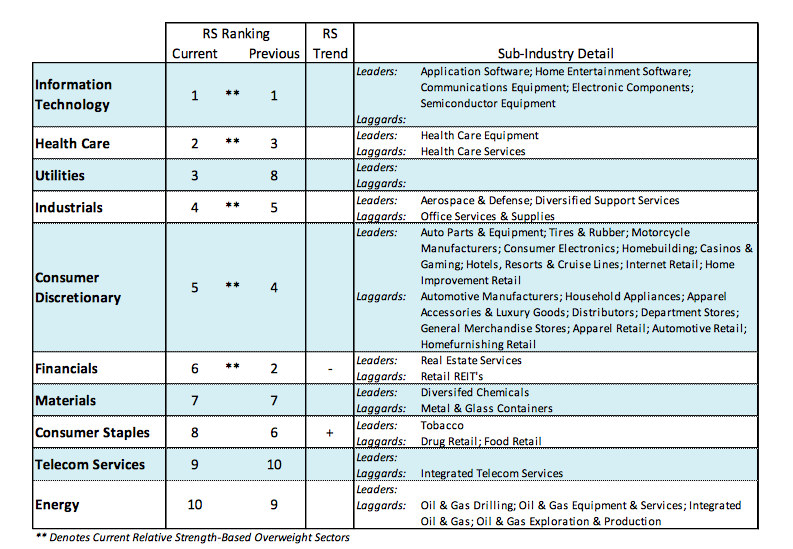

The weight of the evidence argues that the long-term prospects for the stock market remain bullish. But the weakness in the technical condition of the stock market supports the probability that the consolidation phase is underway and likely to continue into the second quarter.

Since the peak in the S&P 500 and Dow Industrials in February, divergences have surfaced that suggest that the upside momentum has been broken and that the risks to a pullback have increased. Small-cap indices and the Dow Transports have not kept pace with the popular averages. The fact that the Russell 2000 and Dow Transports have broken their 50-day moving averages underscores the fact that the equity markets have experienced a momentum peak. The good news is that while there is some evidence that market breadth has weakened, 76% of the industry groups within the S&P 500 remain in uptrends. We would be concerned should the areas in uptrends fall below 60%. Encouragement can also be found in the fact that breadth has improved in the overseas markets, which has been lacking in recent years. More than 70% of international stocks are currently trading above their 200-day moving average. Secular bull markets are global in scope which makes this an important development in 2017. Support for the S&P 500 is found+ near 2275 and resistance 2400.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.