The Global Expansion Continues

In this post, I will focus on the positive forces that are driving the global economy… and the benefit its offered to global equities. My goal is to provide an overview of some of the most important factors in the global economy and highlight how they are still in growth mode.

The main question that my research should answer: Why do global equity markets keep climbing? Here goes…

I think there are plenty of naysayers out there pounding the table that the next crash is around the corner, but the global economy is in expansionary mode. I’m not suggesting that the equity market is not prone to a correction, if anything, equities do look extended here in the near-term. While some equity markets near record valuations, global bond markets are also showing signs of overheating. The Central Bank “hand-off” effect continues to be one of the major driving forces behind the market as balance sheets continue to expand for many Central Banks. When that driving force stops, how quickly will markets reprice risk?

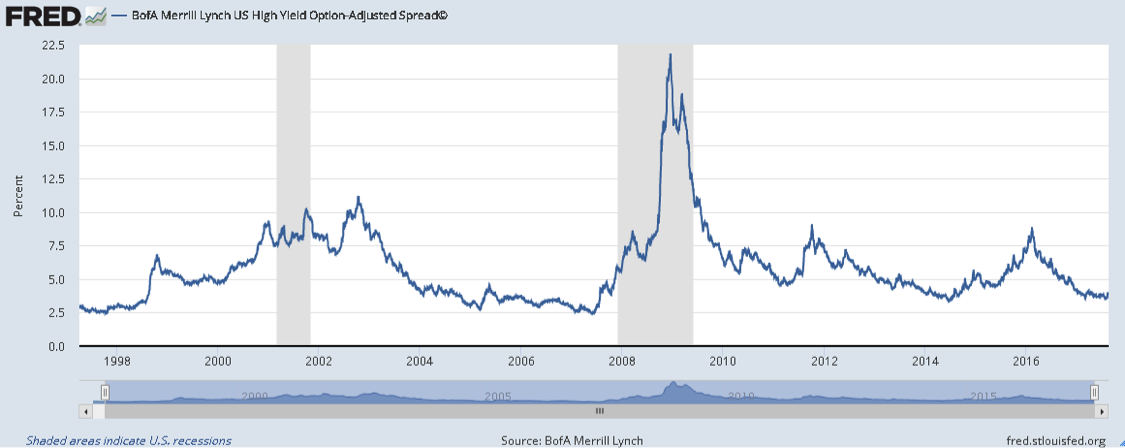

High Yield spreads looking tight at this point but maybe spreads stay tighter for longer than most expect?

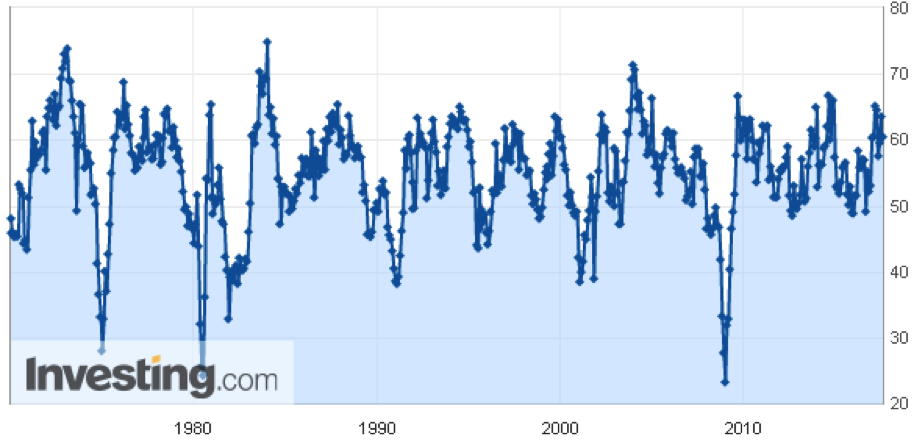

ISM Manufacturing New Orders Index remains robust around 60.4 in the early August release.

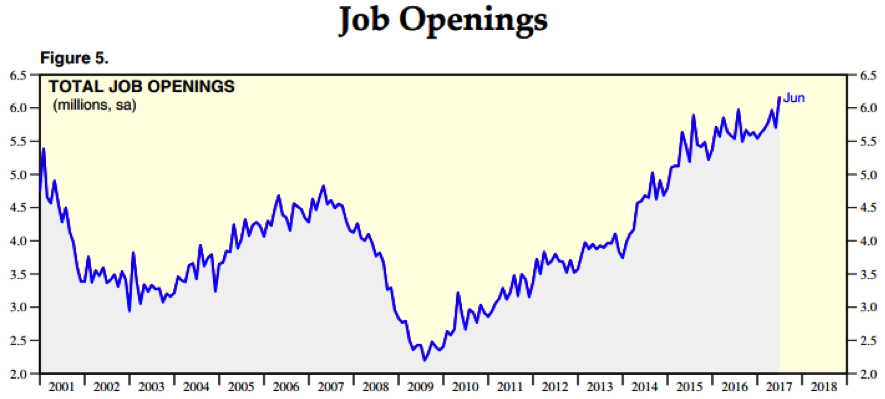

The monthly Job Openings and Labor Turnover Survey (JOLTS) reaching record highs in June showing no signs of economic contraction at the moment.

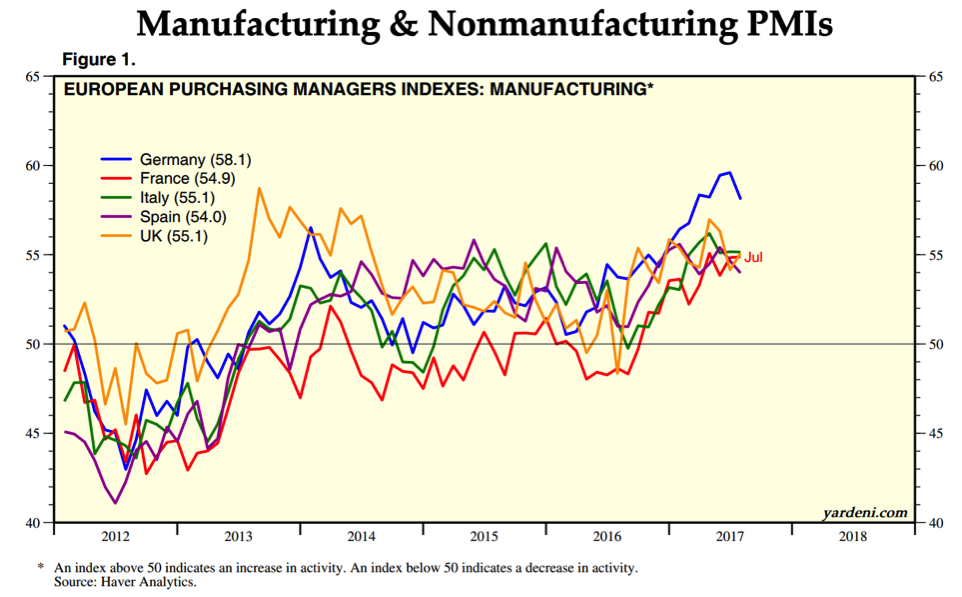

Europe continues to be a major bright spot in the global economy. We’ve recently seen some cooling in Germany’s PMI manufacturing index but remains robust at 58.1 firmly above 50 which indicates an increase in overall activity.

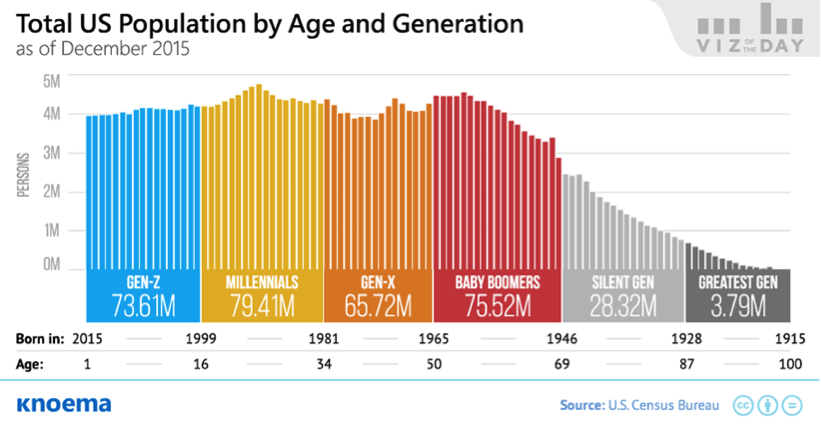

I think something that’s often not discussed is the Millennial generation. Being the largest generation according to the chart below, I think this demographic backdrop will be extremely positive for the U.S. housing market. Low interest rates another reason to think housing continues to stay strong despite sluggish U.S. economy.

continue reading on the next page…