“Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.” Mario Draghi July 26, 2012

On July 26, 2012, European Central Bank (ECB) President Mario Draghi essentially guaranteed the ECB wouldnot allow the markets to cripple the Euro region.

This shot across the bow finally remedied the instability caused by the sovereign debt crisis. The markets quickly reversed the damaging trends and uncertainty that had plagued the Euro-zone for months.

Draghi’s statement essentially boiled down to a promise that the ECB would print unlimited amounts of money to stop the “harmful” will of investors.

Fiat currency, be it dollars, euros, yen, or any other major currency today, are backed by confidence in the government, its ability to tax and the status of its economy. Importantly, however, it is also largely based on the trust and confidence in the central bank that issues those notes.

If Draghi did not have the market’s trust and confidence,his statement would have been ignored, andthere is no telling what might have happened to Greece or the Euro for that matter.

In September 2016, the Bank of Japan (BOJ) introduced Quantitative and Qualitative Easing (QQE) with Yield Curve Control. The new policy framework aimed to strengthen the effects of monetary easing by controlling short-term and long-term interest rates through market operations.

The announcement also introduced an “inflation overshooting commitment” with the BOJ committed to expanding the monetary base until the year-over-year inflation rate “exceeds and remains above the 2 percent target in a stable manner.” Essentially, the BOJ pulled a “Draghi” and promised to do “whatever it takes” to ensure interest rates did not rise more than they wanted.

Recently, the BOJ amended the 2016 statement because bond investors were increasingly testing the central bank’s resolve. We are not claiming this just yet, but if the BOJ is losing the trust and confidence of investors, they could be the first domino in a long line that will change the markets drastically. While this discussion is certainly early, the situation bears close attention.

JAPAN

Before discussing the BOJ’s recent actions,consider the following, which demonstrates the aggressive use of monetary policy by the BOJ:

- The BOJ cut their equivalent of the Fed Funds rate to zero in 1999 and,excluding a few minor variations, it has stayed at or belowzero since then.

- The BOJ buys and owns Japanese Treasury bonds (JGB’s), ETF’s and REITs.

- The BOJ owns 48% of outstanding Japanese Government Bonds (JGBs)

- The BOJ is a top-ten shareholder in over 40% of Japan’s listed companies.

- The BOJ owns nearly 80% of domestic ETF’s.

- The BOJ’s balance sheet is over 110% of Japan’s GDP, dwarfing the Fed (21%) and the ECB (24%).

Throughout the summer of 2016, rapidlyrising interest rates became a concern for the BOJ. We say that tongue in cheek as ten-year JGB yields only rose about 0.30% over a few months and were still negative. A continuation of that trend was clearly a threat to the BOJ and,in September that year, they took decisive action to stop the assent of yields.

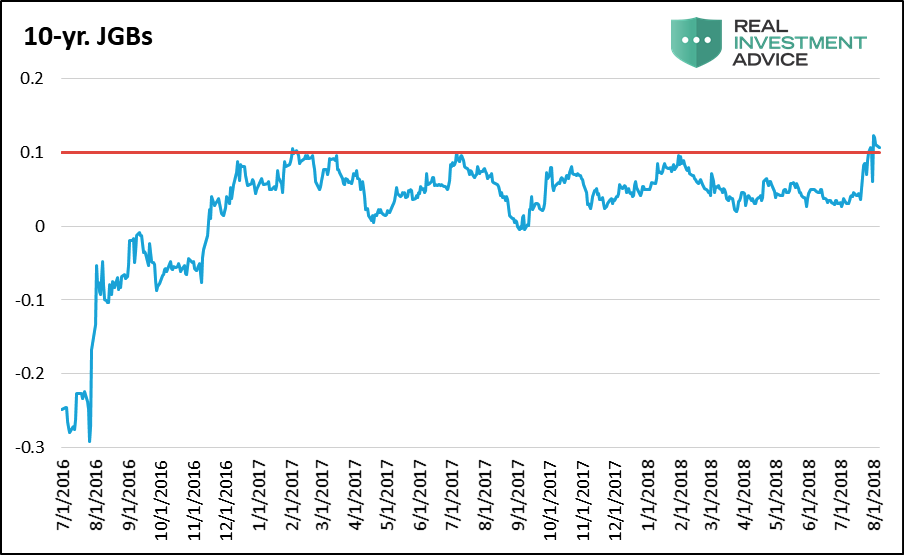

As discussed in the opening statement, QQE with yield control and the new inflation overshooting commitmentwould provide the BOJ with unlimited abilities to fight rising rates. Included with that policy modification was a limit or cap on ten-year yields at 0.10%. If that yield levelwere breached,theywould throw the proverbial kitchen sink at the market to fight it. The graph below shows ten-year JGB yields and the effectiveness of the cap (red line).

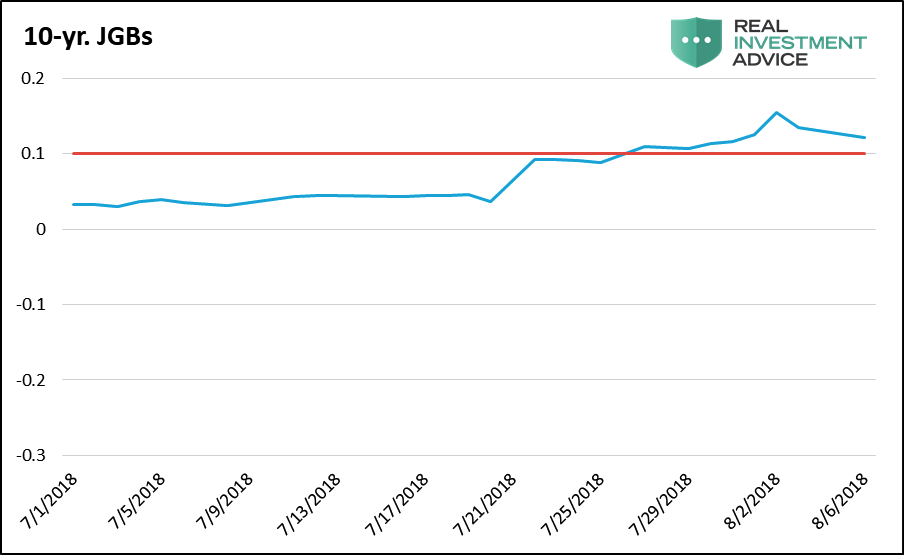

In late July 2018, yields on ten-year JGB’s breached 0.10% on four different days. The BOJ, as they did in 2016 when rates rose, took this threat seriously. On July 31st, they amended their 2016 pronouncement to allow more flexibility in yield levels, leaving the direction of rates more in the hands of the market. This action has been clarified to mean they will increase their cap on ten-year JGB yields to 0.20%. The graph below charts the daily highs since July 1st, to better highlight the yield versus the 0.10% cap.

The BOJ owns an overwhelming majority of Japanese stocks and government bonds. Their control is significantly greater when you consider their ownership ofthe true float of the securities. Thisis incredibly important to grasp as the BOJ is quickly reaching the limit on how many more of those assets it can buy.

That is not to say that they don’t have options once they buy all the bonds and stocksthe capital markets have to offer. The options become more extreme and, quite frankly, much more consequential. For example,they could take the route of the Swiss Central Bank and buy foreign stocks. They could also print money and give it directly to citizens, aka helicopter money. Both options have grave implications for their currency and greatly increase the odds of meaningful instabilities like hyperinflation.

The BOJ’s rationale for allowing greater flexibility is to address “uncertainties” related to the anticipated consumption tax hike in 2019. In our opinion,the flexibility is the BOJ’s way of whispering “Uncle”. They know they are limited in their ability to further manipulate interest rates and stock pricesand do not want to tip their hand to the market. Again, if the market senses the BOJ’s tool boxis empty, trust and confidence could fade quickly.

Some may say this is a first step in the BOJ taking their foot off the monetary gas pedal, and if so, we welcome and applaud such action. What seems more likely is that the market has finally sensed the BOJ’s AchillesHeel.

Summary

Public trust and confidence is the single most important asset a central banker can possess. Without these,they are printing worthless currency and have little to no power.

Shorting Japanese bonds has been called the “widow makers trade” as one must have incredible patience and plenty of time to outlast the BOJ’s will. Thus far, anyone that has fought the BOJ has lost, hence the nickname. Japan’s problems have been brewing for decades, anddespite recent signs that the BOJ is running out of weapons,we would remain reluctant to fight them.

Of greater concern to us is the macro picture that is emerging in Japan. If investors are starting to question the on-going ability of the BOJ to manage rates, it is not unreasonable to think that other central banks could be at risk.While this story will continue to play out over a long time frame, markets seem content to ignore the growing problem.Our concern is that, if you are not prepared to act when the market unexpectedly awakens, you will be the victim of the reversal of years of interest rate price controls and asset price manipulation.

Keep in mind; you can’t buy homeowners insurance once the house is on fire.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.