The following chart and data highlight non-commercial commodity futures trading positions as of January 23, 2017.

This data was released with the January 26 COT Report (Commitment of Traders). Note that these charts also appeared on my blog.

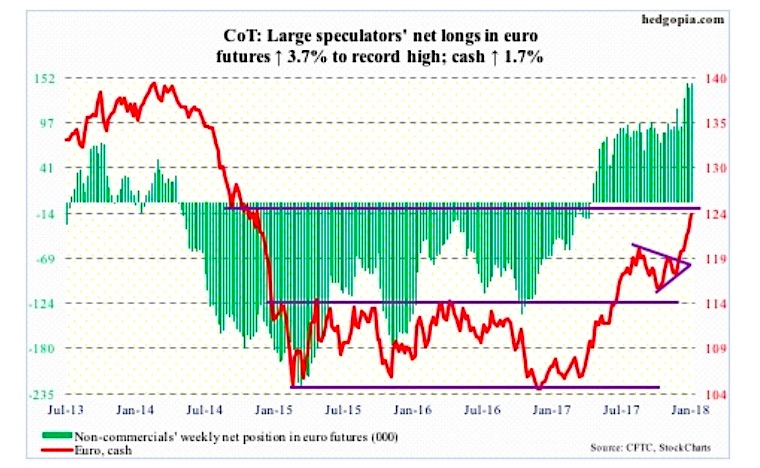

The chart below look at non-commercial futures trading positions for the Euro. For the week, the Euro was up +1.6%. Euro currency record speculation levels are concerning, however.

EURO

January 26 COT Report Spec positioning: Currently net long 144.7k, up 5.2k.

Last July, the cash ($124.27) broke out of a nearly 10-point range. A measured-move target extends to 124-125. Similarly, a trend line drawn from the all-time high of $160.20 in April 2008 draws to 125.

At one point Thursday, the euro was up as much as 1.1 percent, but only to reverse hard after hitting 125.37 to end the session down 0.1 percent.

Also Thursday, Mario Draghi, ECB president, talked about the potential impact of the stronger euro on inflation, suggesting it may end up prolonging the need for stimulus.

In all probability, this kind of verbal intervention will continue. Plus, there is that afore-mentioned resistance for the bulls to deal with.

As mentioned, Non-commercial speculators are the most net long ever.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.