The Euro currency (EURUSD) has been in a downtrend since 2008. A struggling euro zone economy and deflationary concerns are the likely culprits. Several failed attempts at stimulus packages and the introduction of negative rates have gone largely unnoticed (from a macro viewpoint).

All in all, the world hasn’t had much interest in owning the Euro in recent years. Looking at the chart below, you can see the Euro currency has put in a series of lower highs and lower lows over the past several years… the hallmark of a downtrend.

But there is a technical pattern developing within the downtrend that may bode well or the Euro over the near-term.

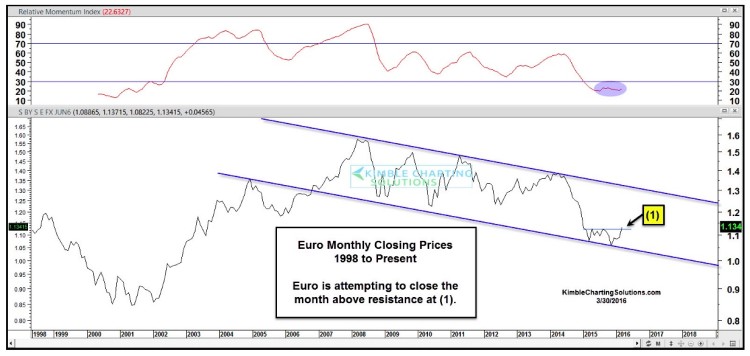

The chart below looks at the Euro currency over the past two decades on a monthly closing basis.

As you can see, the Euro hit the lower channel support late last year and has rallied off those lows. The month of March is nearing an end and the Euro is trying to close above last year’s closing highs – above resistance at point (1) below.

As well, the monthly momentum indicator is very oversold and at levels last seen 15 years ago.

Euro currency weakness (i.e. US Dollar strength) has really hit the commodities space over recent years. So a stronger Euro of late has helped to reawaken commodities. And a breakout to new closing highs could give the beleaguered currency some room to rally (albeit, still within the broader downtrend).

If the Euro breaks out and the Dollar breaks down, it would likely send a message to the markets that the rally in commodities (and perhaps stocks) can continue for a while. Worth watching!

Thanks for reading and have a great weekend.

Read more from Chris: “Can Transportation Stocks Lead The Market Higher?“

Twitter: @KimbleCharting

The author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.