Will Stocks Get “ROC’d” After Record Drop In Volatility Index (VIX)?

The S&P Volatility Index recently dropped at a record pace off of its February highs; is this good news or bad news for stocks?

This...

Market Update: The Growing Tension On The Tape

It's always interesting to see how investors and traders handle market tension. Typically market tension evolves after big runs higher and lower, or alternatively when...

10-Year Treasury Yield Testing Post-2012 Uptrend (Again)

All Eyes On That 10 Year Treasury Yield...

In mid-February, we posted a chart on the U.S. 10 Year Treasury Yield as part of our...

Stock Market Futures Hovering Above Lower Support Levels

The FOMC minutes release comes today at 2pm, and it is clear the markets are waiting for the data. Stock market futures have been...

S&P 500 Futures Update: Markets Under Pressure This Morning

After another failed drift higher on weak momentum we are seeing S&P 500 futures head lower this morning. That said, they are bouncing off an...

Natural Gas Poised To Rally On Technicals, Seasonality

Natural Gas Technical Analysis

Natural Gas prices continue to rally following a bullish momentum divergence at the March low, though price seems to be finding...

Biotech Sector Fund ($XBI) Gets Back On Trend

When we last wrote about XBI, the S&P Biotech Sector Fund ETF, we noted that it appeared ready for a countertrend rally. In the...

Stock Market Futures Fluctuate As Bull And Bears Battle

Traders are battling between long and short positions across stock market futures as the action is getting a bit extended here into April.

Yet traders...

Is The Bond Market Signaling Caution For Equities?

When equity markets are rallying we can often turn to other key pieces of market data to look for signs of confirmation.

It's often thought...

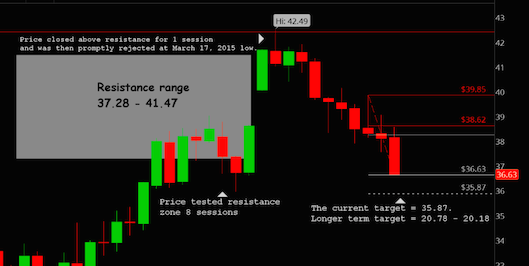

Crude Oil Update: Why Fibonacci Price Targets Matter

In January of 2016, I wrote an article on Crude Oil Futures where I identified a resistance zone of 37.28 to 41.47 using my Fibonacci...