International Business Machines (NYSE: IBM) traded 4% higher on Thursday morning, after reporting earnings that beat Wall Street expectations, even after analysts lowered price targets.

The company reported earnings per share of $3.08 and total revenue of $20 billion, above analyst expectations of $3.04 and $19.9 billion.

They also reconfirmed fiscal year earnings guidance of $13.80 per share, which is also above the average estimate of $13.78.

Contributing to this positive quarter was a 25% increase in sales of hardware and operating systems. However, investors were concerned with lower than expected results from the closely-watched “cognitive” business line, which includes artificial intelligence.

Multiple analysts including Morgan Stanley cited this concern as they lowered price targets.

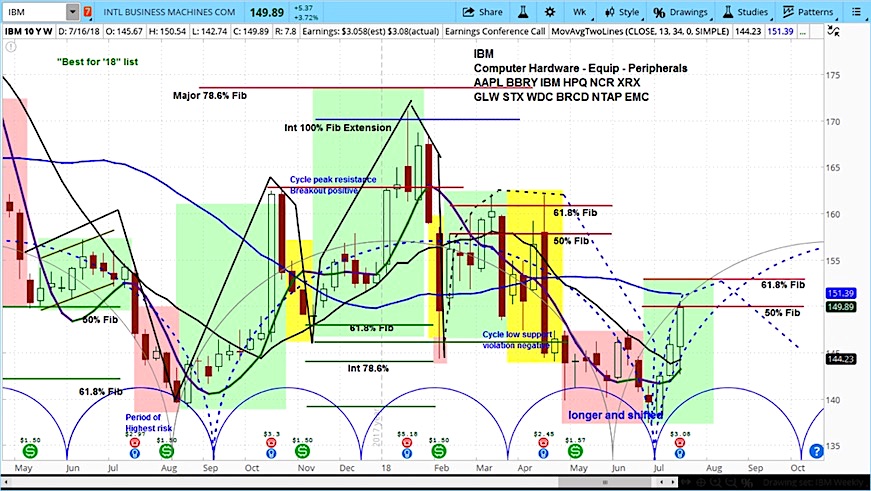

In analyzing IBM’s market cycles, we can see the stock is continuing to move higher in the green rising phase of its current cycle. We note however that the stock recently made lower cycle lows.

While we see intermediate-term upside of $152, we will keep a close eye on this stock to see if it is able to build a base between now and the end of the current cycle in October.

International Business Machines (IBM) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.