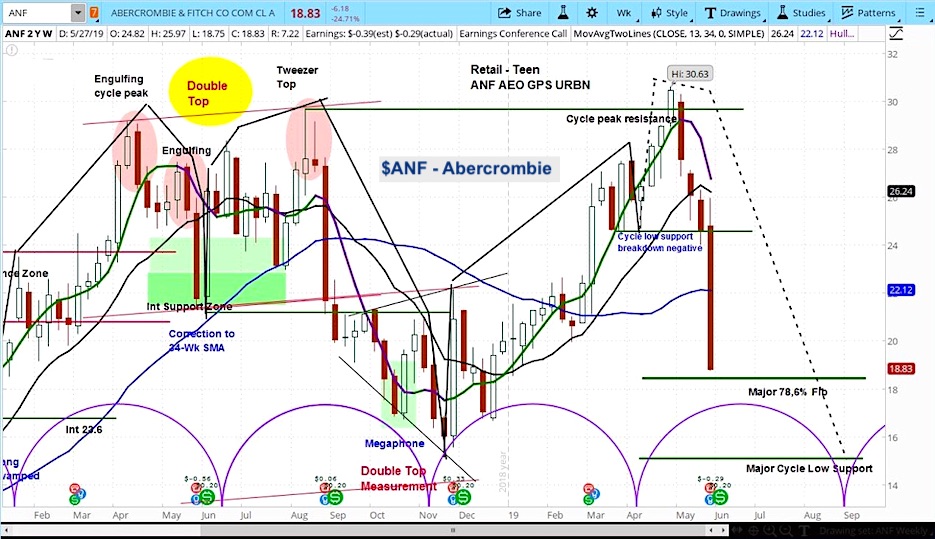

Abercrombie & Fitch (ANF) Stock Weekly Chart

Abercrombie & Fitch (NYSE: ANF) sank 27% on Wednesday, after the company beat on earnings and sales but missed on guidance.

We believe there’s more downside risk, as Abercrombie’s stock price has broken its cycle low relatively early in its current market cycle.

The company reported earnings per share of -$0.29 and total revenue of $734 million, above analyst estimates of -$0.43 and $733 million. However, management’s guidance for next quarter was for sales growth of only 2%, below estimates of 2.8%.

After confirming plans to close 3 large flagship stores, Abercrombie & Fitch CEO Fran Horowitz painted an optimistic picture, “What we’ve learned from the consumer is they are really enjoying the smaller spaces. There’s a more intimate feel and customers like one-on-one interaction.”

Our view is that today’s move represents a rupture in the current market cycle for ANF.

It has now fallen below the point at which it started the cycle and done so early in the cycle and so will be in a bearish phase for a relatively long period of time.

As such, we see continued risk into late August, with a target below $16.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.