Last week was another quiet week for the stock market. Limited progress was made despite some favorable third-quarter earnings reports. The popular stock market averages gained about 0.5% last week leaving the S&P 500 Index (INDEXSP:.INX) virtually unchanged from mid-July. As November nears, market participants are wondering if they will get a year-end stock market rally.

Let’s take a look under the cover.

Third- quarter profits have been better than expected. The positive influence this is anticipated to have on the market is neutralized by the combination of rising interest rates, a stronger U.S. Dollar, uncertainty over the election and a weak seasonal period for stocks. The equity markets have also been struggling with an uphill battle from a flow-of-funds perspective. Mutual fund redemptions the past 12 months have totaled a whopping $238 billion with most of the money moving into bond funds.

This helps explain the lack of follow-through on rallies since the July peak.

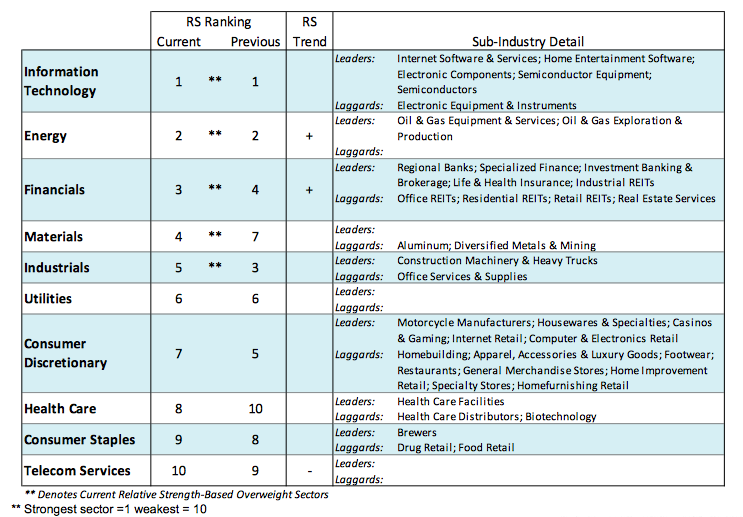

Considering that interest rates are now moving higher and the fed funds futures market is giving a 70% probability of a Fed-inspired rate hike in December, the potential for a reversal in the flow-of-funds out of bonds and into stocks cannot be easily ignored. Evidence that this could already be unfolding can be seen in the decline in relative strength in low volatility defensive sectors to strength in sectors more sensitive to the prospects for economic growth. This would fit with the long-standing seasonal pattern that has had stocks outperforming in November, December and January. And this may lead to a year-end stock market rally.

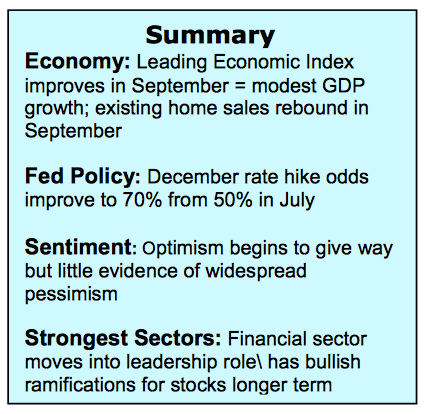

Market Summary Table

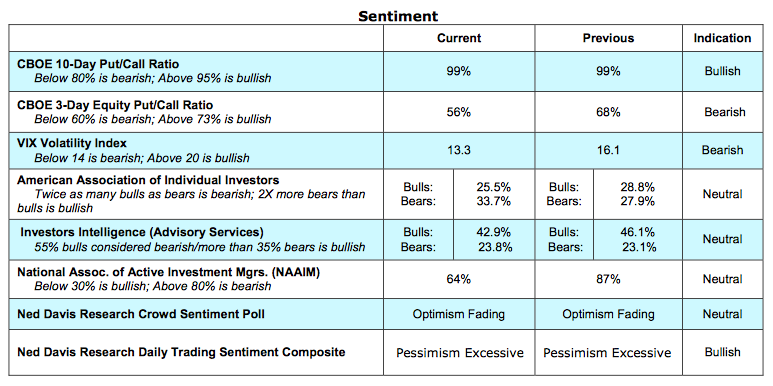

The lack of progress in either direction by the popular averages the past three months is a mirror image of the mixed signals offered by the technical indicators. Short-term market breadth indicators continued to deteriorate last week with a drop in the percentage of groups within the S&P 500 falling to 60% from 80% early in the year urging for caution as we move closer to Election Day. Lower before higher coincides with the pattern of previous rallies this year that were triggered from an oversold condition with many of the sentiment indicators in the excessive pessimism zone. Last week witnessed investor optimism again on the decline but widespread pessimism has yet to surface. Our outlook for a year-end stock market rally (i.e. higher at year-end) is encouraged by the improvement in the relative strength of the financial sector. Within the financials the broker/dealer group, which is often a leading indicator for the market, has outpaced the overall performance of the market in the third quarter. Support is near 2100 to 2120 with resistance at 2180 using the S&P 500.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.