The Big Picture – A Changing Market Environment

Markets are constantly changing and and understanding a changing market environment is essential for long term success.

In 2009 the U.S. Equity markets and most risky asset classes were coming off of a pretty bad year. 2008 was not kind to the stock market and for the first few months of 2009 it seemed like the market would continue lower. On March 10, 2009, the S&P 500 closed up 6.37% and hasn’t really looked back until maybe now.

Once the stock market made that first of many V-Bottoms in March, a relentless rally took place that lasted through the end of 2014. Even though higher prices seem to promise opportunity, many traders lost money in 2009 betting the decline in stocks wasn’t over. It seemed “smart” to be skeptical of the move higher and anticipate another move lower. The reason traders lost money on the move higher in 2009 is that they failed to acknowledge a changing market environment (i.e. the primary trend was higher). I know because in 2009 I was one of those traders.

Over the next few years, we learned that the market tends to rebound from oversold levels fairly quickly and many traders learned to buy the dip. What we need to recognize is that buying the dip only works in certain market environments and, at least for now, that strategy is likely to fail.

While it’s certainly true that stocks have risen over time, we’ve also seen periods of sharp decline where strong counter trend rallies materialize before they subsequently fail. As traders, it’s more important to recognize both when change has taken place and when the market has the potential to change. During 2015 the markets began to change as they transitioned to sideways price action and this year the market has continued to change as the primary trend has shifted lower.

We’ve seen the rate of decline slow over the past few weeks with a little stability coming back into the stock market. At the same time, we can only assume that the stability is temporary. The daily ranges we’re seeing are large in percentage terms, but most of the significant short term levels have held in both directions. On Friday, both the Russell 2000 and the S&P 500 went into the weekend sitting around recent support. That being said, support is only support if it holds and we never know until after the fact. Sitting at support really means that the stock market has the potential to change.

In the current environment, the potential for fast moves in either and both directions is great. Those moves tend to draw in participants only to reverse and stop them out leading to feelings of frustration. When we feel frustrated in trading it usually means we’re imposing our view of what “should” happen on the market. Do I even need to tell you what the market thinks about that?

Volatility:

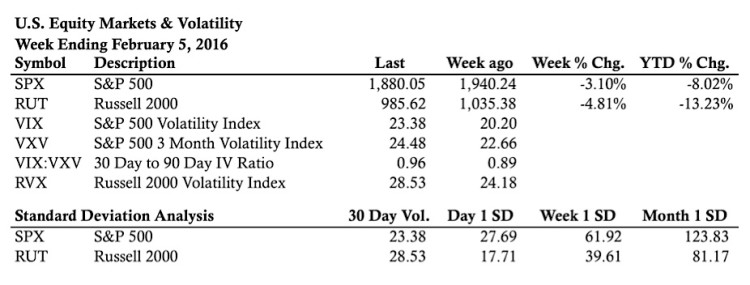

Volatility doesn’t really seem to care about this decline in the stock market. From a raw value standpoint, RVX (Russell 2000 Volatility Index) is under 30 and the VIX Volatility Index (S&P 500) went into the weekend a touch over 23. If a strong bear market materializes we can expect to see an explosion in volatility. If the slow grind lower continues, we might not.

Either way, a changing market environment has been in the works for months, and it took a dismal January to bring it into focus.

Market Stats:

Levels of Interest:

In this section, we’ll look at the S&P 500 and Russell 2000 daily charts to see what’s happening in the markets and how a changing market environment has shown up in the price action. Preparation is key.

S&P 500 – $SPX Daily Chart

Russell 2000 – $RUT Daily Chart

Thanks for reading.

Twitter: @ThetaTrend

Author holds positions in S&P 500 and Russell 2000 related securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.