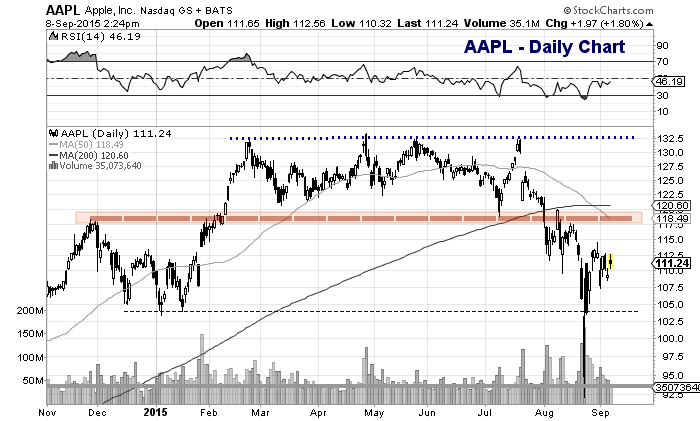

After failing to breakout in mid-July, shares of Apple (AAPL) headed lower. And fast.

Here’s a recount of AAPL’s technical breakdown:

- Apple’s stock (AAPL) fails in its attempt to breakout on July 21st (high that day of 132.92).

- AAPL gaps below it’s 50 day moving average the very next day.

- The stock then fails its retest of the 50 day moving average.

- A quick drop below the 200 day moving average ensues.

- The stock then fails its retest of the 200 day moving average.

- A quick drop to $92 follows (lows made on crash Monday, August 24th).

This action occurred within a span of 5 weeks, and saw the stock price drop around $42 dollars (or 30 percent) during that time (highs to lows).

My first thought: technical damage. This type of psychological damage takes time to heal and that typically shows up in the price action.

My next thought: wow, Apple stock rallied over 20 points off those lows.

My final thought, patience is a trader’s best friend. More importantly, there is usually a “retest” at some point on the horizon. See the bullets above and note how each “broken” moving average was retested. (You can also read my recent post on trading retests / backtests).

We should see something similar here on Apple’s stock. There isn’t any “timing” mechanism attached here – it could occur next week or next month, etc – but some sort of a retest of the lows should play out. But that can only occur when the current rally has run its course. And Apple may still have some legs near-term (I’m watching the overhead moving averages). Note the falling 50 day moving average pierced the flattening 200 day moving average.

Check out the chart below and I’ll finish with some thoughts on retests.

Here are a few notes on retests. They don’t have to occur. And they don’t need to be exact. For instance, Apple could see a shallow or full retest of the lows. This demonstrates some of the gaps in technical analysis. But those gaps are filled with proper planning and risk management (i.e. using proper scale and setting stops). For instance, a bounce off $104 may look pretty, but if it fails days later, then a more complete retest of the lows may unfold. And should that retest fail… well, that’s why traders use stops.

Thanks for reading. Trade safe, trade disciplined.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.