One market leading indicator (and sector) is the consumer. If the consumer and consumer-related stocks are healthy, the stock market tends to perform well. One of my favorite ETFs to follow in this regard is the Consumer Discretionary Select Sector ETF (XLY). This sector ETF takes into account the health of consumer by looking at stocks that sell things consumers “want” instead of “need”.

And if consumers are buying stocks they want, then that tends to be a good sign for the economy.

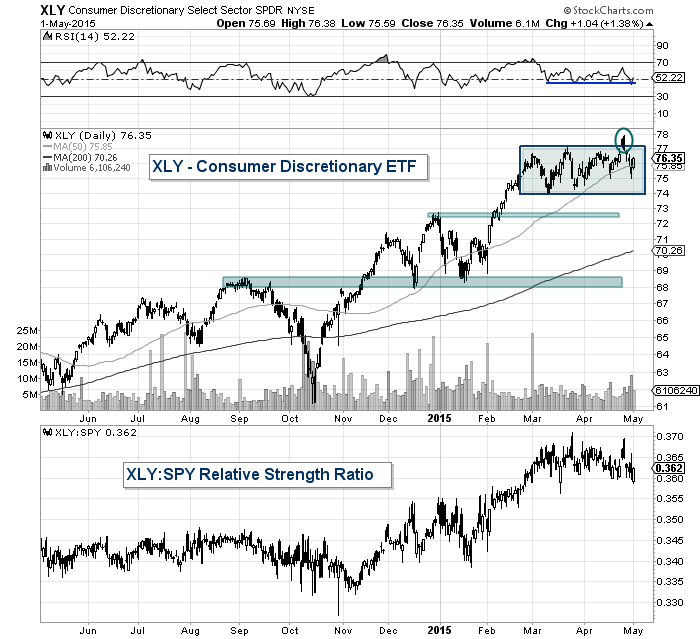

In the chart below, you can see that consumer stocks have fared well since October, leading the market higher. But the Consumer Discretionary ETF (XLY) has stalled out recently. As well, the ETF recently had a failed breakout attempt, leading its price back into the blue shaded box. Any weakness that sees XLY fall below the lower support of the box would be concerning.

Consumer Discetionary ETF (XLY) Daily Chart – How healthy is the consumer?

Lastly, consumer stocks have had trouble keeping up with the broader market (S&P 500). The chart box in the lower frame (see above) is a ratio of the XLY:SPY (SPDR S&P 500 ETF). If it’s going higher, consumer stocks are outperforming and lower means they are underperforming. Keep an eye on this into May.

One stock that everyone is aware of is Apple. With it’s $750 Billion market cap, it can certainly lead the market higher or lower. Although it’s recent earnings report blew out estimates, the stock still sold off. This is something to watch – I posted about this and Apple’s chart setup yesterday.

Another big economic number to watch will be the April Jobs report due out next Friday. Recent economic data has pointed to slowing economy. The jobs number will either fuel further concerns or assuage them. The current forecast is for the U.S. to add 213K jobs. We’ll shall see.

Twitter: @andrewnyquist

Author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.