I really want to put on my jaded hat and get pissed off like the old man I aspire to become, but sometimes I foolishly hope I’m wrong. Like most rational people (politicians excluded), I believe we have a pretty serious debt problem in the U.S. and I’m concerned about how things will play out in the next 10 years and beyond. Specifically, I’m worried about both Federal debt and Student Loan debt. Student loan debt is on track to become the next crisis. Trust me, it will happen if things don’t change.

Seriously, what happens when a well educated generation of young people can’t find jobs to pay for the exponentially increasing amount of debt they took out specifically to find jobs? That’s right, they get pissed. Really pissed. In fact, they get even more pissed when the soccer mom with a subprime minivan loan defaults on hers, but they can’t walk away from their student loans and, on top of that, Uncle Sam is the one holding out his hand for payment. Do you know who sees all of this playing out? Obama.

On Friday Obama mentioned that he’s planning to offer two free years of Community College subject to certain requirements. From a government spending standpoint, that’s horrifying and from a policy standpoint is suggests that he knows there’s a problem. The problem is debt and student loan debt in particular. At the same time, young people are becoming more resourceful. I read an article in the Economist earlier this week about Apps that make it possible for freelancers to find work (think Uber and Handy). Will young people figure out a way to get out of the system of debt serfdom? Who knows, but apps to promote freelancing give us a little bit of hope.

Financial Market Commentary

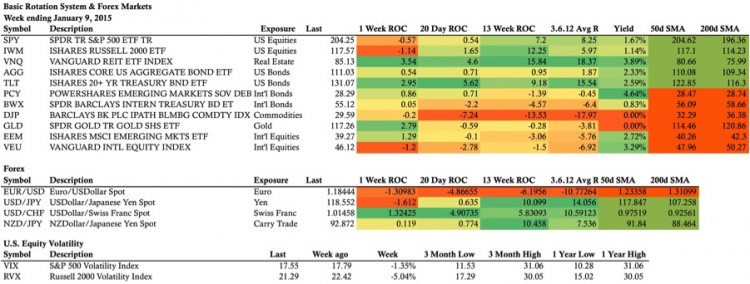

How does that all play out in the markets? I’m not sure, but U.S. Equities stumbled this week while the 20+ Year Treasury Bond ($TLT +2.95%) and Real Estate iShares ($IYR +3.54%) were strong. That being said, I think the bigger story is that Gold looks like it’s firming up and both Emerging Markets Equities ($EEM +1.29%) AND Debt ($PCY +0.86%) were higher on the week. I’m watching for a breakout in the Gold via the SPDR Gold Trust ETF ($GLD) above 119. If we see that level, the Dollar may start to weaken.

On Thursday morning the S&P 500 ($SPX) gapped higher at the open and raced higher during the day. I sold a Jan 2015 Weekly Call spread above the market, took a little pain on Thursday, and enjoyed the sell off on Friday. $SPX hasn’t closed the gap from Thursday morning, but the weakness on Friday suggests that it may happen sometime soon. We’ll see. Here’s my weekly ETF stats sheet (click to enlarge).

ETF Rotation System Positions:

The Basic ETF Rotation System positions had a mixed week. The iShares Russell 2000 ($IWM) was down on the week and the $IYR (Real Estate) was up. The strong performance in $IYR left the Basic system slightly positive on the week.

Forex:

There really isn’t much to say right now other than the Euro continues to fall.

$SPX Weekly Options Trade:

On Thursday morning I sold a $SPX weekly call vertical that was in line with the Weekly Options system. Honestly, the trade was somewhat discretionary because I don’t take these trades every week. That being said, I was watching $SPX bounce hard after yet another Fed announcement and just didn’t buy the move. Since the Weekly Theta system said it was ok to be short, I got short. I might get proven wrong on Monday morning, but for now the trade is okay.

Note that I tweeted this position before getting filled. If you aren’t already, you can follow me on Twitter: @ThetaTrend.

Looking ahead:

It will be interesting to see what happens to U.S. Equities this week after the move higher Thursday followed by the weakness on Friday. I don’t get the sense that the S&P 500 wants to move higher right now, but I’ve definitely been wrong about that before. On Monday I’ll be looking for a $RUT Iron Condor to sell. Lastly, I had a post up on See It Market this week that talks about potential weakness in the Dollar. Check it out here if you haven’t already. Thanks for reading.

Read more from Dan on his blog: ThetaTrend

Author holds positions in EURUSD, USDCHF, USDJPY, NZDJPY, SPX, IWM, and IYR at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.