Last week the payroll number came in higher than expected and the S&P 500 and the Dow Jones Industrial Average set new all-time highs. As I write this on Monday morning we are seeing the markets retreat about 0.3%. The trending indicators still show the market has more room to go higher. But this doesn’t mean I’m comfortable, or that investors should become complacent! Volume continues to be light and the bearish sentiment continues to lighten up.

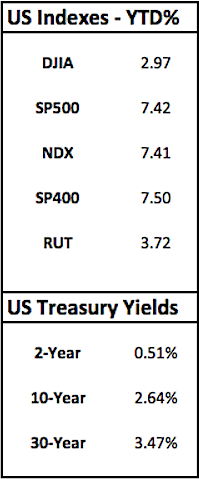

There continues to be an interesting divergence between growth (Russell 2000) companies and their slower-growth dividend-paying cousins. The S&P 500 is up 7.42% YTD whereas the Russell 2000 is only up 3.72% YTD. To say that differently, the slower companies are performing twice as well as the growth companies. That has been the surprise (to the consensus folks) this year but has allowed those of us who have invested relative to a growth-slowing theme to reduce our risk while still making gains.

There continues to be an interesting divergence between growth (Russell 2000) companies and their slower-growth dividend-paying cousins. The S&P 500 is up 7.42% YTD whereas the Russell 2000 is only up 3.72% YTD. To say that differently, the slower companies are performing twice as well as the growth companies. That has been the surprise (to the consensus folks) this year but has allowed those of us who have invested relative to a growth-slowing theme to reduce our risk while still making gains.

And bonds continue to do well with my favorite bond fund still performing close to 6.5% YTD with very little volatility. Since the USD continues to struggle, investments in inflation and/or commodity-oriented holdings, utilities, REITs and foreign holdings continue to do well. For those keeping score, the Canadian TSX continues to out-perform the US stock markets. The TSX is up 11.09% YTD.

Market Recap – U.S. Equity Indexes and Treasuries:

Trending Indicators:

US Stock Market – Trending Up

Canadian Stock Market – Trending Up

US Bond Market Yields – Trending Down

Have a wonderful week.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.