The Fed released their quarterly Z.1 report yesterday. This report looks at the balance sheets of US households in more ways than you’d think was humanly possible. If you are really bored you can read all 179 pages here, I wouldn’t recommend it though.

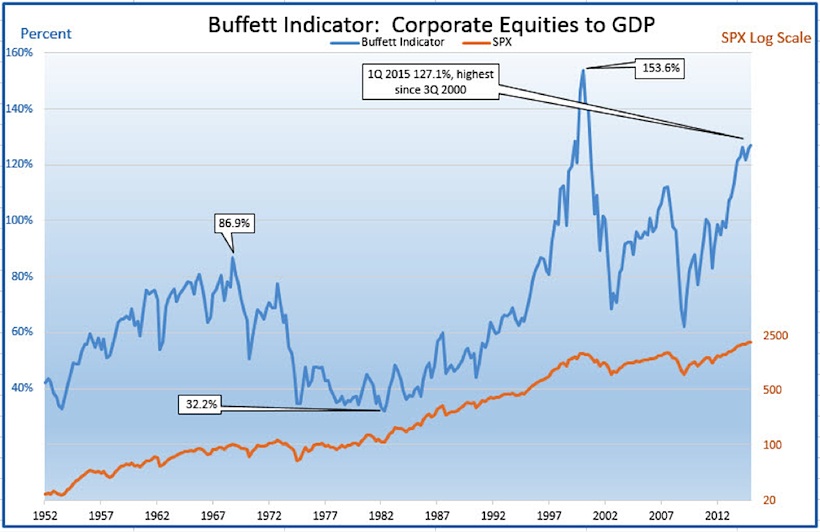

One valuation indicator we can now update with the release of the Z.1 is affectionately known as the “Buffett Indicator.” This is simply the market cap of corporate equities to GDP. Warren Buffett once called this indicator “probably the best single measure of where valuations stand at any given moment.”

Here’s where things get good, in 1Q 2015 the Buffett Indicator came in at 127.1%, the highest reading in nearly 15 years! Check out the chart below.

The Buffett Indicator vs The S&P 500

Going back to 1952, only the tech bubble of 2000 had a higher Buffett Indicator than the current level. What does it all mean? As my friend (and fellow SIM contributor) Chris Kimble likes to say, no bull market has started with this indicator this high. But that doesn’t mean the bull market has to end right here and now either.

When the Buffett Indicator broke out above the 2007 peak and had you sold everything, you’d have missed out on some great gains the past two years. Plus, who’s to say we don’t eventually get above the 2000 peak? I doubt it, but I’m not smart enough to know when market valuations will matter. They usually don’t matter, until they do.

Buying and holding for the next five years, this indicator says expect below average market returns. But for the next year or two? I don’t think we should panic just yet, let’s see some technical deterioration first.

Thanks for reading and good luck out there.

Twitter: @RyanDetrick

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.