My research and sources that I follow are indicating the potential for 2nd quarter US GDP to surprise to the upside. Perhaps with growth as high as 4%. So the question is: How will US treasury bonds deal with this kind of surprise?

Such an announcement would cause US Treasury bond prices (NASDAQ:TLT) to fluctuate significantly and could hurt my bond positions. And when considering alongside current stock prices, I expect market volatility to tick higher in both markets.

With that thought, I have two choices:

- To maintain the current positions with the recognition that there may be short-term downside (i.e. market volatility) in them.

- Reduce the amount invested in treasury bonds in hopes of buying them back again at better prices.

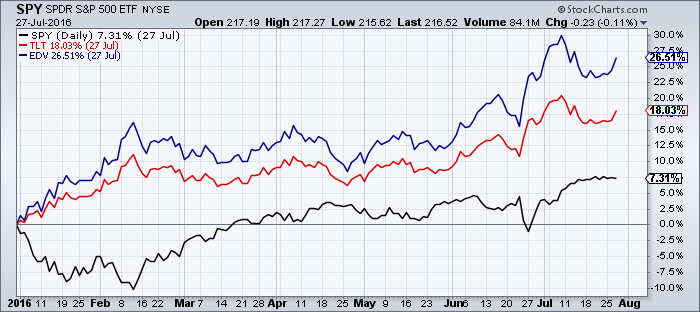

CHART – S&P 500 vs 20 Year+ Treasury Bonds ETF (TLT) & Extended Duration ETF (EDV)

As I conveyed in previous updates, I don’t believe that an increase in US GDP figures is due to the US economy “turning a corner”. That’s likely not the case as this is going to be the third quarter that companies in the S&P 500 Index (INDEXSP:.INX) will report negative sales and earnings. The stock market is at or near all-time highs (S&P 500) just like it was at this time last year. And like last year, there is a high probability that we will see a market pullback from here (last year it declined 14% by the end of August).

Moreover, the main reason that the US GDP will be so high this quarter has to do with the value of the deflator. This is a data point that isn’t tied directly to data. There is ‘wiggle room’ in what they decide it is. And this deflator is often ‘used’ as a tool in election-year politics by both sides to make the economy look better.

The last time there was a situation like this, I sold off treasury bonds but the market didn’t react as expected and rallied. I ended up missing some gains because I was trying to ‘time’ shorter term moves in treasury bonds.

I have already diversified the maturities of bonds that I hold to lessen the volatility in events like this. And if there are losses, I expect them to last for a period of days to weeks, not months. To say that differently, my expectation is that by the end of this current quarter (end of September) my bond positions will be similar to higher than they are now.

I will continue to watch the data closely but it is my expectation that I will maintain the existing bond positions.

I just wanted to keep you informed of my current thinking. There is a lot of unknowns out there and I expect market volatility to pick up.

Twitter: @JeffVoudrie

The author holds positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.