The Volatility Index (VIX) is followed by most active investors and traders as a way of understanding the market’s sentiment toward stocks. It’s often referred to as the “Fear Index”. When it is really low, it signals complacency and sends a VIX warning to stocks. When it is high, it indicates fear in the market and the potential for a near-term momentum bottom in stocks.

Currently, market volatility is clocking in around 15 and resting a few points above its 2016 lows. So did the early action in 2016 send another VIX warning to stocks?

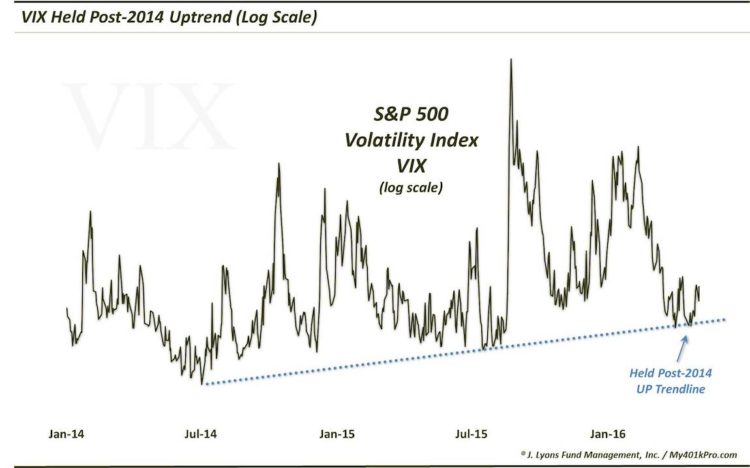

Below is a chart looking at the trend of the Volatility Index, preceded by some bullet points about the VIX price action:

- The S&P 500 Volatility Index (VIX) formed a bull market cycle low in July 2014.

- Since then, the VIX has been forming a series of higher lows. Using a log scale, the lows from summer 2014, summer 2015 and this past month form a well-defined Up trendline.

- In previous cycles of varying degree, the VIX has bottomed prior to tops in the stock market (S&P 500). Thus, stock bulls would be better served if the VIX could break its uptrend line and make a run at its 2014 cycle lows.

VIX Volatility Index Chart

Keep an eye on the VIX trend line. Thanks for reading and have a great weekend.

More from Dana: “Smart Money” Gets Bearish Silver Futures In Size

Twitter: @JLyonsFundMgmt

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.