Small caps have been getting a lot of attention in the last few months, and particularly the last week or so as they bump up against strong resistance levels.

In the chart below, you can see that the 1210-1215 area has signaled the death knell for prior rallies. However, this time, small caps are setting up with a much better chance of breaking that level. And as I’ll get to, it could make for a good broken wing butterfly options trade.

MACD has just had a bullish cross and RSI is only at 61 so has plenty of room to move higher. The index has also just broken of a nearly 2 month consolidation.

Russell 2000 Daily Chart – 2014

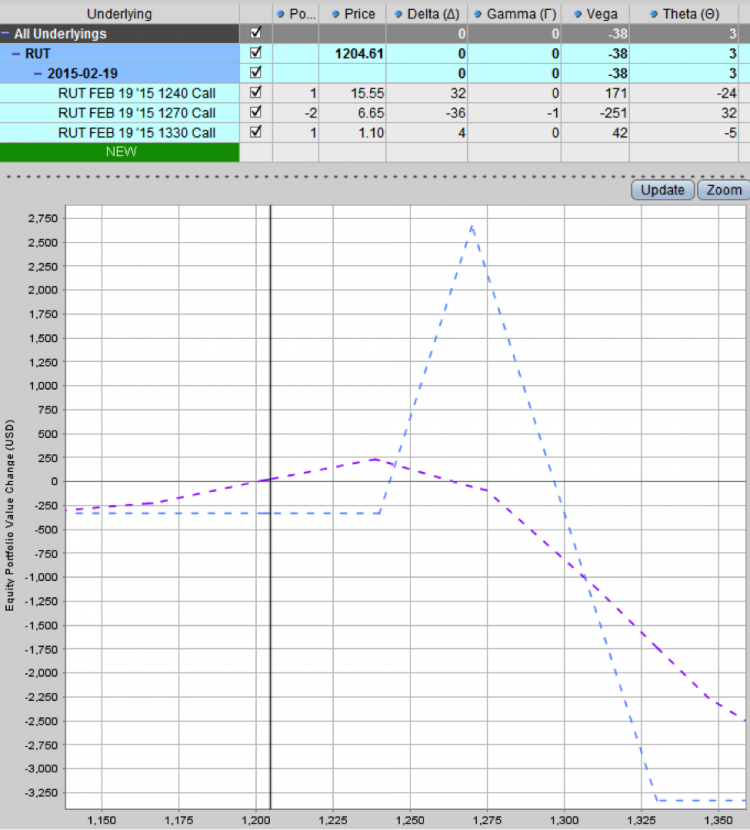

If a trader was of the opinion that small caps might rally between 3-8% from now until February expiry on the 19th, they could construct a broken wing butterfly using RUT call options as shown below.

This trade would involve buying 1 of the February 19th 1240 calls, selling 2 of the 1270 calls and buying 1 of the 1330 calls.

Currently the net cost of this trade is around $300, and that is the maximum the trade would lose if RUT stayed below 1240.

The total capital at risk if RUT rallies past 1270 by expiry is $3,300.

The healthy profit zone is located between 1243 and 1297. The maximum profit would be achieved if RUT settled right at 1270 on settlement day in which case the maximum profit would be around $2,600.

RUT Broken Wing Butterfly Options Trade Table

What the trader would not want to happen is a strong rally in the first 1-2 weeks of the trade. The purple line below is one month from today, you can see that large losses will start to accumulate if RUT heads above 1285 in that time. Remember to always trade safe and with discipline.

Follow Gavin on Twitter: @OptiontradinIQ

The author currently has a position in the Russell 2o00 at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.