The second quarter was a difficult one for those like me that hold exposure to US Treasury Bonds. For those of you that regularly read my weekly commentaries, you know that I have owned ETFs based in US Treasury bonds (symbols TLT and EDV) for several months.

The second quarter was a difficult one for those like me that hold exposure to US Treasury Bonds. For those of you that regularly read my weekly commentaries, you know that I have owned ETFs based in US Treasury bonds (symbols TLT and EDV) for several months.

The ticker symbol TLT is based on the 20-year US Treasury Bond whereas EDV is based on the 30-year US Treasury Bond. EDV is the more volatile of the two, but the way the past quarter went down, that can be said for both ETFs.

Here is a chart of EDV for Q2 2015 ending June 30th (note it declined roughly 12%):

As you can clearly see on the chart, EDV had a very rough quarter. I didn’t sit idly by watching the decline in treasury bonds – I actually liquidated portions of my positions in EDV on mini-rallies. Still, the bottom line is that EDV was a dog for me in Q2.

When an investor thinks about selling a position, the questions that they face revolve around how much to sell and what to do next.

Based on the extensive research that I incorporate into my decisions, I believe that the larger macro trends still favor maintaining a significant position in US Treasury bonds relative to stocks.

In other words, stocks have also performed poorly in the first half of 2015. And with stocks at all-time highs I wasn’t ready to shift money out of treasury bonds and into stocks. Although I reduced the amount invested in EDV (the more volatile treasury bond ETF), I stayed the course with my position in TLT. I also maintained an allocation to stocks using a trading strategy as opposed to buy and hold. Those actions allowed me to drastically reduce the volatility across my portfolio while US Treasuries took time to recover.

The volatility that occurred in the second quarter (I believe) was a result of the turmoil surrounding Greece, the slowdown in China and the tug-of-war here in the US between those that think the Federal Reserve would raise interest rates in June or September versus those that didn’t. The underlying larger macro trends gave me the confidence that the likelihood of the Federal Reserve raising rates in June or September was low—despite what all the pundits were saying at the time. I stuck to my thesis and we are now seeing the potential fruit of that decision in the start of the 3rd quarter.

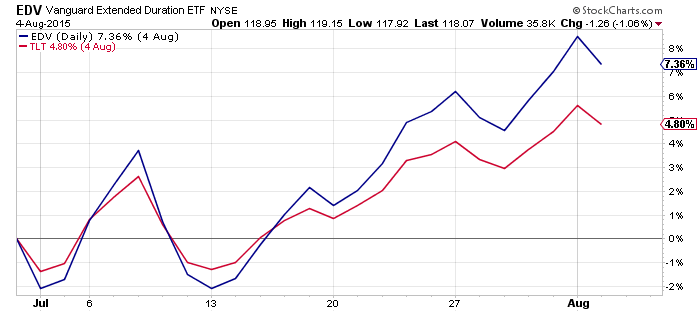

EDV vs TLT (July 1 – Aug 4)

EDV hit a low of 107.53 on July 1st before moving as high 119.50 on Monday. That’s a nice start to the quarter and compares favorably to the S&P 500 thus far.

I wrote last week about why I continue to believe that the macro trends favor continued gains in these US Treasury bond ETFs over the next several months. And, on a risk-adjusted return basis, I expect bond ETFs like TLT and EDV to out-perform the S&P 500 for the rest of the year. Again, my opinion.

There aren’t any ‘sure things’ when you invest in volatile markets like today’s market. But recent economic reports continue to show the economy is slowing and that favors bonds. As it becomes more and more apparent that the Federal Reserve won’t raise interest rates in June or September, I believe we will see the 10-year US treasury yields dip lower. It won’t be in a straight line, but I believe that those that are patient will be rewarded. Time will tell.

Thanks for reading.

Twitter: @JeffVoudrie

The author holds positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.