September was an eventful month in the markets as the financial markets accelerated a risk-off move on concerns about economic growth in China, and the global economy in general.

The Federal Reserve decision to delay raising rates was taken as bad news by many market participants, with the interpretation being “what bad news do they know that we don’t.” The idea is that the Fed would have raised rates if they believed the economic recovery was on firm footing, so the delay introduces several types of uncertainty.

And we are seeing that play out in several markets, including the stock market.

Stocks & Bonds

The S&P 500 sold off in September, along with most other global stock markets. The best-performing sector of the S&P 500 this year, biotechnology, was hit hardest with double-digit declines. Government bond yields around the world moved lower in a flight to safety. The ‘surprise’ Chinese devaluation in August will likely negatively impact exports from the U.S. and Europe, and the outlook for corporate profits is uncertain as a result.

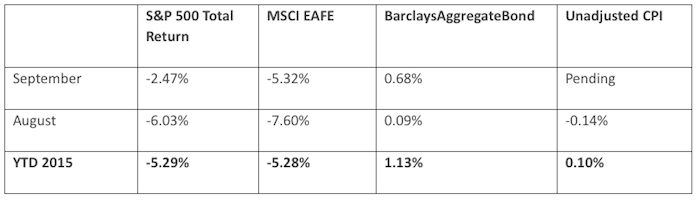

The Federal Reserve continues to say that they are going to raise rates pretty soon … same thing they have been saying for a couple of years. By the numbers:

Commodities & Currencies

NYMEX crude oil prices fell about 10% in September, and are down nearly 25% year-to-date. The U.S. dollar index is down from its high of just over $100 in March, closing at the end of September at $95. However this is still up just over 5% year-to-date. Gold treaded water in September, and is down about 4% year-to-date. Copper is down 21% year-to-date, soybeans are down about 12%, and corn is down about 8%. As China is the world’s largest commodity importer by far, yuan devaluation and the accompanying economic slowdown are having outsized effects in commodity markets.

Economy

The CPI is negative year-over-year, and is barely changed year-to-date. In other words, “what inflation”? Global risks continue to pile towards deflation rather than inflation, in my opinion. The ISM Manufacturing PMI in August came in at 51.1, showing slight expansion, albeit at a declining pace from the previous months 52.7. The sub-index of exports, interestingly, is reading at 46.5, indicating contraction, as dollar strength continues to hurt American exports. The unemployment rate fell to 5.1% in September, and continues to benefit from record numbers of Americans retiring, or taking part-time jobs.

Summary

The sell-off in the U.S. stock market is noteworthy, but the strongest current in global markets right now is coming from China. Although they have some of the world’s largest foreign currency reserves, they are currently burning through these assets at a prodigious rate. This is being done as they are trying to prop up their stock market, and as they are trying to defend their currency from capital flight. History shows neither endeavor can ultimately succeed. A trillion dollars of foreign reserves is a lot of money, but it pales in comparison to the tens of trillions of dollars of global assets that follow the direction of individual and institutional investors.

continue reading on the next page…