Key Takeaway: Job openings are back to record levels and this is giving workers confidence to voluntarily leave their job to look for better opportunity. Higher wages are also being seen and this appears to be relatively broadly-based (and not just in lower-paying industries).

The hullabaloo over last Friday’s employment report looks increasingly misplaced in light of this week’s JOLTS data. Last week’s employment report covered a more recent period (April) than did this week’s JOLTS data (March), but the disappointment on Friday seemed to be more about noise (and/or misplaced expectations) than a meaningful change in trend. This week’s data helps confirm that the healthy underlying trends in the labor market remain intact. That the consensus expectation for the employment report missed the mark should not come as a surprise to anyone who is familiar with the considerable volatility in the economic surprise indexes and other evidence regarding the folly of economic forecasting.

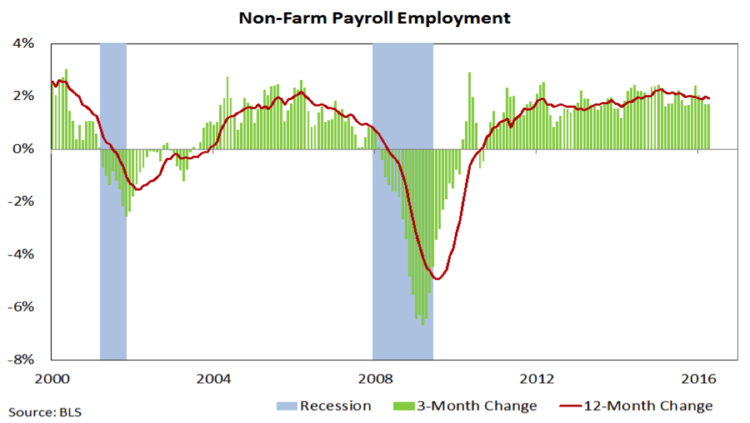

Month-to-month fluctuations aside, the growth in payroll employment has actually been quite steady in recent months. April marked the 14th consecutive month for which the yearly growth in payrolls has been between 1.9% and 2.1% (a slightly wider range of growth between 1.6% and 2.3% stretches back three years). During this time period, the yearly growth in private sector payrolls has been even a bit better, staying between 2.2% and 2.4%. Perhaps, then it should not be too surprising that despite considerable day-to-day and week-to-week fluctuations, the S&P 500 stock index is where it was 14 months ago.

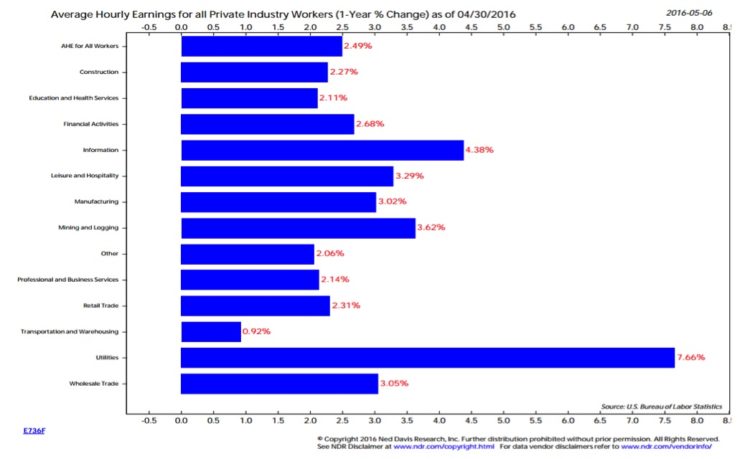

While on the surface labor market conditions appear relatively steady, underneath there is evidence of continued improvement. After being dormant during the early stages of the economic recovery, higher wages are kicking in. Through March, the Atlanta Fed’s hourly wage tracker was showing growth of 3.2% and based on the uptick in average hourly earnings in the employment report, we may see a continuation of this trend in higher wages.

While it is popular to dismiss both the jobs growth and wage growth as primarily coming from low-skilled (and low-earning) areas of the jobs market, the chart below shows broad strength across industries in terms of earnings growth.

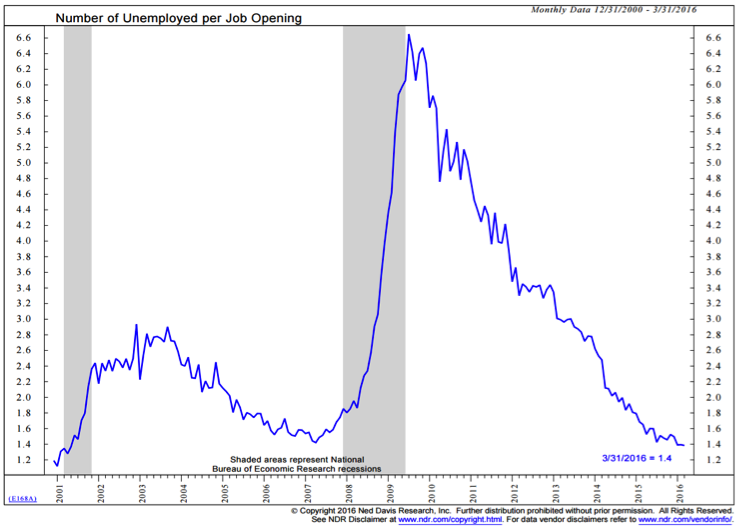

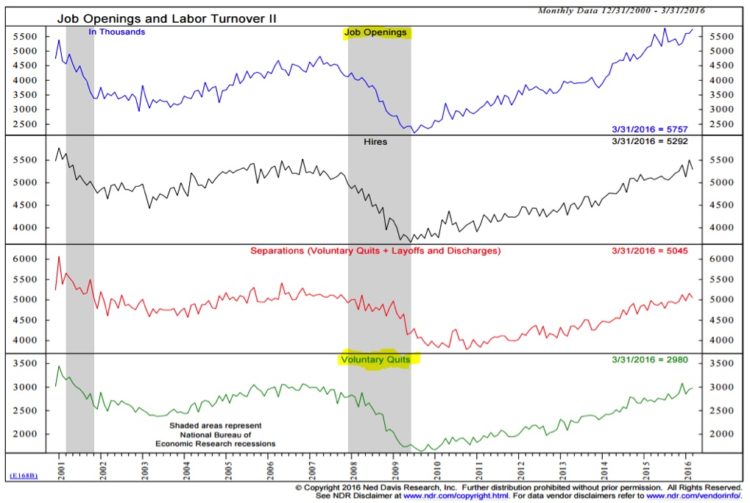

One reason for the upward pressure on wages may be a shift in labor market dynamics that favors the worker. Coming out of the most recent recession, there were more than 6.5 unemployed workers per job opening. With the supply of workers significantly exceeding demand, prices (wages) stayed low. Now, seven years into the recovery, there are fewer than 1.5 unemployed workers per job opening. This supply/demand shift seems to be working its way into higher wages.

Not only has the number of job openings increased but the composition of the pool of unemployed workers is changing. Even as the overall pace in job growth (chart on the first page) has been steady, the number of job openings has continued to expand, rising to nearly 6 million in March. Perhaps even more important, becoming unemployed is an increasingly voluntary decision. Workers are quitting their current jobs at an increasing pace in search of better opportunities elsewhere. This increased confidence could help the economy find a higher gear for growth.

Thanks for reading.

Further reading: Stocks Hesitate But Path Of Least Resistance Higher

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.