I was six years old when the Apollo 13 mission had a major malfunction that resulted in aborting their mission to land on the moon. From that moment on, the entire focus became getting those brave astronauts back to earth safely. It took the entire brain trust of NASA to come up with out-of-the-box solutions to a problem they had never anticipated.

Ever since then, the words ‘we have a problem’ evoke fear and loathing in those who receive bad news…

So in that vein, let me say, “Americans, we have a problem…”

You see, the global mission of national leaders around the world should be to produce economic security and an ever increasing standard of living for its citizens. They should be acting in the best interests of those they govern. Unfortunately power, greed and avarice often get in the way. In the end, decisions tend to be made based on what is best for those in power; there is a personal and political influence behind decisions. Moreover, the belief systems of leaders (Central Bankers) may be wrong, causing unintended consequences.

Globally, we are now dealing with the unintended consequences of politicians and Central Bankers who thought that they could control complex economies just by raising or lowering interest rates. The result is that systemic risk—the risk of a global financial collapse—is rising and increases the probability of a crash. This doesn’t mean that a crash is imminent but there isn’t any way to know for certain which individual event (snowflake) could set it off.

When governments print money, they assume that it will result in inflation because there is more money chasing the same amount of goods. Governments need consistent inflation of 2-4% so that they can pay back their debt with inflated dollars.

As consumers, we do the same thing. We buy a home or car or furniture on credit, assuming that we will keep our job and that we will get pay increases and/or promotions each year. That allows us to pay off our debts with inflated dollars.

But what happens if we lose our job or we fail to get promoted or get a raise? What happens when many of us start to struggle? If there isn’t inflation, it is very difficult to get out of debt. Even worse, if there is deflation, the relative size of our debt grows. When that happens there aren’t as many of us that are able to buy new homes, cars, or appliances. We have to cut back. And when we cut back, car dealers don’t sell as many cars, we don’t buy as many appliances, and we don’t embark on expensive home renovations. So economic growth slows which then makes it even harder to stay ahead.

That’s why they refer to it as an economic cycle—it is like a ball rolling downhill, gathering speed over time.

The cycle problem I just described gets worse because local governments don’t cut back. So when tax revenues start to decline, they raise taxes, which make it even worse on the consumer. The national government does the same thing—raising taxes, tariffs, and regulatory burdens on businesses.

More from Jeff: Is It Time To Sell U.S. Treasury Bonds?

The Central Bank (the Federal Reserve in the US) is tasked with breaking that cycle so that growth will resume and everyone can live large. Their playbook says that they need to lower interest rates and print more money, because they believe that it will spur economic growth and result in inflation. And Central Bankers around the world have been doing this for years.

So if all of the previous actions of lowering interest rates and printing money didn’t work, what do they do? They do more of what hasn’t worked in hope it will magically start working. And the ‘more’ that they are talking about now is the need for fiscal stimulus. In their minds, that lack of government ‘investment’ in infrastructure is what is holding inflation back.

So now both presidential candidates are announcing plans for massive fiscal stimulus. The problem is that this has become a global problem that is affecting Japan, China, Germany, and Great Britain, the rest of EU and about every other country in the world. They have all leveraged up with debt, trying to get economic growth and inflation, to no avail.

Japan has been following this belief since 1990. And it still isn’t working; they still are fighting deflation instead of inflation. In fact, the government has virtually bought all of Japan’s government debt, its commercial debt and is even the largest shareholder of the top 50 corporations in Japan.

Something has to change.

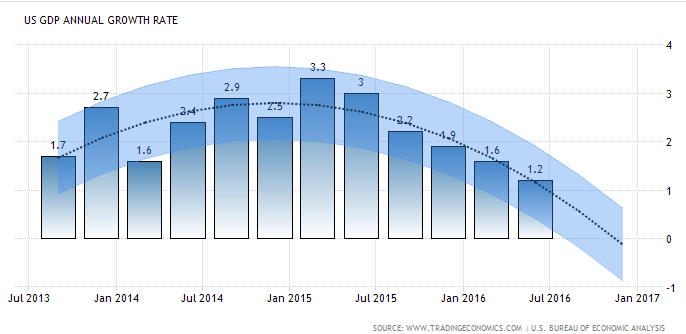

It is becoming obvious to investors that low interest rates have not fixed the problem; it has only exacerbated it. Now the major economies of the world find themselves with massive debt, low or negative interest rates, low inflation and little or no economic growth. Here in the US, the annual GDP has been declining since mid 2015 when it was 3.3% and has since slowed to 1.2% in July of 2016.

So what happens when interest rates are already abnormally low and economic growth continues to slow? Houston, we have a problem!

The US Stock market remains at or near all-time highs in the midst of this troubling situation, but I sure wouldn’t recommend any retired or near-retired investors to lock in those prices!

continue reading on the next page…