Summary: The macro data from the past month continues to mostly point to positive economic growth. On balance, the evidence suggests the imminent onset of a recession is unlikely.

The following is an excerpt from a post on Urban Carmel’s blog The Fat Pitch.

Overall, the main positives from the recent U.S. economic data are in employment, consumption growth and housing:

- Monthly employment gains have averaged more than 200,000 during the past year, with annual growth of 1.7% year over year (yoy). Full-time employment is leading.

- Recent compensation growth isthe highest in more than 6 years: 2.6% yoy in June.

- Most measures of demand show 3-4% nominal growth. Real personal consumption growth in May was 2.7%. Retail sales reached a new all-time high in May.

- Housing sales and starts in May remain near their 8 year highs.

- The core inflation rate ticked up above 2%, among the highest rates since 2008.

The main negatives are concentrated in the manufacturing sector (which accounts for just 10% of GDP):

- Core durable goods growth fell -0.9% yoy in May. It was weak during the winter of 2015 and it has not rebounded since.

- Industrial production has also been weak, falling -1.4% yoy due to weakness in mining (oil and coal). The manufacturing component was flat yoy.

U.S. Economic Data Update – Employment & Retail Sales

Our key message over the past 2 years has been that (a) growth is positive but slow, in the range of ~3-4% (nominal), and; (b) current growth is lower than in prior periods of economic expansion and a return to 1980s or 1990s style growth does not appear likely.

Modest economic growth should not be a surprise. This is the typical pattern in the years following a financial crisis like the one experienced in 2008-09.

This is germane to equity markets (i.e. the S&P 500 – INDEXSP:.INX) in that macro growth drives corporate revenue, profit expansion and valuation levels. The saying that “the stock market is not the economy” is true on a day to day or even month to month basis, but over time these two move together. When they diverge, it is normally a function of emotion, whether measured in valuation premiums/discounts or sentiment extremes.

A valuable post on using macro data to improve trend following investment strategies can be found here.

Employment and Wages

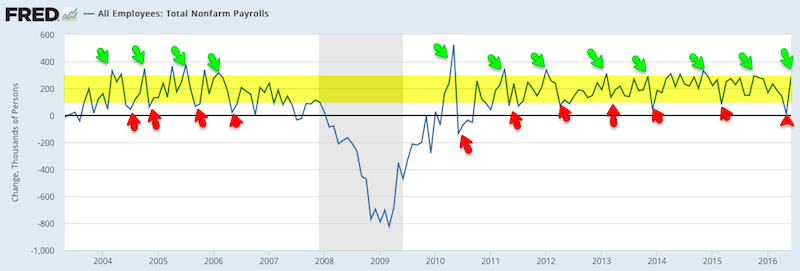

The June non-farm payroll was 287,000 new employees minus 6,000 in revisions. This was the strongest monthly report since October 2015.

In the past 12 months, the average gain in employment was 205,000.

Monthly NFP prints are normally volatile. Since 2004, NFP prints near 300,000 have been followed by ones near or under 100,000. That has been a pattern during every bull market; NFP was negative in 1993, 1995, 1996 and 1997. The low print of 84,000 in March 2015 and 11,000 in May 2016 fit the historical pattern. This is normal, not unusual or unexpected.

Why is there so much volatility? Leave aside the data collection, seasonal adjustment and weather issues; appreciate that a “beat” or a “miss” of 80,000 workers in a monthly NFP report is equal to just 0.05% of the US workforce.

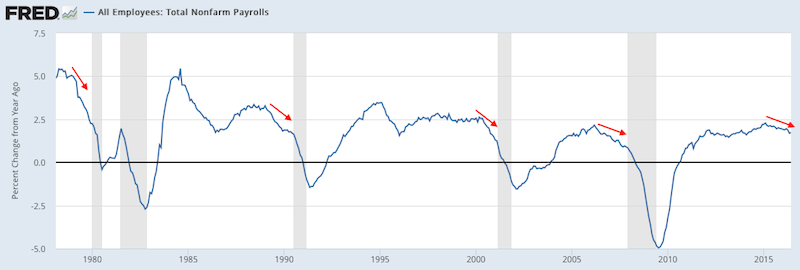

For this reason, it’s better to look at the trend; in June, trend employment growth was 1.7% yoy. Until this spring, annual growth had been the highest since the 1990s. Ahead of a recession, employment growth will likely markedly fall (arrows). Continued deceleration in employment growth in the coming months is therefore a watch out.

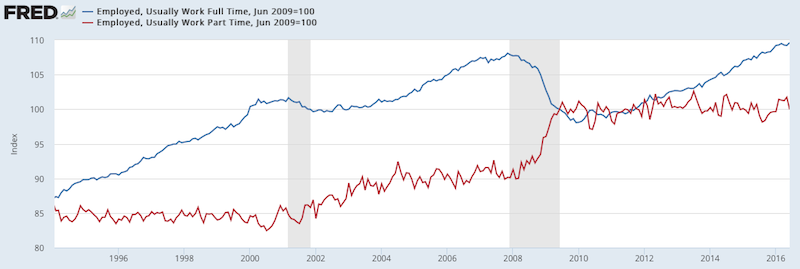

Employment has been been driven by full-time jobs, which are at a new all-time high (blue line), not part-time jobs (red line).

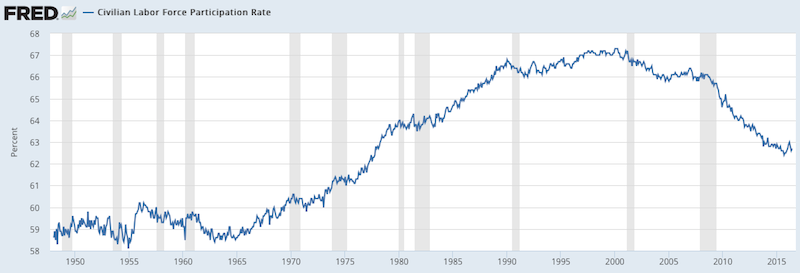

The labor force participation rate (the percentage of the population over 16 that is either working or looking for work) has been falling. This has little to do with the current recovery; the participation rate has been falling for more than 16 years. Participation is falling as baby boomers retire, exactly as participation started to rise in the mid-1960s as this group entered the workforce. Another driver is women, whose participation rate increased from about 30% in the 1950s to a peak of 60% in 1999.

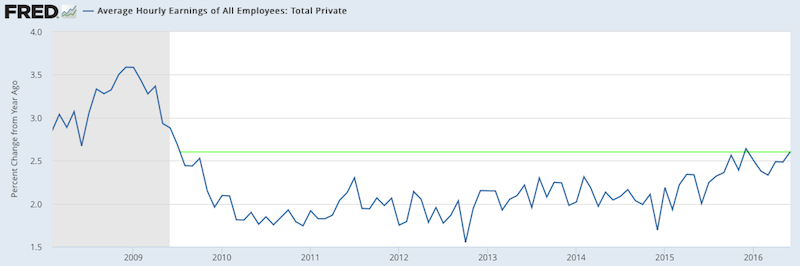

Average hourly earnings growth in June was 2.6% yoy, the highest in more than 6 years. This is a positive trend, showing demand for more workers. Sustained acceleration in wages would be a big positive for consumption that would further fuel employment.

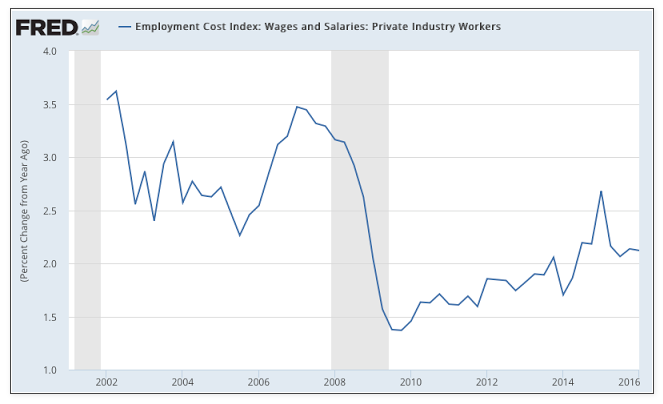

1Q16 employment cost index shows compensation growth was 2.1% yoy. This is down from 2.7% in 1Q15, which was the highest growth since the recession.

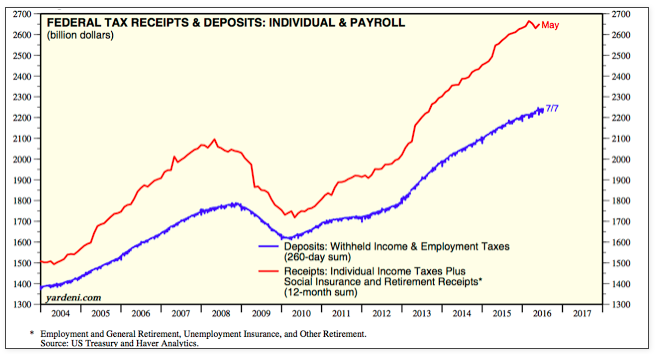

For those who doubt the accuracy of the BLS employment data, federal tax receipts are also rising (red line), a sign of better employment and wages (from Yardeni).

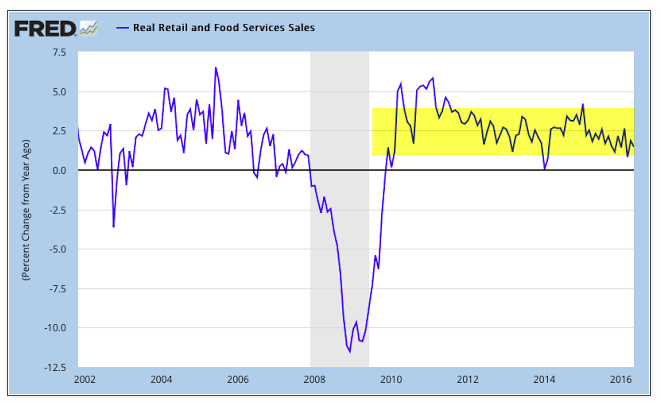

Real retail sales reached a new all-time high in May, growing 1.5% yoy. Note, though, that the range has generally been centered around 2.5% yoy for most of the past 20 years. The latest month is near the bottom of the range.

Thanks for reading.

Twitter: @ukarlewitz

Read more from Urban’s Fat Pitch Blog

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.