Our society seemingly has given way to shorter time frames. We simply revel in looking at the next minute rather than “tomorrow”. In this fast-paced Information Age, we all want a little bit of instant gratification… and we want it sooner than now. I could digress into other areas of life as we know it, but that’s a broader societal question. What I want to write about is how our behavioral need for a quick fix shows up in today’s markets, and how we can learn from it to become better traders/investors.

Trading in the Information Age

If you haven’t noticed, the local stock market has slowly diverged from the local economy. This has been a big change for active investors as the marketplace becomes more global and data flows more freely. BUT the market’s transition into a global one has not been easy post-financial crisis. In today’s markets, the big money movers (and traders, if you are savvy enough) celebrate the “quick fix”.

Why? Well, it’s three-fold.

1. We are all greedy bastards! Okay, maybe not all of us;)

2. Traders have access to more information and the speed of that information is truly amazing. Counterintuitively, this can actually make trading in the information age more difficult. If traders aren’t careful, they can become overly sensitive to the news. And because information hits the markets instantaneously, some may feel compelled to make a rash decision (often taking on the big money, who has likely already participated in some way… potentially selling to you)… That said, waiting for the “dust to settle” in today’s day in age can mean waiting anywhere from 15 minutes to a couple days.

3. Since the crisis, active investors have been more guarded and defensive, leading to more of a day to day mentality, focusing on news/events/bias – call it a defense mechanism. But it’s not healthy for traders nor the markets. Although it can successfully be argued that it plays into the broader market “wall of worry”, it also manifests itself in quick pockets of volatility.

This makes it tough for traders that don’t have a well-oiled disciplinary plan. The takeaway from this is that whether we are a trader or investor, now more than ever do we need to be aware of our emotions (and ways to suppress them). On-going success depends largely on our ability to stay focused on “price” and capital flows, while maintaining a plan-based disciplinary process.

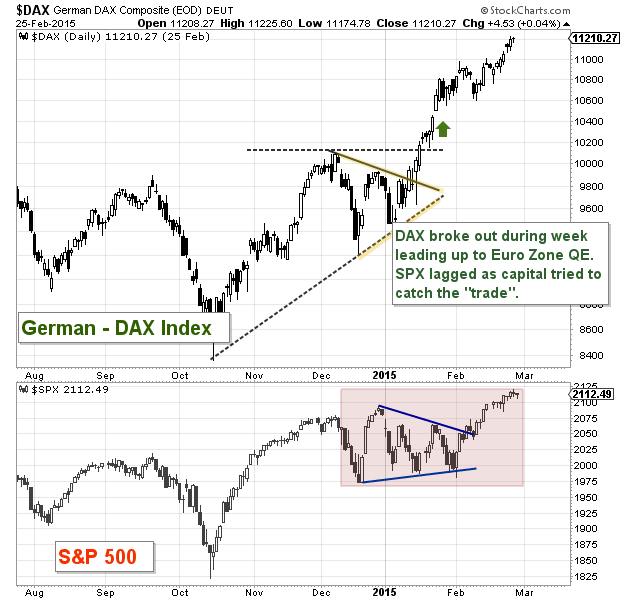

Here’s an example of an inter-global market move on a wider fractal of time. The U.S. market outperformance of Europe abruptly stopped in the days leading up to European QE and the Greek elections. Just two months into the year, the German DAX is up 14 percent while the S&P 500 is up 2.6 percent. Two ways to see this: 1). The big boys got what the big boys wanted “today” (whether it’s good long-term or not) and 2). Active investors needed to be prepared and/or make quick adjustments or risk missing out on “The Trade”. Developments happen quickly now and a focus on price and capital may have picked up on this.

We are all have bias. And this makes trading more difficult as our markets process information, including pre/post market moving events, faster than ever. In this environment, time frames can also get distorted. The combination of the two can leave investors vulnerable to emotion and poor decisions.

Trade safe and stay disciplined.

Follow Andy on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.