Week in and week out, the goal of Top Trading Links is to myth bust and think different. At the same time we try to share some of the brightest technical insights across the financial web. Let’s be honest. The guys who constantly make the linkfest are some of the brightest minds in the game. Hopefully these insights have helped you work through this increasingly tough, volatile market. Here are a few more things that are increasingly evident to keep in mind in the coming weeks.

Week in and week out, the goal of Top Trading Links is to myth bust and think different. At the same time we try to share some of the brightest technical insights across the financial web. Let’s be honest. The guys who constantly make the linkfest are some of the brightest minds in the game. Hopefully these insights have helped you work through this increasingly tough, volatile market. Here are a few more things that are increasingly evident to keep in mind in the coming weeks.

Price action wise, we need to note the increasing tendency, across various stock markets and groups, major supports are becoming ‘speedbumps’. This suggests strong downside momentum. That’s nothing new in emerging markets and commodities, but that action is spreading aggressively across the world and now to the U.S. indices.

It’s worth noting the environment has started to change versus the past couple of years. Any time you see a study or data that only takes into account 2012 or later, run for the hills. Numerous indicators and systems have been tuned to game the rhythm of the 2013-2014 market. Now, they are starting to blow up in people’s faces.

Building on that, various edges have deteriorated as price action has taken over. Many signs of stabilization and potential for the market to find some footing appeared last weekend. Well, we found no footing. Thursday morning after seeing sentiment data points, the popular narrative was how investor sentiment was so negative, the market couldn’t possibly break down. Well, to end the week, we saw the strongest two day drop in four years. @RyanDetrick lays out the massive drop.

First $SPX 2-day drop of 5% since Nov ’11. These are rare and don’t happen during healthy markets. $SPY pic.twitter.com/2QncDWWDGY

— Ryan Detrick, CMT (@RyanDetrick) August 21, 2015

MARKET INSIGHTS

VIX Futures became backwardated Thursday so we should buy, right? Not so fast my friend! per @OptionPit:

“While probability of the long indicator working is somewhat high, the expected return is actually negative. When VIX is higher than VXV that is when all the REALLY bad things happen.”

On gold:

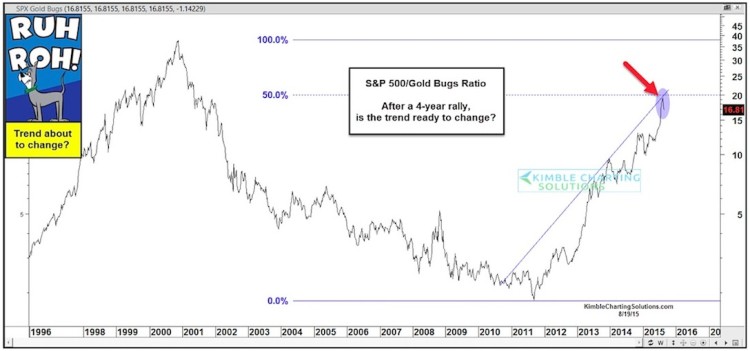

Are gold bugs about to outperform the S&P 500 for the first time in years? via @KimbleCharting:

@PeterLBrandt notes the monster volume on this gold rally:

$GC_F $GLD 491 million ounces traded in two weeks — highest volume in history. Markets ring bell at major turns pic.twitter.com/mOL9w3eQlY — Peter Brandt (@PeterLBrandt) August 20, 2015

@hedgopia looks at the quickly deteriorating credit market:

“Come October, bank lenders will be performing a biannual review of the loans and revolving credit they have extended to exploration & production companies. The renewed drop in the price of crude oil does not help. Banks lend using reserves in the ground as collateral. The longer crude stays low, the more pressure they come under to restrict lending standards.”

Global currency wars and deflationary headwinds are an increasingly popular topic these days. @JeffVoudrie shares some insights on how investors can protect themselves.

@MarkArbeter nailed the Gold bottom. Now he’s looking for a bottom in Oil. Numerous bottoming conditions are present, but it just hasn’t happened as yet.

Some times, we can reverse engineer momentum to give us clues about price. @AndrewThrasher points out that RSI support is just now being tested even though price is starting to crack.

Momentum is currently testing support for its bullish range. Has been intact since 2012. $$ pic.twitter.com/QYzTpHWdVE

— Andrew Thrasher, CMT (@AndrewThrasher) August 21, 2015

David Stockman has a very aggressive bearish take on China. It’s worth a read as the next wave lower is underway and appears to be quite strong.

@jessefelder shares an example of a not well known consequence from oil’s collapse. It’s things like these that can really add suddenness to a market decline.

‘Real Q2 earnings are down 16%’ via @WSJMoneyBeat

Recent IPOs aren’t doing so well:

Of 113 US-company IPOs completed YTD15, 43% are now trading under their offer price. #spgmi — S&P Capital IQ (@SPCapitalIQ) August 20, 2015

@ReformedBroker: “In theory” doesn’t do you any good when you’re living and investing in the real world.

@ReidHoffman tells us everything we want to know about ‘unicorns’.

MARKET OPERATOR INSIGHTS

The misconceptions of chance via @farnhamstreet

@MatthewCave gives us a great visualization of why protecting against downside is so important.

Why risk per trade is so important; Percent loss Drawdown Vs Percent to Recover pic.twitter.com/TchUxuLoa9

— Matt Cave (@MatthewCave) August 16, 2015

@AdamHGrimes on the illusion of control:

“This illusion seems to be a part of who we are, and it’s not something you’re going to fix. Instead, work to understand it; understand your weaknesses so you can master them and the art of trading.”

@MarkYusko’s Morgan Creek Capital Q2 Newsletter has some great tidbits on thinking and philosophy:

“In investing, the ability to withdraw from the “survival” mode, from the daily barrage of information and distraction, and spend quality time away in reflection and contemplation will allow us to discern where the best opportunities exist and how to best attack them.”

@fabiancapital with some great general investing advice while discussing small caps:

“…avoid being overly predictive or one-sided in calling the direction of small cap stocks. If you are worried about the potential for further declines, simply set a sell discipline or employ a risk management plan in place to avoid a significant sell-off. This will protect your capital and still allow you to participate in the upside if conditions react favorably.”

NEWS & RESEARCH

It’s still on track to be the hottest year on record.

A major El Nino is coming this fall.

Some research on prior El Nino’s effect on commodity prices.

BTW, the ocean is going through an amazing transformation.

Siemens latest ’Facts and Forecasts’ of the Internet of Things.

Is there any question that virtual reality will be a speculative market theme in the coming cycles? Keep an eye out for the Oculus developers conference coming next month.

VIDEO OF THE WEEK

Jack Schwager shares the key lessons from his Market Wizards Series. Hat Tip @chessnwine.

Quotable via @OptiontradinIQ:

“Making trades when conditions appear 2 b only marginally in favor of the trade idea has more to do with entertainment than trading success”

Funny Tweet of the Week via @TheFibDoctor

Thanks for reading!