The stock market’s resilience has been amazing. The Russell 2000 (RUT) and S&P 500 (SPX) made new all time highs this week and the NASDAQ Composite (COMPQ) has made new 52 week highs (just off its all timers). It’s been important to truly keep an open mind. If we continue to rally, let’s keep in mind some layered resistance starting at the S&P 500’s fibonacci extension level around 2138.

Time to dig into the broad market and more in this week’s “Top Trading Links”.

MARKET INSIGHTS

@AndrewThrasher notes a key market cycle turning point is approaching soon.

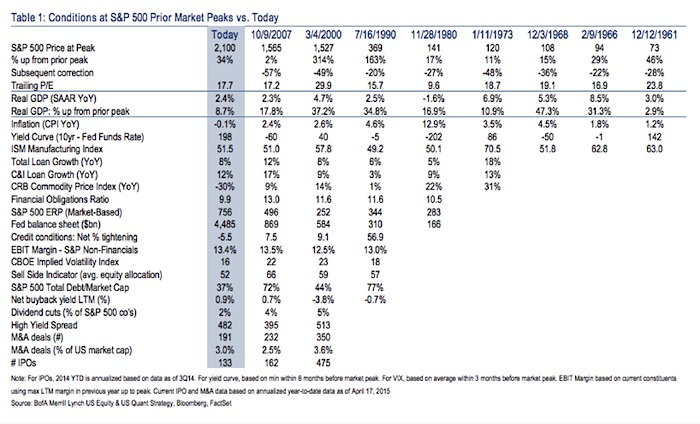

Bank of America’s top strategist notes this is not what a cycle peak looks like after comparing the current market to major tops via @ReformedBroker

@hedgopia goes in depth on the home construction industry

The emerging markets are breaking out of a major pattern relative to the S&P 500 via @jbeckinvest.

@JLyonsFundMgmt notes South Korea is joining the ever broadening Asia rally. It’s stuff like this that adds legitimacy to the China rip and supports the case of the emerging east.

@sirmarket dug up an old Peter Lynch speech:

“If you don’t understand it, investing doesn’t work”

“Coca-Cola is earning 30x what they did 32 years ago. The stock is up 30 fold in that amount of time”

@GregGuenthner on momentum trading:

“Momentum is actually the best performing strategy you can employ—yet barely anyone does it. Most investors are too wrapped up in debating growth vs. value. Yet when it comes to performance, both growth and value trail momentum.”

@FZucchi looks at the longer term potential for Akamai as it breaks out. The long term chart and trend of this thing is fantastic.

@chessnwine shared two cool videos about John Law and the Mississippi Bubble.

SPECULATOR PROBLEMS

@BtrBetaTrading on thinking about the other side of the trade:

“Before you get worked up and begin touting your insightful chart reading, take a moment to think through why someone might take the long side of your ‘short’ trading setup. What’s in it for them? What might you be missing?”

Here’s a solid post on why trying to avoid losing trades is a huge trading error via @corymitc

It can be very difficult to understand how much capital is the right amount to put in a position.

- @toddwenning shares an investing example and discusses sizing in your favorite ideas.

- Also, @jessefelder talks about the position sizing of top traders

via Greg Morris – news is noise

“Today’s financial media is constantly repeating breaking news. Guess what, it is just part of the continuous noise they generate. Noise is something you do not need to be a trader or an investor who uses technical analysis. It is actually more harmful than helpful.”

@Alephblog explains why the average investor underperforms.

We’re all constantly floating ideas and lines of thought. @ritholtz dug up Carl Sagan’s bullshit detector kit, which helps us vett these ideas.ssssvvsscx

@steenbab on fixing attitude problems.

“One key to emerging from a bad attitude is making the transition from noun-thinking to verb-thinking. In the noun-thinking mode, a negative attitude is something we have; we own it. In verb mode, a negative attitude is something we’re doing–we can control it.”

HAPPENINGS AND OTHER INSIGHTS

The Pentagon is opening an office in Silicon Valley with the goal of upping it’s defense and cybersecurity technology. Those mega-trends are continuing to strengthen.

Tesla wants to be a battery company as much as a car company. They unveil that plan next week

The J.D. Power tech choice survey was released this week

- Further reading: The main reasons people want self driving cars is…cheaper insurance

Global Temperatures continue to hit fresh highs.

China continues to show signs they are moving into the modern global world. They’ll allow Visa and Mastercard in the country in June.

The ‘master flash crash manipulator’ apparently spoofed us all.

“It is not enough to understand something that others don’t understand.“ via @FredWilson

Thanks for reading!

Follow Aaron on Twitter: @ATMcharts

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.