Market turning points are ugly. Speaking of individual stock breakdowns, this week’s ‘turning point pain’ has been pretty severe.

When the market starts to pull back, it’s a great time to check in on your favorite investment themes and get your stock list in order. Also, when we note how high investor sentiment is, we probably have to look farther out for new themes.

What better way to get started than reading this week’s “Top Trading Links”.

MARKET INSIGHTS:

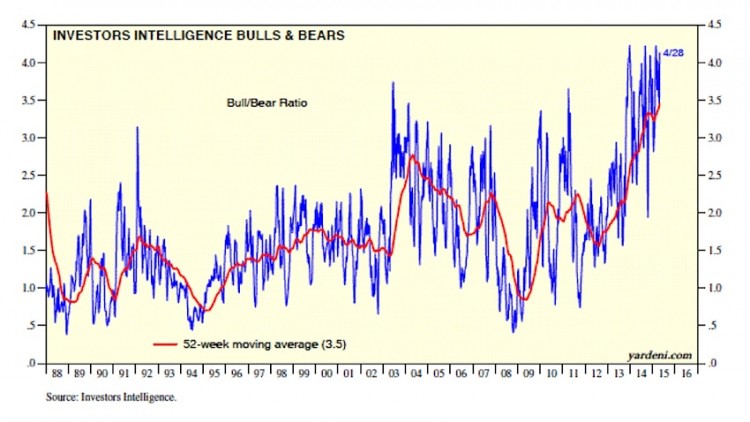

@yardeni breaks down investors intelligence sentiment data. We’re at a disgustingly high level.

@MktwHulbert tells us how the ‘cash on the sidelines’ argument is wrong, featuring Ned Davis.

@awealthofcs discusses the herd mentality:

“People are quick to blame every market move on the Fed these days. It’s as if they think bubbles didn’t exist in the pre-Fed era. Maybe the Fed changes the timing and the magnitude of these things, but it would be silly to assume that human behavior wouldn’t cause the pendulum to swing too far in both directions even if the Fed didn’t exist”

@KimbleCharting notes a major support level in Biotech ETF IBB.

@AndrewThrasher highlights a key trend support level in biotech.

@JLyonsFundMgmt shows how the euro is testing major resistance after it’s recent counter-trend move.

“So goes Apple, goes the broader tech sector. And now that Apple is a part of the Dow Jones and S&P 500, we need to be on the lookout for weakness in the prized jewel.” – via @andrewnyquist

@AdamHGrimes was featured on the @stocktwits Must Follow podcast discussing meditation and trading mastery.

It’s easy to get caught up in the whim of the market’s endless possibilities. @GregGuenthner has some tips for letting things go.

@BtrBetaTrading on the S&P 500 relative to the Russell 2000.

mcoscillator.com compares the U.S. stock market during President Obama’s two terms.

”The bias from overconfidence is insidious because of how many factors can create and inflate it. Emotional, cognitive and social factors all influence it. Emotional, as we see, because of the emotional pain of believing bad things about ourselves, or in our lives” via @farnamstreet

@Usman_Hiyat offers some solutions for dealing with groupthink.

Are Gazprom bonds a leading indicator for Crude Oil prices? via @stockpickexpert

INVESTMENT RESEARCH:

Are concerns about pension funds underestimating life spans overblown? Apparently so, at least in the public sector via slge.org

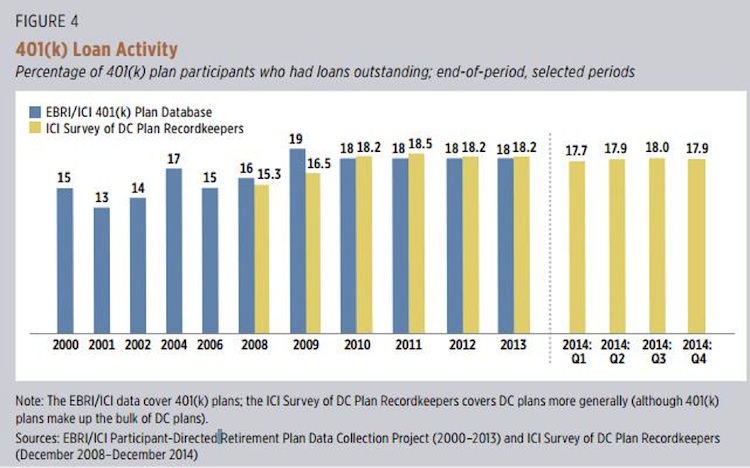

@ICI’s Defined Contribution Plan Participants’ Activities report is out. Notably 401(k) loans remain historically elevated after dropping slightly in 2014.

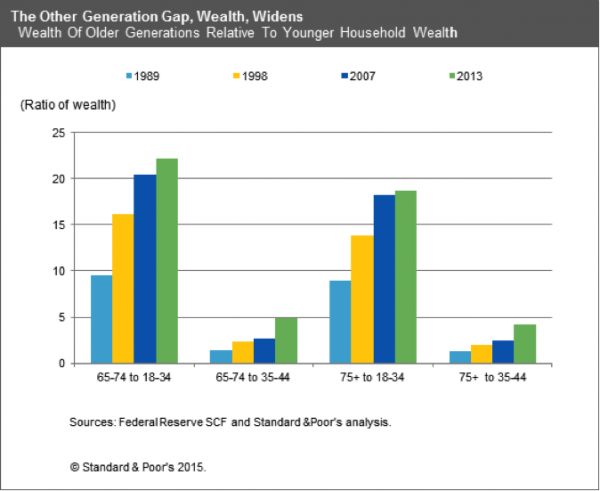

Beth Bovino and her crew at Standard & Poors take a deep look into the state of millennials economic health.

@PewResearch released their State Of The News Media annual report:

if news in the social space is more incidental and driven to a large degree by friends and algorithms, then gaining a foothold there may be even more elusive – or at least less in the industry’s own hands – than a secure financial model.

HAPPENINGS:

Astrophysicists at the University of Waterloo have put together a 3D map of the universe.

How the Fed changed their statement.

Microsoft showed off their augmented reality technology at their developer conference.

Amazon broke out the numbers of their web services business in the latest earnings call. That may be the main driver for the next quarter or two.

The EU is taking significant measures to prevent large bank withdrawals as rates turn negative H/T @jessefelder

Big names at the Milken Conference this week were quite pessimistic on the global economy:

“The only hope that shined through the dense fog of worry was the potential for technology to revolutionize the economy….But even as they salivated over the possibilities this technology affords us, there was much concern over the jobs that would inevitably be lost as technological progress continues—which would only compound issues like income and wealth inequality.”

Russian hackers got their hands on Obama’s nonclassified golf emails.

Cartoon of the Week:

Thanks for reading!

Follow Aaron on Twitter: @ATMcharts

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.