It’s that time of year. Holidays, santa claus rallies, and market joy. Right?

Well, we all know that it’s not that easy. But market seasonality patterns have historically been on the bulls side into year end. Will it be different this time?

Hope you all had a happy Thanksgiving with friends and family. Below you’ll find a healthy batch of research to help you transition into December and the holidays. Hope you enjoy this week’s “Top Trading Links”.

Market Ideas

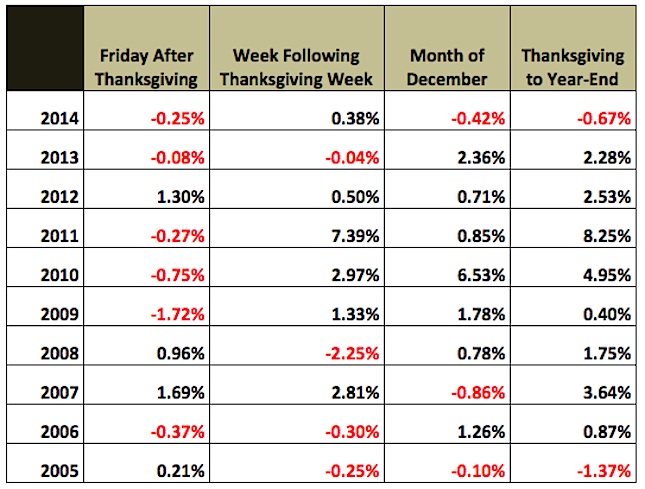

S&P 500 Seasonality has been very bullish from Thanksgiving to year’s end over the past decade via @andrewnyquist.

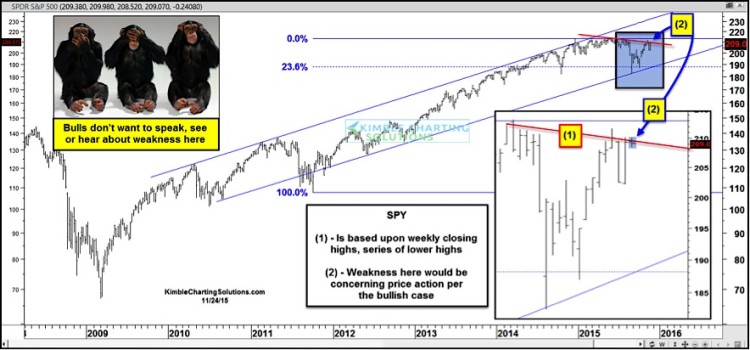

@KimbleCharting notes that the S&P 500 is at a critical price level.

@investwithanedge takes a look at which types of stocks are working now.

The Buffett Valuation Indicator is ticking lower via @AdvPerspectives

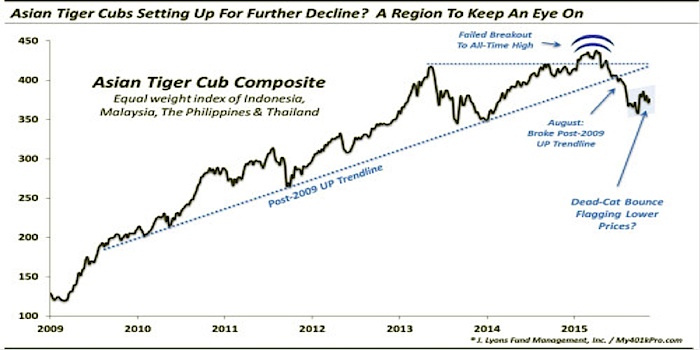

@JLyonsFundMgmt analyzes Asia’s smaller stock markets for hints about China’s market.

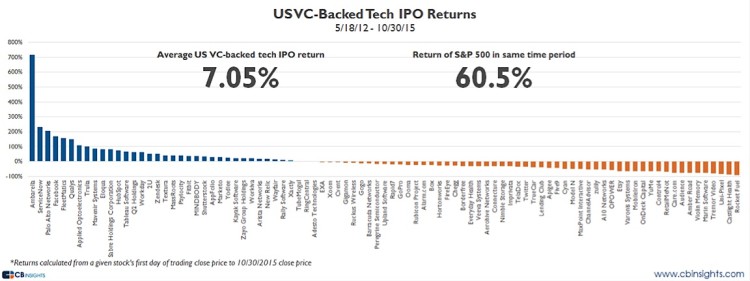

Venture Capitalist backed tech IPOs have drastically underperformed the market after going public. via @CBinsights

Commodity sensitive emerging Markets remain very oversold as the global markets have bounced. @shortoflong takes an in depth look.

5 charts that highlight the Twitter growth story via @OphirGottlieb

continue reading on the next page…