Traders, half the battle is choosing the best technical set-ups and FX pairs poised to move the most for the move you are expecting. But the technical picture alone is not enough. Even the best technical set-ups can often times not react very well when the move you are forecasting gets underway.

While no method is foolproof this simple analysis technique can save you a lot of frustration.

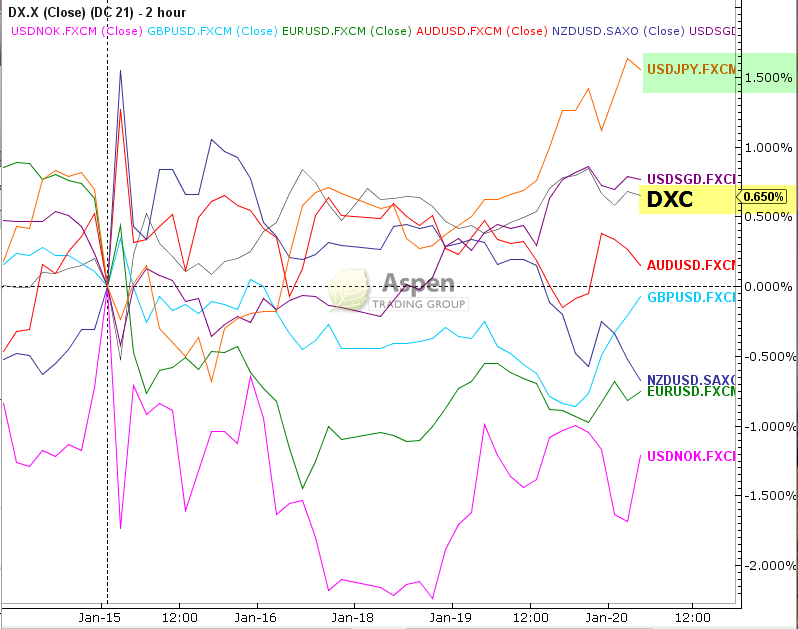

If you trade the major FX pairs like EUR/USD, GBP/USD and USD/JPY you better be paying attention to the US Dollar Index (DXC). If you are fighting DXC you have little to no chance of your trade working out.

That said, FX pairs will not always move in tandem with DXC, often times they can lead or lag. Knowing which ones are outperforming or underperforming can save trades not only frustration but money.

As the chart below shows, from the January 15th lows, the Dollar Index (DXC) has rallied .64% while USD/JPY is up 1.50%. Thus, all other things being equal, if the DXC rally continues, USD/JPY would appear to be the pair best suited to trade. Again, “trades” are short-term and require discipline and focus.

I did a blog post on this analysis technique back in March of 2014: Why Do Traders Overlook This Simple But Powerful Analysis Technique?

Have a great day and thanks for reading.

Follow Dave on Twitter: @aspentrading10

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.