The following is a recap of The COT Report (Commitment Of Traders) released by the CFTC (Commodity Futures Trading Commission) looking at futures positions of non-commercial holdings as of September 15, 2015. Note that the change is week-over-week.

10-Year Treasury Note: When the Federal Reserve finally raises rates – whenever that is – ahead of that move, the question is should we now pay attention to fed funds futures or two-year yields? In days leading up to Thursday, the former was assigning low odds of a hike this week, even as the latter was yielding 0.82 percent on both Tuesday and Wednesday. As early as August 24, two-year treasury notes were yielding 0.59 percent; post-FOMC decision on Thursday, treasury yields crashed 12 basis points. They were not only wrongly priced but were also in disagreement with the long end of the curve.

Yields on 10-year treasury notes did rise from 2.01 percent on August 24 to 2.3 percent on Wednesday, but were as high as 2.5 percent early June. For the most part, the long end never bought into what the short end was forecasting. On Thursday, the iShares 20+ Year Treasury ETF (TLT) rallied 1.2 percent, and then another 1.5 percent on Friday. The message? No matter what we heaar and read in the media, the economy is not as strong as it is made out to be. The FOMC said as much.

“Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term,” read the FOMC statement. Four FOMC members do not expect economic conditions to warrant a liftoff until next year or later. One member predicts the fed funds rate will go negative this year and next.

Not sure if a precedent has been set or not, but it is not often the Fed cites global developments as a reason for inaction. A cynic would say they were just looking for a reason not to hike. If they were strictly focused domestically, and were looking to fill their monetary quiver with arrows, they could have moved. On the other hand, one look at, for instance, capacity utilization, which in August (77.6 percent) was more than a point lower than the November 2014 cycle high of 79.04 percent, in all probability they have missed a window of opportunity.

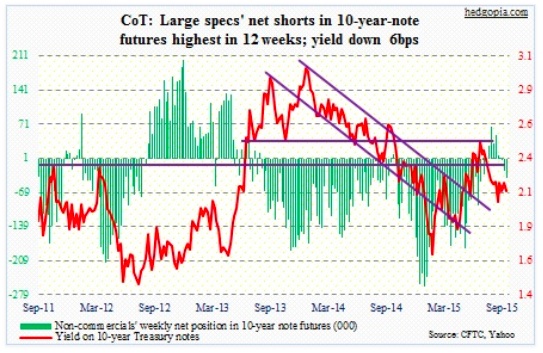

Prior to the FOMC decision, non-commercials continued to add to net shorts.

The COT Report: Currently net short 39.5k, up 15.6k.

30-Year Treasury Bond: Next week’s major economic releases are as follows.

Existing home sales for August come out on Monday, and new home sales on Thursday. Of late, they have both been relatively strong. At a seasonally adjusted annual rate, sales of existing homes were 5.59 million units in July – the highest since 5.79 million in February 2007. New home sales were 507,000 units in July, with five of the seven months this year north of 500,000. Caution: the pending home sales index inched up to 110.9 in July from 110.4 but was below the May high of 112.3.

The advance report on durable goods for August is published on Thursday. Of late, orders for non-defense capital goods ex-aircraft – proxy for business capital expenditures – have lost momentum. July was $70 billion, versus the $74 billion peak last September. Year-over-year, orders have dropped the past six months.

Friday, we get the third estimate for second-quarter GDP as well as a revised estimate for corporate profits. Real GDP was revised up to 3.7 percent growth in the second estimate, although inventory accumulation contributed nicely. Similarly, corporate profits with inventory valuation and capital consumption adjustments were $2.06 trillion in the second quarter, down from $2.16 trillion in 3Q14. However, profits after tax and without adjusting for inventory and depreciation were $1.82 trillion – an all-time high.

Also on Friday the University of Michigan will release its final consumer sentiment reading for September. The first estimate was disappointing – down 6.2 points month-over-month to 85.7. The recovery high of 98.1 was recorded in January this year – the highest reading since 103.8 in January 2004.

Three FOMC members are scheduled to speak, including Federal Reserve Chair Janet Yellen on Thursday; Dennis Lockhart, president of the Atlanta Federal Reserve, speaks three different times.

The COT Report: Currently net long 9.5k, up 17.8k.

Crude Oil: In the week ended September 11, crude inventory fell 2.1 million barrels, to 455.9 million barrels. But gasoline stocks rose 2.8 million barrels, to 217.4 million barrels, and distillates by 3.1 million barrels, to 154 million barrels. On the other hand, Cushing, OK, saw the largest drawdown in seven months – down 1.9 million barrels, to 54.5 million barrels. The week saw a mix of some good, some bad. In the end, spot West Texas Intermediate Crude Oil probably traded along expectations of what might come out of the FOMC meeting.

continue reading about Crude Oil, Gold, Equities, and more…